Updated 12 August 2023 at 16:32 IST

How did Nvidia manage to enter the trillion-dollar market capitalisation club

Nvidia's revenue for quarter ended April 30, 2023 came in at $7.19 billion, down 13 per cent from a year ago and up 19 per cent from the previous quarter.

- Republic Business

- 4 min read

American chip making giant Nvidia’s stock has surged over 185 per cent year-to-date, while its market capitalisation, as of now, stands at a little over $1 trillion-mark. But what did the company really do to enter this elite trillion-dollar market capitalisation club?

Nvidia’s journey to $1 trillion club

With the boom in high-end graphics card sales fueled by gaming, artificial intelligence (AI), virtual reality, and the automotive industry in 2016, Nvidia's market capitalisation began to rise. During the coronavirus outbreak, the industry grew as gaming, cloud computing, and bitcoin mining all grew in popularity which spiked demand for chips manufactured by Nvidia.

However, the stock plummeted almost 50 per cent by the end of 2022 from its yearly high due to a halt in growth and a broader market selloff.

Earlier this year, Nvidia became the fifth most valuable US corporation behind Apple, Microsoft, Alphabet, and Amazon, when its valuation surpassed $1 trillion-mark for a brief period for the first time. Tesla and Meta are the other two US-based companies who have, in the past, crossed the $1 trillion-mark, but are currently worth less than that.

Advertisement

Financial Performance

Nvidia announced its financial results for the first quarter of fiscal 2024 in May. Its revenue for the first quarter ended April 30, 2023 came in at $7.19 billion, down 13 per cent from a year ago and up 19 per cent from the previous quarter.

Generally accepted accounting principles (GAAP) earnings per diluted share were $0.82, up 28 per cent from a year ago and up 44 per cent from the previous quarter while Non-GAAP earnings per diluted share were $1.09, down 20 per cent from a year ago and up 24 per cent from the previous quarter.

Advertisement

“The computer industry is going through two simultaneous transitions — accelerated computing and generative AI,” said Jensen Huang, founder and CEO, Nvidia.

“A trillion dollars of installed global data centre infrastructure will transition from general purpose to accelerated computing as companies race to apply generative AI into every product, service and business process. Our entire data centre family of products — H100, Grace CPU, Grace Hopper Superchip, NVLink, Quantum 400 InfiniBand and BlueField-3 DPU — is in production. We are significantly increasing our supply to meet surging demand for them,” he added.

During the first quarter of fiscal 2024, Nvidia returned to shareholders $99 million in cash dividends.

Outlook

Nvidia expects its revenue to be $11 billion, plus or minus 2 per cent in the second quarter of fiscal 2024. Its GAAP and non-GAAP gross margins are expected to be 68.6 and 70 per cent, respectively, plus or minus 50 basis points.

In other developments, China’s internet giants are hurrying to buy high-performance Nvidia chips vital for building generative AI systems, making orders worth $5 billion in a buying frenzy fuelled by fears the US will impose new export controls, according to a report by the Financial Times. Baidu, ByteDance, Tencent and Alibaba have ordered worth $1 billion to acquire about 100,000 A800 processors from the US chipmaker, which is expected to be delivered by this year.

The Chinese groups had also purchased a further $4 billion worth of the graphics processing units, which are to be delivered in 2024, two people close to Nvidia told Financial Times.

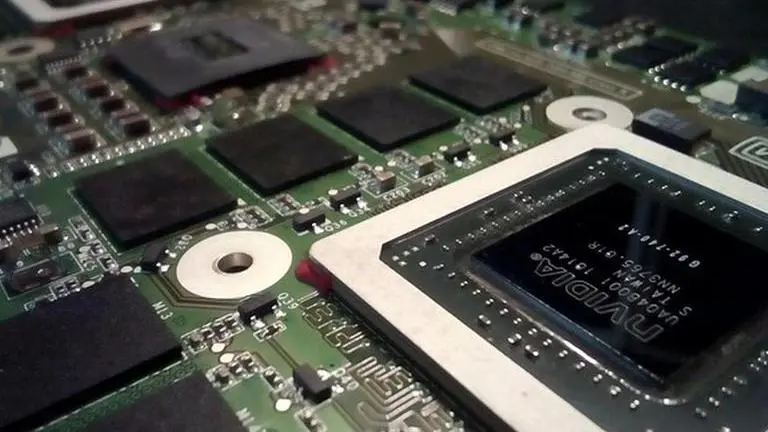

Established in 1993 by Jen-Hsun Huang, Curtis Priem and Chris Malachowsky, the Santa Clara headquartered company is amongst the largest developers of graphics processors and chipsets for personal computers and game consoles. In May 1995, Nvidia launched the NV1 (STG-2000), one of the first 3D accelerator processors (GPU). The company went public in January 1999, and delivered the ten millionth graphics chip in the same year.

Published By : Tanmay Tiwary

Published On: 12 August 2023 at 16:32 IST