Updated 15 June 2025 at 17:14 IST

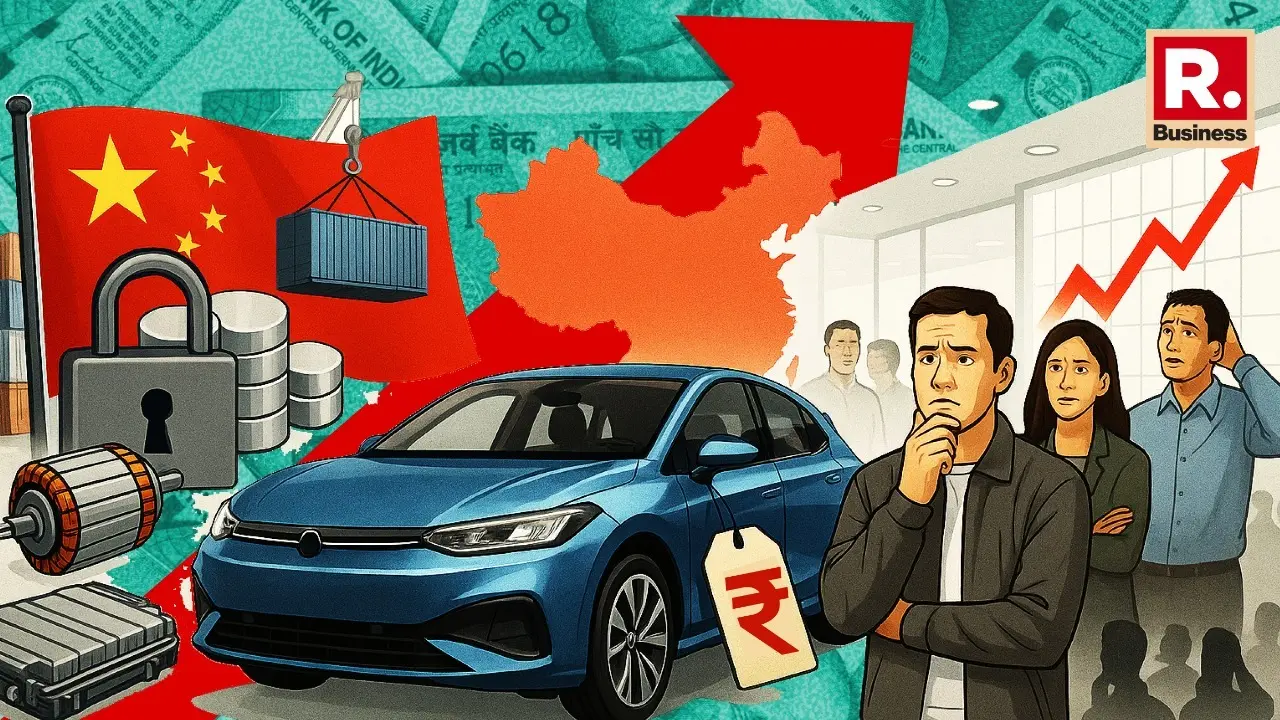

China Rare Earth Magnet Restriction Threatens India EV Boom, Warns Crisil

China's export restrictions on rare earth magnets could be India's electric mobility plans' gamechanger. Without strategic reshuffling and quick fixes, India's automobile ride may be in for a bumpy detour.

- Republic Business

- 3 min read

India's ambitious roll-out of electric vehicles (EVs) could be in for a massive speed hurdle as a lack of rare earth magnets — critical elements in EV motors — narrows, according to a new report by Crisil Ratings. The crisis stems from China's recent export clampdown, posing serious supply-side challenges for the Indian auto industry.

Rare Earth Magnets: Small Size, Big Impact

Rare earth magnets, although inexpensive, are crucial for Permanent Magnet Synchronous Motors (PMSMs) in electric and hybrid vehicles. They offer high torque, increased energy efficiency, and reduced size. Even internal combustion engine (ICE) cars depend on them for electric power steering as well as other motorized applications.

China's Clampdown Chokes Global Supply

Advertisement

In April 2025, China, which dominates more than 90% of the world's magnet production, enacted new export regulations on seven rare earth materials and finished magnets. The new framework requires export permits and end-use statements, particularly prohibiting use in defense or re-export to the US. Shipments have been greatly delayed by at least 45 days with authorization.

India, which imported more than 80% of its 540-ton magnet imports from China during the previous fiscal year, is now experiencing the heat. Crisil has reported that by end-May, almost 30 import requests from Indian companies had been endorsed locally, but none were cleared by Chinese authorities.

Advertisement

As per Anuj Sethi, Senior Director, Crisil Ratings, "The supply pinch arrives at the time when India is preparing for a barrage of EV launches. Delays after July would jeopardize EV production timelines."

Automakers currently carry a 4-6 week buffer stock, but sustained disruptions could lead to deferrals or rescheduling, particularly of two-wheelers and passenger EVs.

Growth at Risk: EVs, 2-Wheelers at Risk

Crisil predicts that while passenger vehicle sales in aggregate could expand 2-4% in FY26, EVs could rise 35-40%—as exports abort if supply chains continue to get clogged. Electric two-wheelers, which are anticipated to expand 27%, are particularly vulnerable. Any persistent bottlenecks could arrest this pace brutally.

India Scrambles for Alternatives

The Indian government and manufacturers are taking two-track action, sensing the danger:

Short Term: Strategically building inventories, switching to alternate suppliers, and increasing domestic magnet assembly under PLI programs.

Long Term: Accelerating exploration of rare earth, scaling up domestic manufacture, and creating recycling infrastructure.

The External Affairs Ministry confirmed that negotiations with Beijing to regain predictability in the export of rare earth were on. Commerce Minister Piyush Goyal, describing China's action as a "wake-up call for the world," indicated that India is going all out to create alternative supply chains and positioning itself as a reliable partner to global enterprises.

Global Vulnerability, Regional Alliances

Outside of India, the world is exposed to Chinese rare earth hegemony. These resources play a vital role in automobiles, white goods, and renewable energy. To neutralize this, India recently conducted rare earth cooperation with Central Asian countries such as Kazakhstan and Uzbekistan at the India-Central Asia Dialogue.

Also Read: US-China Trade Pact Left Military Use Rare Earth Issue Unresolved

Published By : Rajat Mishra

Published On: 15 June 2025 at 17:14 IST