Updated 4 April 2024 at 22:58 IST

Lambda secures $500 million loan, Nvidia chips as collateral in deal

Lambda secured the financing through a "special purpose GPU financing vehicle," which is backed by GPUs and supported by their cash flow generation.

- Republic Business

- 2 min read

Specialty artificial intelligence cloud provider Lambda has obtained a $500 million loan from lenders, including Macquarie Group, with Nvidia's highly sought-after chips serving as collateral, it said on April 4.

Startups addressing the demand for chips and software capable of supporting complex computing requirements have been attracting significant private investment amid the cut-throat AI competition.

Many companies are striving to develop their own generative AI (GenAI) offerings to gain a foothold in the growing AI market.

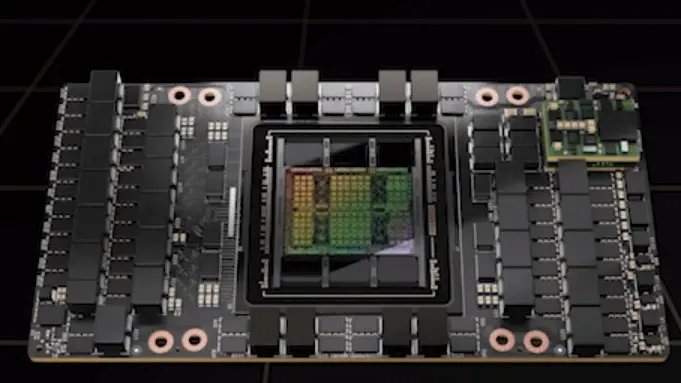

The shortage of fast AI chips, equipped with millions of transistors, has heightened their appeal, particularly Nvidia's graphics processing units (GPUs), which are highly coveted in the industry.

Lambda secured the financing through a "special purpose GPU financing vehicle," which is backed by GPUs and supported by their cash flow generation. This asset-based financing structure involves lenders providing funds against a company's assets as collateral.

The funds obtained will be utilised by Lambda to significantly expand its GPU Cloud, featuring Nvidia's H100s, as well as to acquire Nvidia's latest Blackwell AI chips, including the B200 and GB200. Nvidia CEO Jensen Huang disclosed in March that the B200 AI chip would be priced between $30,000 to $40,000.

Lambda was previously announced by Nvidia in November last year as one of the first cloud service companies to offer access to its H200 chips.

In addition to Macquarie Group, the loan also involves investment adviser Industrial Development Funding.

This development follows Lambda's $320 million funding round led by billionaire Thomas Tull's US Innovative Technology in February.

Lazard served as the exclusive financial adviser and placement agent to Lambda for this transaction, according to the company's statement.

(With Reuters Inputs)

Published By : Gauri Joshi

Published On: 4 April 2024 at 22:58 IST