Updated 23 February 2024 at 00:02 IST

Unlock UPI Overseas: How To Activate International Payments, Your Complete Guide Is Here

Did you know, UPI services extend internationally, simplifying transactions in multiple countries? Here's everything you need to know about using UPI overseas

- Travel News

- 2 min read

Transfer of payments in India has been revolutionized by UPI (Unified Payment Interface), NEFT, and IMPS. But did you know that UPI services extend internationally, simplifying transactions in multiple countries? Here's everything you need to know about using UPI overseas while traveling.

Expanding UPI Services Beyond Borders

The Unified Payment Interface (UPI) is no longer confined to India's borders. It has expanded its reach to several countries, including Sri Lanka, Mauritius, Bhutan, Oman, Nepal, France, and the UAE.

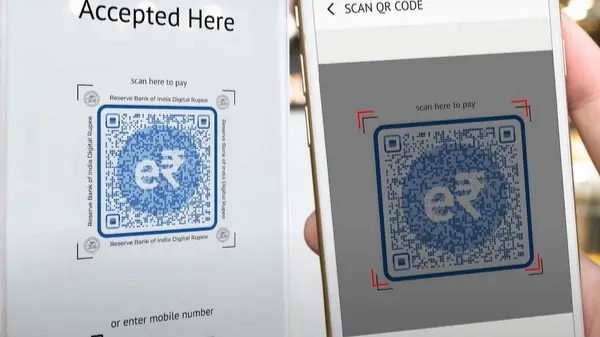

This expansion has been facilitated by NPCI International Payments Limited (NIPL), the international branch of India's National Payment Corporation. NIPL has partnered with 10 Southeast Asian countries to enable QR-based UPI payments.

Advertisement

This initiative seeks to enhance the payment experience for travelers engaging in cross-border transactions.

Benefits of Using UPI Overseas

Advertisement

When traveling to countries where UPI services are available, travelers have the option to skip the hassle of converting Indian Rupees to the local currency. Instead, they can conveniently use their phone's UPI app to make payments directly in the local currency, saving time and effort.

How to Activate International UPI Services

Activating international UPI services while traveling is simple. Here's a step-by-step guide using popular UPI apps like Google Pay and PhonePe:

Using Google Pay:

- Open the Google Pay app and tap “Scan QR code”.

- Scan the international merchant's QR code.

- Enter the amount in the payable foreign currency.

- Select the bank account you want to use for payment.

- A screen will appear to activate “UPI International”, tap to activate.

Using PhonePe:

- Open the PhonePe payment app and navigate to your profile picture.

- Under Payment Settings, select "UPI International".

- Click the Activate button next to the bank account you wish to use for international UPI payments.

- Enter your UPI PIN to confirm activation.

Important Considerations:

- Users can activate international transactions only for bank accounts that support UPI International.

- Debit from the bank account will be in Indian currency, subjecting transactions to foreign exchange conversion rates and bank fees.

With UPI services extending, travelers can now enjoy seamless and convenient payment experiences while travelling foreign countries.

So next time you travel abroad, don't forget to activate international UPI services for a smoother payment experience.

Published By : Rishi Shukla

Published On: 23 February 2024 at 00:02 IST