Updated 7 August 2025 at 08:36 IST

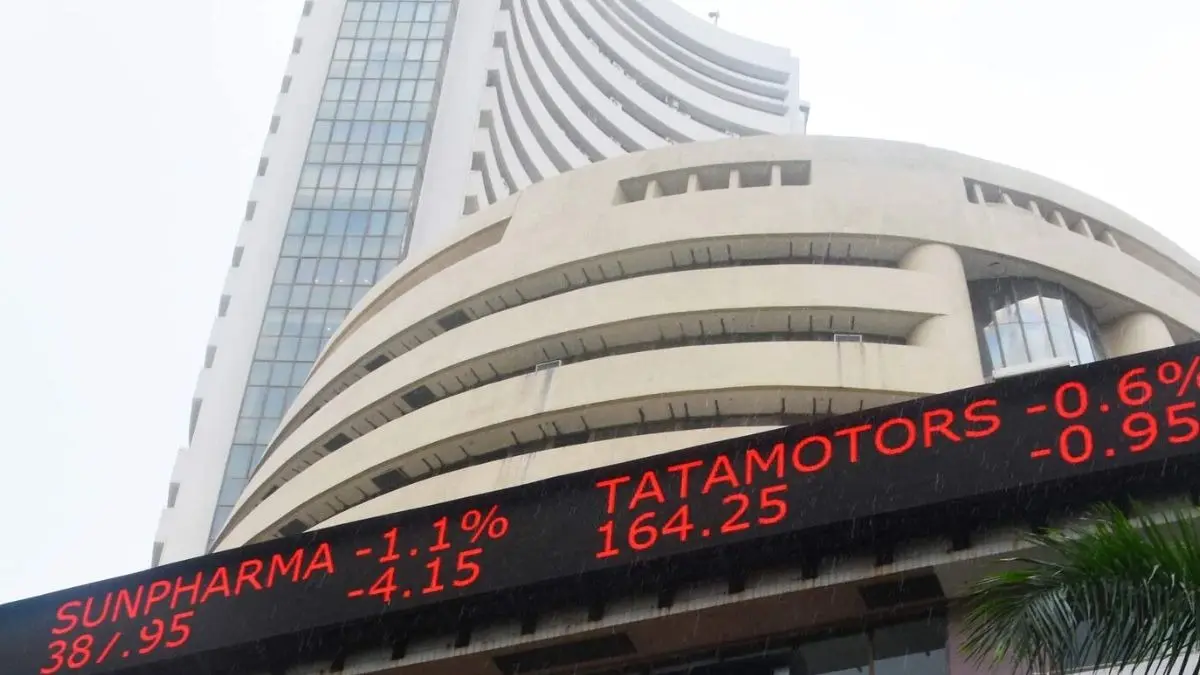

Indian Markets Brace For Volatility Amid US President Donald Trump's 25% Tariff Hike - Key Insights

Indian equity markets are poised for a volatile open following a fresh escalation in trade tensions as US President Trump has imposed an additional 25% tariff on India.

- Republic Business

- 3 min read

Indian equity markets are poised for a volatile open following a fresh escalation in trade tensions, as US President Trump has imposed an additional 25% tariff on India's continued crude oil imports from Russia.

This comes on top of the 25% duties already made effective from August 7 on all Indian-origin goods, raising the total tariff burden on Indian exports to a steep 50%, the highest imposed on any country globally under the revised US trade policy, said Sugandha Sachdeva, Founder of SS WealthStreet.

The move is part of a broader geopolitical strategy aimed at coercing Russia into a peace deal with Ukraine, with India’s energy ties with Moscow now coming under direct fire. As per the latest order, India has a 21-day window to engage in trade negotiations before the additional tariffs take effect, offering a narrow opportunity to potentially ease tensions, she said.

This punitive step threatens to derail the Indo-US strategic and economic relationship, which has evolved steadily since 1998. The implications of these levies extend beyond trade and into critical areas such as technology partnerships, H-1B visa access for Indian tech talent, cross-border capital flows, and the future of US firms' offshore manufacturing in India, she added.

Advertisement

The Indian government has strongly denounced the new measures as "unfair, unjustified, and unilateral", and is expected to explore both diplomatic and trade avenues to defend national interests. However, the near-term sentiment in financial markets is likely to remain cautious, as investors brace for potential retaliatory moves and await clarity from upcoming negotiations.

Advertisement

From a technical standpoint, Nifty is hovering near a key support zone at 24,450, and a breach below this level could trigger a swift decline toward 24,180 in the short term, Sachdeva said. Key resistance in the near-term rests at the 24,750 and 24,950 levels. For the banking index, 55200 remains a crucial support, and a break of the same shall pave the way towards 54600 mark.Broader market sentiment may remain under pressure amid geopolitical uncertainty, with volatility expected to intensify, particularly in sectors sensitive to global trade flows, energy imports, and foreign capital exposure.

Until there is visible progress on the diplomatic front or signs of a softened stance from the US administration, risk sentiment is expected to stay fragile, and a defensive approach may prevail among market participants.Eyes would also be on the Q1 earnings from several key companies which shall also influence the direction of the market.

Published By : Nitin Waghela

Published On: 7 August 2025 at 08:36 IST