Updated 19 September 2024 at 16:00 IST

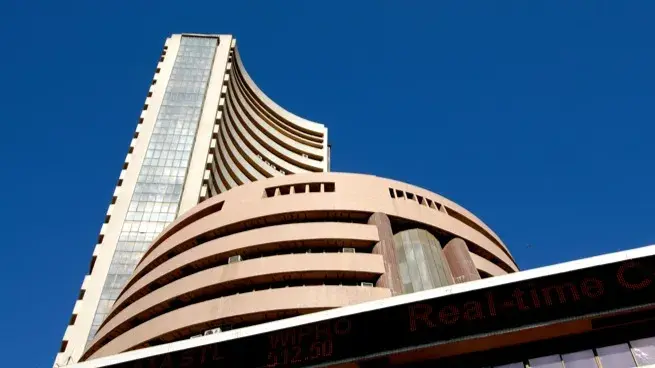

Fed rate cut lifts Indian shares to record high

The Fed's dot plot also signalled that the central bank has projected another half-a-percentage point cut in 2024.

- Republic Business

- 2 min read

Indian shares climbed to a record high on Thursday, buoyed by expectations of a rise in foreign inflows after the US Federal Reserve kicked off its monetary easing cycle with a large half-percentage point rate reduction.

The Nifty 50 index gained 0.15 per cent to 25,415.8, while the S&P BSE Sensex added 0.29 per cent to 83,184.8.

"The Federal Reserve's rate cut is expected to boost Indian equities and attract foreign investment in the short term," said Vipul Bhowar, senior director of listed investments at Mumbai-based wealth advisory firm Waterfield Advisors.

The Fed's dot plot also signalled that the central bank has projected another half-a-percentage point cut in 2024.

Advertisement

"However, concerns about the underlying weaknesses in the US economy persist and could lead to increased market volatility," Bhowar said. The IT and pharma indexes, which added about 1 per cent and 0.6 per cent respectively in early trade, reversed gains to settle 0.3 per cent and 0.4 per cent lower. Two analysts attributed the drop to profit booking at record levels.

IT and Pharma companies earn a significant share of their revenue from the US

Advertisement

Banking, consumer and realty stocks added about 0.5 per cent each, while the oil and gas index shed 1.3 per cent, dragged by oil marketing companies.

The broader, more domestically focussed small- and mid-caps lost 1.3 per cent and 0.7 per cent, respectively.

"The margin of safety in terms of valuations for small- and mid-caps has reduced due to the recent sharp rally," said Neeraj Chadawar, head of fundamental and quantitative research at Axis Securities.

"There could be some correction in broader markets with flows likely to shift to large-caps," Chadawar said.

Among individual stocks, state-owned power producer NTPC rose 2.4 per cent after its green energy arm filed for a $1.2 billion initial public offer.

Telecom companies such as Vodafone Idea fell 20 per cent, while Indus Towers dropped about 9 per cent after the country's top court rejected their plea to correct alleged errors in calculating the license fee they owe the government.

Published By : Priyanshi Mishra

Published On: 19 September 2024 at 16:00 IST