Updated 13 November 2023 at 13:35 IST

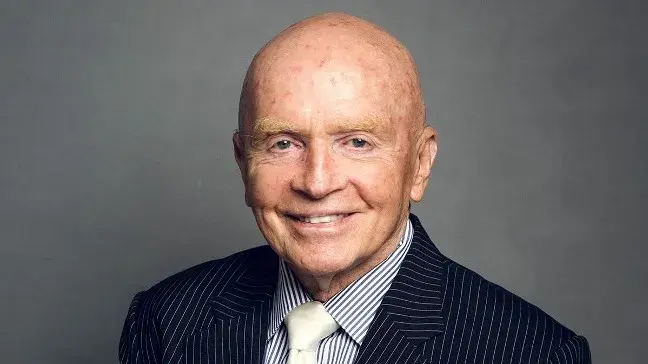

Mark Mobius, pioneer of emerging markets investing, announces departure from Mobius Capital Partners

Having spent the majority of his career at Franklin Templeton, Mobius played a pivotal role in establishing the Templeton Emerging Markets Group.

- Republic Business

- 3 min read

Renowned emerging markets investor Mark Mobius is set to step down from Mobius Capital Partners, the firm he co-founded in 2018, marking the end of a remarkable 40-year career in asset management. At 87 years old, Mobius has been a trailblazer in the industry, having initiated one of the first funds dedicated to emerging markets over three decades ago.

It’s been an incredible journey at @MobiusCap, where I witnessed its growth and success, going forward I will be shifting my focus and dedicating more time to exciting new projects in #Dubai, centered around #entrepreneurship investments and consulting. I also have two new books… pic.twitter.com/KlQYiFJUvj

— Mark Mobius (@MarkMobiusReal) November 13, 2023

Having spent the majority of his career at Franklin Templeton, Mobius played a pivotal role in establishing the Templeton Emerging Markets Group. During his tenure, he not only launched one of the world's first funds focused on growth economies in 1987 but also significantly expanded the group's investments in the sector from $100 million to an impressive $40 billion.

Upon retiring from Franklin Templeton in 2018, Mobius, along with Carlos Hardenberg and Greg Konieczny, co-founded Mobius Capital Partners. The firm currently manages a $42 million fund and a £164 million investment trust, both concentrating on emerging markets. Notably, the fund has outperformed, boasting a 26.9 per cent return since its inception, compared to the 11.5 per cent return from MSCI's EM Midcap index.

Mobius, known for his strategic investments in Asia and Russia following financial crises, has been a key figure in the industry's evolution. The Mobius Capital Partners' statement indicated that Mobius plans to step down in the coming months, emphasising that his departure is amicable, and that he will continue to remain active.

Advertisement

Carlos Hardenberg, who has collaborated with Mobius for 23 years, expressed gratitude for Mobius's contributions to emerging market investing. He assured that new partners for the firm would be announced in due course, emphasising the need for a robust structure to support the company in the years to come.

In a separate report, it was disclosed that Mobius Investment Trust, based in London, will continue to be managed by Mobius Capital Partners LLP, led by Founding Partner Carlos Hardenberg. The trust, with $250 million in assets under management as of February, affirms its commitment to Mobius's legacy.

Advertisement

Mark Mobius, despite stepping back from the investment firm, remains optimistic about the Indian market. He recently expressed confidence in India's economic growth, predicting that the Sensex is poised to reach new heights, with a target of 100,000 within the next five years. Mobius sees India as a land of opportunities and innovation, poised to play a pivotal role in the global financial arena.

Mobius's departure from Mobius Capital Partners marks the end of an era, but his legacy and impact on emerging market investing will undoubtedly endure. The firm plans to continue managing the Mobius Investment Trust, showcasing a commitment to Mobius's vision for developing regions, including China, India, Latin America, and frontier markets. As the industry bids farewell to one of its pioneers, Mobius's influence will continue to shape the landscape of emerging market investments.

Published By : Sankunni K

Published On: 13 November 2023 at 13:35 IST