Updated 30 December 2023 at 12:33 IST

Indian, Hong Kong customs bust $65M syndicate laundering money using synthetic diamonds, 4 held

Indian and Hong Kong authorities collaborated in unveiling a $65 million trade-based money laundering scheme, leading to arrests and asset freezes.

Advertisement

New Delhi: Indian Customs and Hong Kong Customs, in a joint operation, busted a Trade-Based Money Laundering (TBML) scheme and exposed a complex web of illicit activities involving exporters in Hong Kong and importers in India's Special Economic Zones (SEZ), as stated by Finance Ministry officials on Friday.

The report of this scheme closely follows the recently concluded Global Conference of Cooperation in Enforcement Matters (GCCEM) organised by Indian Customs and Directorate of Revenue Intelligence (DRI). The event's theme, 'It takes a network to fight a network,' aptly resonates with the approach employed in uncovering this international cartel.

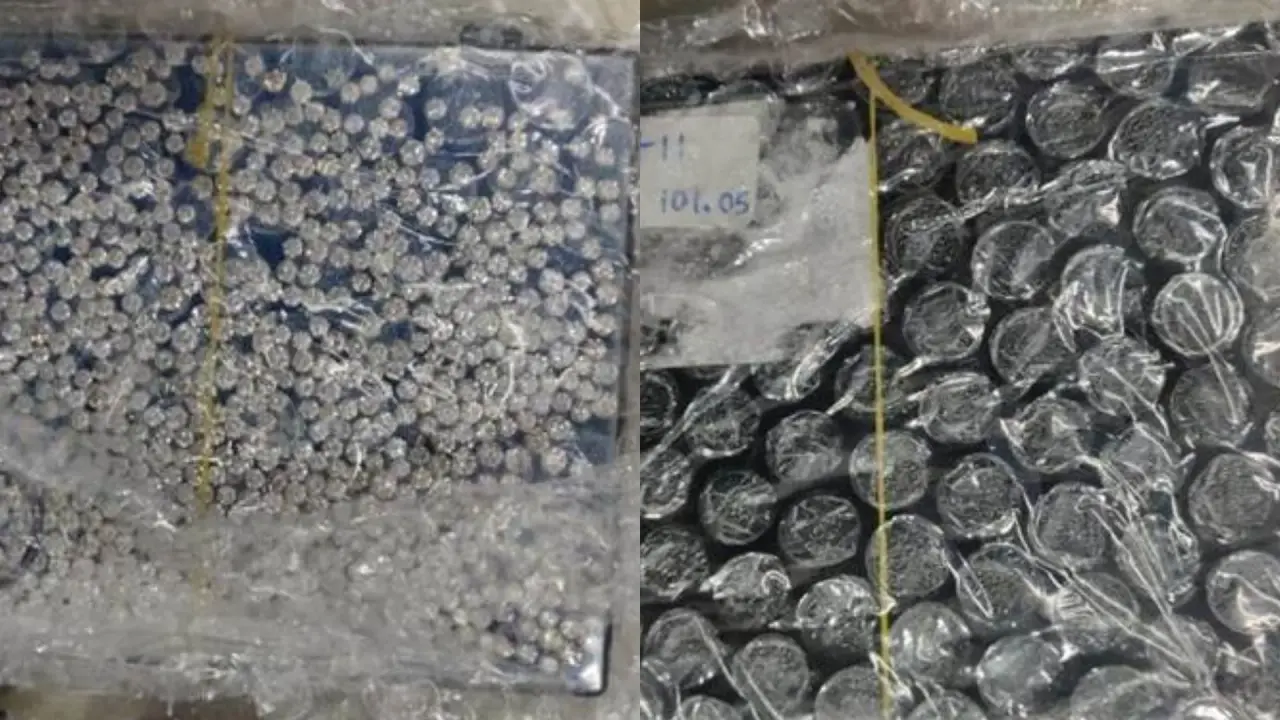

The Directorate of Revenue Intelligence (DRI) had previously unearthed a case of Trade-Based Money Laundering originating from an SEZ. Investigations revealed a deceptive practice where low-cost synthetic diamonds were being imported into India under the false declaration of natural diamonds. These synthetic diamonds were overvalued—more than 100 times their actual worth—and imported from companies based in Hong Kong to SEZs in India.

According to Officials, further scrutiny revealed that while some genuine diamonds were imported, they were secretly replaced with synthetic ones and smuggled out of the SEZ. The importing entity was found to be exporting diamond-studded jewellery at highly inflated values to Hong Kong and a few other countries. Notably, although a substantial amount from the inflated import values was remitted out of India through legitimate banking channels, the funds received for the exports accounted for only a marginal 0.2 percentage. This indicated that the primary purpose of this trade was to launder money abroad.

Investigations uncovered a complex process where money flowed into the importing entity's bank account via transactions conducted by various dummy firms in India, the officials added. Subsequently, this money was laundered from the same account to overseas suppliers in Hong Kong under the guise of payment for 'diamond' imports. The mastermind behind this intricate trade-based money laundering network was traced to Hong Kong.

As a result of the investigations, Indian Customs apprehended four individuals under the provisions of Section 104 of the Customs Act, 1962. Show Cause Notices (SCNs) were issued for seized goods, extending to the involved entities in Hong Kong, who, however, declined to respond to the Indian Customs' summonses. In response to India's enforcement actions, Hong Kong Customs conducted an operation targeting a transnational money laundering syndicate, uncovering a staggering $65 million laundered through the diamond trade. Four individuals connected to the case were arrested, and assets totaling $1 million held by them were frozen.

Published 30 December 2023 at 06:43 IST