Updated 9 July 2025 at 19:02 IST

Electric Vehicles to Fuel Massive Surge in Lithium-Ion Battery Demand by 2030: ICEA-Accenture Report

According to the report, which is cited by ANI, the country’s LiB demand is expected to reach 115 gigawatt-hours (GWh) by 2030. The surge will be powered by three key sectors: consumer electronics, stationary energy storage, and EVs — with the latter projected to grow at a staggering 48% compound annual growth rate (CAGR) over the next six years.

- Republic Business

- 2 min read

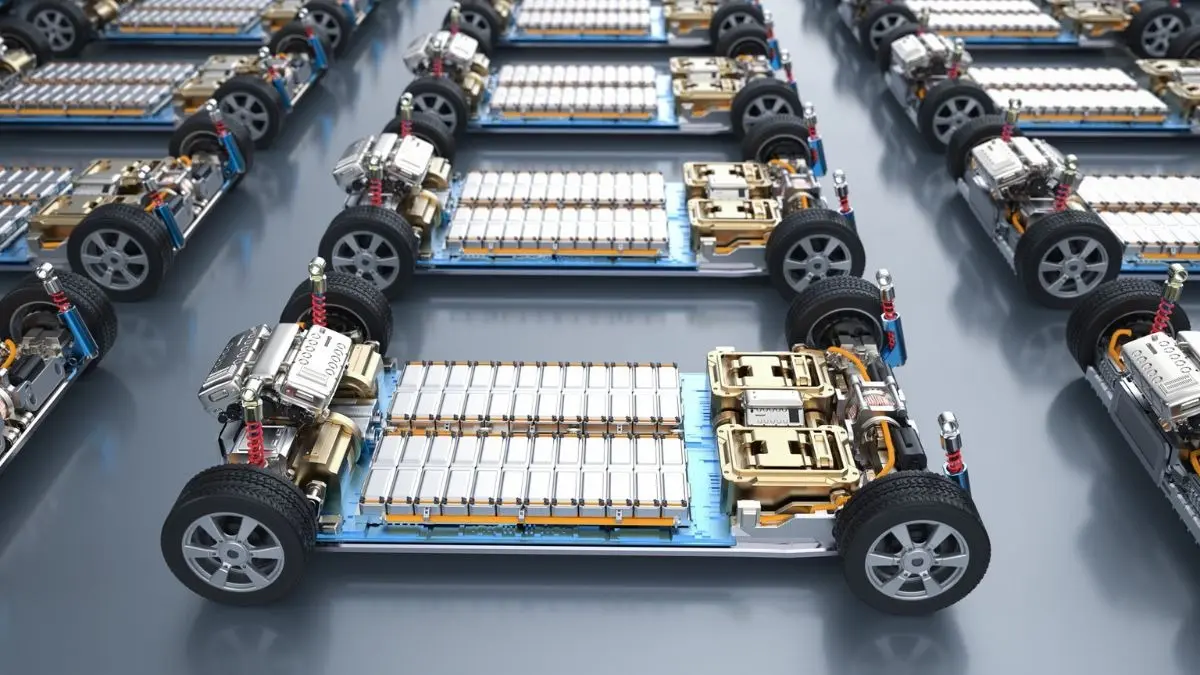

India’s lithium-ion battery (LiB) market is on the cusp of exponential growth, with Electric Vehicles (EVs) set to play a leading role in driving demand, a new report by the India Cellular and Electronics Association (ICEA) and Accenture has revealed.

According to the report, which is cited by ANI, the country’s LiB demand is expected to reach 115 gigawatt-hours (GWh) by 2030. The surge will be powered by three key sectors: consumer electronics, stationary energy storage, and EVs — with the latter projected to grow at a staggering 48% compound annual growth rate (CAGR) over the next six years.

By contrast, demand from consumer electronics is expected to rise at a modest 3% CAGR, while stationary storage systems are anticipated to grow at 14% CAGR, underscoring the rapidly accelerating role of EVs in India's green energy transformation, as per the same report.

Also Read: Are Single-Crystal Electrodes The Future Of Lithium-Ion Batteries In EVs? | Republic World

Advertisement

Driving factors

The report attributes this upward trend to India's climate commitments, such as the country’s Net-Zero pledge and a series of government initiatives designed to boost clean energy adoption. These include policies that encourage battery manufacturing, promote the recycling of used batteries, and reduce dependency on fossil fuels.

India's broader ambitions, as outlined during COP26 in Glasgow, include adding 500 GW of non-fossil fuel power capacity, fulfilling 50% of energy requirements through renewables, and cutting emissions by 1 billion tonnes by the end of this decade.

Stumbling blocks

However, India’s ambitions come with pressing challenges. The country still lacks domestic manufacturing capacity for lithium-ion battery cells and related critical materials such as lithium, cobalt, nickel, and manganese.

Advertisement

This leaves India heavily dependent on imports — a vulnerability that could cost the country over $5 billion between 2024 and 2030, based on projected demand of more than 250,000 tonnes of active materials.

Additionally, battery waste management remains a concern. Nearly 39% of lithium-ion batteries used in consumer electronics are never collected after reaching their end-of-life stage, posing serious environmental risks and reducing opportunities for material recovery.

Government’s response

To address these concerns, the government has rolled out a series of measures. The Critical Minerals Mission aims to secure access to essential raw materials, while import duty exemptions have been announced to ease the sourcing of key inputs. On the environmental front, the Battery Waste Management Rules (BWMR), introduced in 2022 by the Central Pollution Control Board (CPCB), seek to build a circular economy for batteries through regulated recycling practices.

Published By : Avishek Banerjee

Published On: 9 July 2025 at 19:02 IST