Updated 10 June 2025 at 16:40 IST

India May Inflation Likely Declined To 3% As Food Prices Ease

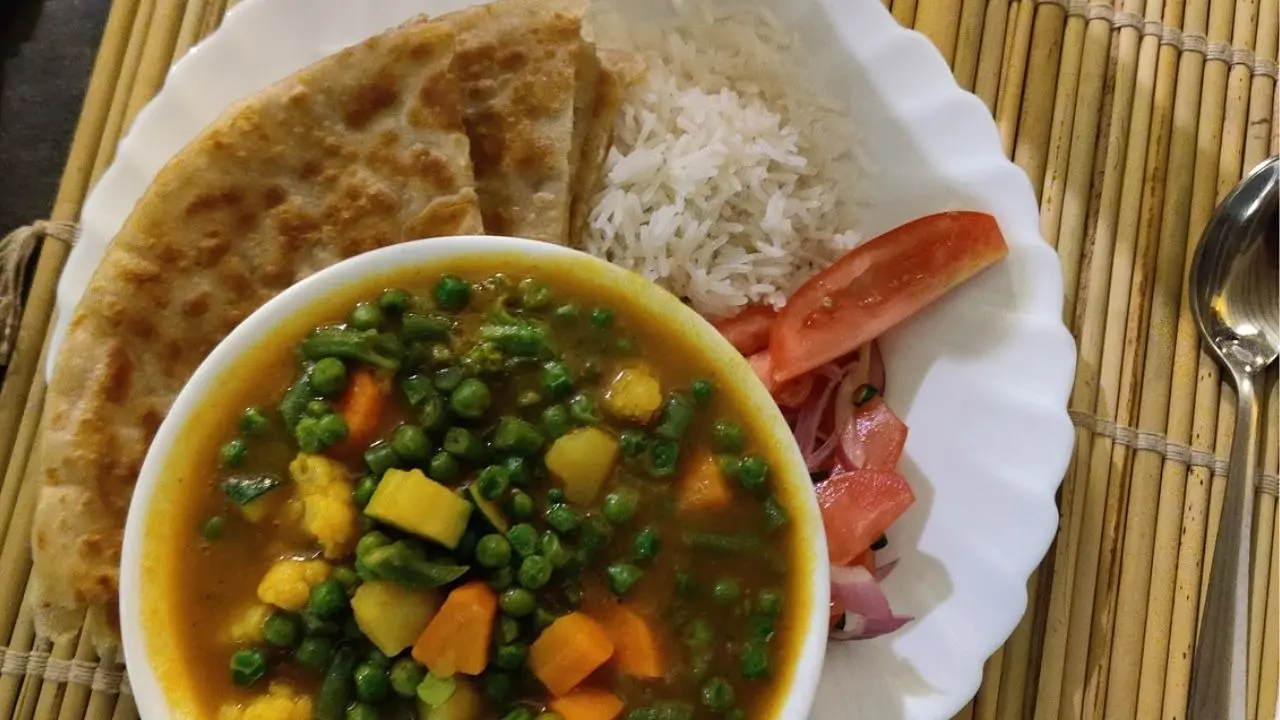

Consumer inflation rate in India, likely eased to a low of over six years, to 3% in May due to favourable base and an easing in food prices, a Reuters report said.

- Republic Business

- 2 min read

Consumer inflation rate in India, likely eased to a low of over six years, to 3% in May due to favourable base and an easing in food prices, a Reuters report said.

The Reserve Bank of India (RBI) on Friday by slashing its key policy rate by 50 basis points stunned the financial markets.

While this was done to boost economic growth as inflation had remained subdued, it was double of the reduction that was predicted.

Additionally, the central bank, which typically targets inflation in the middle of its 2-6% range in the medium term, also shifted its policy from 'accommodative' to 'neutral'.

Advertisement

Consumer Price Index (CPI) Likely Declines

According to a Reuters poll of 50 economists, forecast inflation measured by the annual change in the consumer price index (CPI) fell even further to 3% in May from 3.16% in April.

This would mark the fourth consecutive month below the central bank's 4% medium-term target, which is the longest such streak in almost six years, the Reuters report added.

Advertisement

"We are expecting a cooling of inflation to 3% on a combination of a favourable base effect and... sequential moderation in prices of cereals and pulses even as most other segments started to strengthen," the report cited Kanika Pasricha, chief economic advisor at Union Bank of India.

While there were concerns of widespread heatwaves, raising fears of an inflation spike last month, a healthy harvest and the early arrival of monsoon helped ease those risks.

Additionally, core inflation, which strips out volatile food and energy items and is seen as a better marker of domestic demand, was expected to rise to 4.20% year-on-year in May, from an estimated 4% to4.10% in April, as per the Reuters poll.

The wholesale price index (WPI)-based inflation likely declined to a 14-month low of 0.80% in May from 0.85% in April, the survey found.

Published By : Sagarika Chakraborty

Published On: 10 June 2025 at 16:40 IST