Updated 29 March 2024 at 10:24 IST

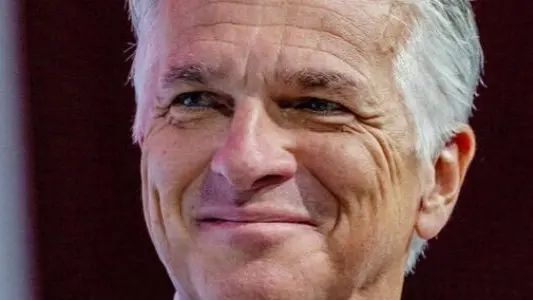

Sergio Ermotti has a path to Wall Street-style pay

JPMorgan boss Jamie Dimon and Morgan Stanley’s outgoing CEO James Gorman last year took home $36 million and $37 million.

- Republic Business

- 3 min read

Peak performance. Sergio Ermotti is well rewarded or underpaid, depending on which side of the Atlantic you’re on. UBS on Thursday revealed it had handed its chief executive 14.4 million Swiss francs ($15.9 million) for the nine months since he returned to lead the Swiss lender in April last year, making him Europe’s best-paid bank chief. While his Wall Street peers routinely get double that, there’s a way to narrow the gap.

JPMorgan boss Jamie Dimon and Morgan Stanley’s outgoing CEO James Gorman last year took home $36 million and $37 million, respectively. That reflects U.S. investors’ comfort with bumper remuneration packages, but also the fact that their banks report healthy returns on tangible common equity and have stocks which trade at twice the value of their net assets.

UBS is some way short of those lofty heights. As it absorbs Swiss rival Credit Suisse, the bank this year expects to earn an underlying return on common equity Tier 1 capital, a roughly similar metric, in the mid-single digits. Its shares change hands at 1.2 times tangible book value – well below its New York-based competitors. But shareholders like Cevian Capital think the enlarged group’s huge wealth management operations provide a path to U.S.-style returns and valuations. The bank itself aspires to an 18% return on common equity Tier 1 in 2028.

Annualise Ermotti’s compensation for 2023 and he would have earned $21 million – within the $20 million to $40 million range for CEO pay set out by Morgan Stanley. However, UBS caps its top executive’s compensation at 5 times his annual salary of 2.5 million Swiss francs, limiting his total package to 15 million Swiss francs ($16.7 million). That’s not the end of the story, though. UBS’s annual report says the bank will raise this limit to 7 times in the coming years, adding 5 million Swiss francs to Ermotti’s maximum payout.

Advertisement

This generosity risks upsetting stakeholders in Switzerland, who watched the government provide financial support and emergency legislation to enable UBS to rescue Credit Suisse. UBS can point to the fact that 80% of Ermotti’s bonus is in deferred stock and bonds rather than cash. But if the bank achieves its objectives, the stock will also be worth more.

Providing he hits his target, Ermotti therefore has a path towards joining Wall Street’s elite. His American peers are still well ahead, but rival European bank bosses like HSBC’s Noel Quinn and Santander’s Ana Botín can only look on in envy.

Advertisement

Published By : Saqib Malik

Published On: 29 March 2024 at 10:24 IST