Published 13:45 IST, August 26th 2024

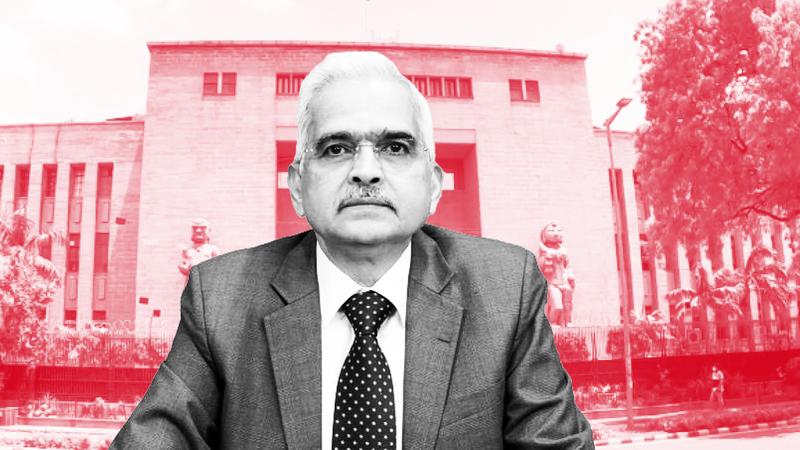

RBI constantly working on policies, platforms to make India's financial system strong: Guv Das

The ULI platform facilitates seamless and consent-based flow of digital information, including land records of various states.

Reserve Bank Governor Shaktikanta Das on Monday said the central bank is constantly working on policies, systems, and platforms to make the country's financial sector strong, nimble and customer centric.

Addressing the RBI@90 Global Conference on 'Digital Public Infrastructure and Emerging Technologies', Das recalled various initiatives being taken by the RBI with regard to Unified Lending Interface (ULI) and Central Bank Digital Currency (CBDC).

The Governor also said that the UPI system has the potential to evolve into a cheaper and quicker alternative to the available channels of cross-border remittances and "a beginning can be made with small value personal remittances as it can be quickly implemented".

According to the Economic Survey tabled in Parliament in July, remittances to India, the second largest source of external financing after service exports, ? are projected to grow at 3.7 per cent to USD 124 billion in 2024 and at 4 per cent to reach USD 129 billion in 2025.

Das said the Reserve Bank of India is looking forward to the journey towards RBI@100 with considerable optimism.

"We are constantly working on devising policies, approaches, systems and platforms that will make our financial sector stronger, nimble and customer centric," he said.

Speaking on the theme of DPI and emerging technologies, he said over the last decade, the traditional banking system has undergone an unprecedented technological transformation.

By all indications, this process is likely to become even more intense in the coming years, he added.

He said DPI spurs market innovation by reducing transaction costs, democratising access, maintaining competition through interoperability, and attracting private capital.

Referring to the country's experience, Das said "DPI has enabled India to achieve, in less than a decade, levels of financial inclusion that would have otherwise taken several decades or more".

Digital Public Infrastructure refers to basic technology systems, created mainly in the public sector, which are openly available to users and other developers.

India's DPI journey is a unique model, wherein the base technical infrastructure is built, operated and managed in the public sector, while the private sector accesses the DPI to create innovative customer facing services.

"The advantage of developing DPI in the public sector is that typically the private sector would be averse to capital investment to create infrastructure with uncertain returns," the Governor said and added that privately created infrastructure may not also be amenable to democratised access or interoperability.

The Governor talked about India's advancements in the field of digitalisation of the financial services.

He further said Unified Payments Interface (UPI), a real-time payment system, has emerged as a robust, cost-effective and portable retail payment system and is attracting active interest across the globe.

"Continuing on this journey of digitalisation of banking services, last year we launched the pilot of a technology platform which enables frictionless credit. From now on, we propose to call it the Unified Lending Interface (ULI)," he said.

The ULI platform facilitates seamless and consent-based flow of digital information, including land records of various states, from multiple data service providers to lenders. This cuts down the time taken for credit appraisal, especially for smaller and rural borrowers.

He said that by digitising access to the customer's financial and non-financial data that otherwise resided in disparate silos, ULI is expected to cater to large unmet demand for credit across various sectors, particularly for agricultural and MSME borrowers.

Based on the experience from the pilot project, Das said a nationwide launch of the ULI will be done in due course.

"Just like UPI transformed the payments ecosystem, we expect that ULI will play a similar role in transforming the lending space in India. The 'new trinity' of JAM-UPI-ULI will be a revolutionary step forward in India's digital infrastructure journey," he said.

On artificial intelligence (AI) and DPI, Das said for customers, AI enables hyper-personalised products and faster, more relevant services, while for financial institutions like lenders there are benefits from advanced tools for risk and fraud management, streamlined operations, and reduced compliance costs.

"Such advancements, however, come with serious challenges. Data privacy concerns arise from handling vast volumes of personal information. Ethical AI governance is essential to ensure fairness and prevention of bias," he said.

He further said AI technology can also be misused to spread misinformation, potentially causing severe damage and disruption to DPIs as well as other digital systems. They can also damage the reputation and operations of financial institutions.

"AI promises to make processes simpler and efficient. It can also emulate decision-making to a great extent. However, when it comes to the regulated financial institutions, there should be careful adoption of AI in critical decision-making segments, for example in loan sanctioning," Das said.

Das also said with the emergence of fast payment systems across countries and experimentation around central bank digital currency (CBDC), new possibilities are opening up to bring in greater efficiency to cross-border payments.

Maximum efficiency gains in such initiatives would come from ensuring interoperability as a key design element, the Governor said.

Updated 13:45 IST, August 26th 2024