Updated 11 August 2023 at 19:50 IST

Move over unicorns, it is time for proficorns

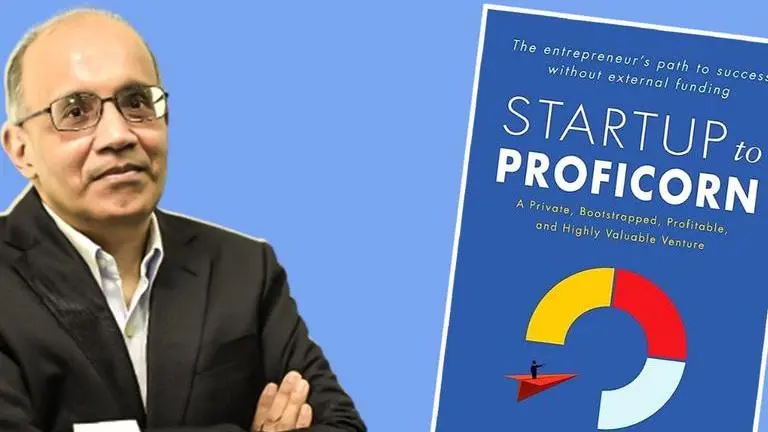

The froth of valuation may soon begin to settle as entrepreneurs realise the need to drive profits, says entrepreneur-author, Rajesh Jain.

- Republic Business

- 5 min read

Celebrating unicorns and rounds of fundings could be alright, only when a company is cash positive and has a profit engine running for itself. Rajesh Jain, founder of two tech companies IndiaWorld and Netcore and author of ‘Startup to Proficon’ a book on the theme of driving profits, shared his insights in a conversation with Republic.

A business should establish profitability within 5 years

A business always starts with a dream. It should ideally start showing profits within five years, believes Jain. “If a company is not being able to show profits within five years of starting up, there is something fundamentally wrong with its plan. It could take a business around 10 years to establish fully. But from the very start, there should be a focus on profits. The profit engine should kick in early on, so that the profits can be circulated for growth. This is the growth model that could help a company remain resilient during turbulence and I call such companies proficons,” says Jain. “Without profits, one has to either shut down or be dependent on a continuous inflow of external capital,” he explains.

Say no to cash burn, yes to bootstrapping!

Jain shares his decades of financial prudence from running his tech companies and says that burning cash could sound the death knell for companies if not kept under check. “At all times, companies today need to be wary of preventing the leaky bucket,” says Jain. He cites the example of Ferns N Petals and how it has managed to promote itself without spending on advertisement. “Barters, revenue sharing models are all options that young startups should take to create presence without cash burn. Those who burn a lot of cash and create a lot of froth in the start, are ought to hit reality when the froth clears,” says Jain.

Keep your skin in the game

Jain thinks that the cycle of continuous rounds of funding, scale and growing too large too soon, ultimately leads to a dilution of ownership. “So many founders ultimately end up working for their investors – exactly the situation they wanted to escape when they quit their jobs to turn toward entrepreneurship. With subsequent rounds of funding, the stake of the founder in the company goes reducing. Sooner or later, they lose touch with the customer and the company loses steam and the founder starts looking for exits. This is not how one builds a sustainable business. If growth is funded from profits, that is how a company continues to grow. It is important that the founder continues to have skin in the game. So many founders today just have 10-20 per cent stake in their startups after rounds of fund-raising, they practically have no control over their own companies as investors call the shots.

Advertisement

Becoming antifragile

Jain talks of the unicorn model where founders startup and grow fast and expand fast and then fire people as soon as they hit a roadblock. “A big difference is that during tough times, usually the unicorns fire while proficorns hire,” Jain writes in his book. He says he is a fan of companies that are ‘antifragile’ or a typical set up which has the “financial heft and freedom to turn a crisis into an opportunity.”

Fall in love with the problem

“A business is ultimately about creating solutions. Entrepreneurs should fall in love with the problem. Businesses must understand that they have to identify a problem and then solve it for the customers. Businesses take five or even 10 years to grow, but they should have a profit engine within five years of founding,” says Jain. Jain says in the book that he has learnt early on the need to turn the business profitable.

Advertisement

Roll out an IPO for the right reason

The danger of ever greening of debts and going from fund to fund by most companies, Jain says, is trap. “One has to understand that one day the ponzi sceheme will end,” he says, citing several tech-disruptors who have been expanding valuations while increasing debt-liabilities in recent years. Companies are rolling out IPOs for all the wrong reasons, usually when an investor is exiting, so as to be able to raise money. The ideal situation to go for an IPO is when a company has a predictable growth going forward. Obviously when one is going into the market to retail investors, the companies would be under much closer scrutiny.

New entrepreneurs will have to do much more

There is trust deficit for new founders in the market and funding is more difficult to secure than before. However, Jain believes that the entrepreneurial ecology is already established in the country. “The Indian entrepreneurial landscape has matured but new entrepreneurs beyond the motive of just market capitalisation,” says Jain. “For SaaS companies, the growth will come from being able to create a global presence. For other companies, serious investors may be keener on companies making a difference in small cities or ‘Bharat.’ “Companies have to derive product-market fit, show profits early and develop sustainable models,” he says.

Published By : Sharmila Bhowmick

Published On: 11 August 2023 at 19:24 IST