Updated 1 February 2025 at 14:19 IST

Budget 2025: How to Pay 0 Tax on Income Under ₹12 LPA | A Step-by-Step Calculation

Under the proposed tax structure, individuals with annual salaries up to ₹12 lakh will pay no taxes.

- Republic Business

- 2 min read

Budget 2025 LIVE: In a major boost for middle-class taxpayers, Finance Minister Nirmala Sitharaman, in the Union Budget 2025, announced an increase in the tax rebate under Section 87A, guaranteeing that individuals with a net taxable income of up to Rs 12 lakh will pay no tax under the new income tax regime.

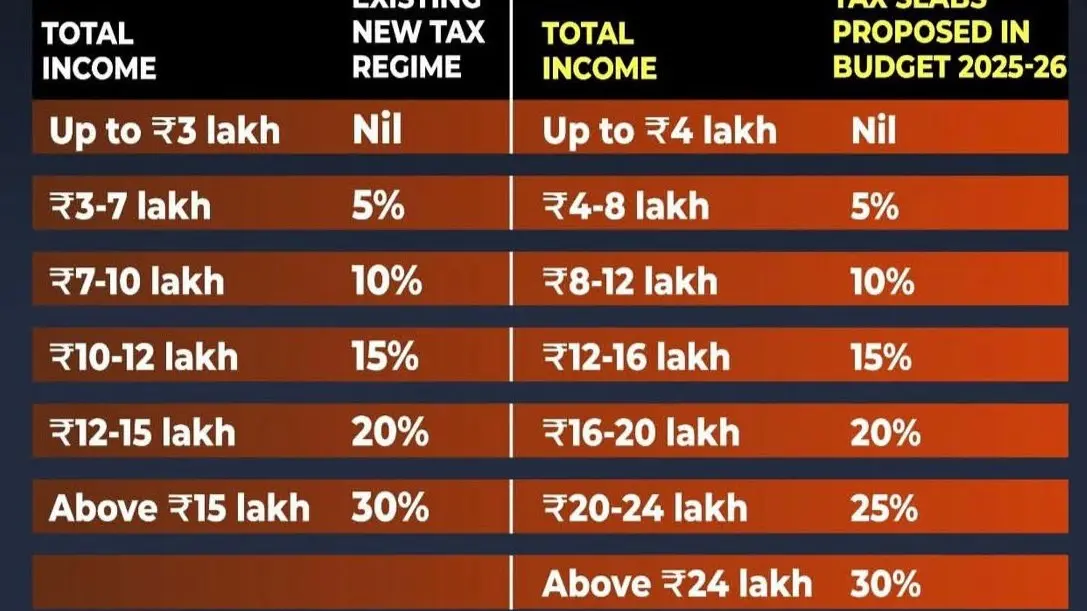

Under the new tax regime, Sitharaman proposed a revised tax slab.

Under the proposed tax structure, individuals with annual salaries up to ₹12 lakh will pay no taxes. Previously, those earning ₹12 lakh would have to pay ₹80,000 in tax. However, under the Union Budget 2025 proposal, the tax has been reduced to ₹60,000, leaving a balance of ₹20,000. With the introduction of a tax rebate, the net tax payable for such individuals will be zero.

Under Rs 12 LPA, How to Pay 0 Tax?

- Salary- 0 - 4 LPA

Tax Slab -NIL

Rebate - NA - Salary - 4 - 8 LPA

Tax Slab - 5%

Rebate - 100% - Salary - 8 - 12 LPA

Tax Slab - 10%

Rebate - 100%

BUDGET 2025: HOW MUCH WILL YOU SAVE | BENEFIT FOR DIFFERENT CATEGORY OF TAXPAYERS

What Does the Rs 12 Lakh Rebate Mean? What Will You Pay if You Earn Above That?

The finance minister has increased the income tax rebate limit from ₹7 lakh to ₹12 lakh, ensuring that individuals earning up to ₹12 lakh will have no tax liability.

But does this mean that those earning ₹15 lakh will only pay tax on the remaining ₹3 lakh?

Advertisement

No, the rebate only applies to income up to ₹12 lakh. If your taxable income exceeds ₹12 lakh, you will be taxed according to the new tax regime slab rates on the amount exceeding that limit.

Published By : Surabhi Shaurya

Published On: 1 February 2025 at 14:19 IST