Updated 2 May 2025 at 20:50 IST

Seven Decades, Twenty Bailouts: Inside Pakistan’s Endless Dance with the IMF

Fast forward to 2024, and Pakistan’s external debt has reached a staggering $130 billion. A significant portion — nearly 22%—is owed to China

- Republic Business

- 3 min read

Pakistan’s financial relationship with the International Monetary Fund (IMF) dates back to 1958 — and since then, it has become a recurring lifeline. What began as support for a newly independent state grappling with the economic fallout of Partition has evolved into a chronic dependency. Wars with India in 1947, 1965, and 1971, the secession of East Pakistan (now Bangladesh), and persistent instability cemented Islamabad’s need for external help.

The first IMF bailout in 1958 set a precedent. From that moment, every economic crisis — whether triggered by internal mismanagement or external shocks — led Pakistan back to Washington, cup in hand.

The Adjustment Era: Austerity Without Reform

Between the 1980s and early 2000s, Pakistan entered a phase dominated by IMF structural adjustment programs. These reforms demanded privatisation, subsidy cuts, and strict fiscal controls. But successive military and civilian regimes implemented them half-heartedly, often undermined by corruption and political instability.

Advertisement

By 2007, Pakistan’s external debt had soared to $43 billion — a fourfold jump from 1980. Much of it was driven by rising security expenditures during the Afghan-Soviet war and the post-9/11 global “War on Terror,” both of which elevated Pakistan’s geopolitical importance — and its fiscal burdens.

A Tipping Point: Debt, Disasters, and China

Advertisement

Fast forward to 2024, and Pakistan’s external debt has reached a staggering $130 billion. A significant portion — nearly 22%—is owed to China, primarily under the China-Pakistan Economic Corridor (CPEC), a marquee Belt and Road initiative.

Natural disasters have only deepened the crisis. The 2022 floods, which affected 33 million people, inflicted damages worth $30 billion. Combined with the economic fallout of COVID-19 and supply chain shocks, these events pushed Pakistan to the edge of sovereign default.

Another Bailout, Familiar Conditions

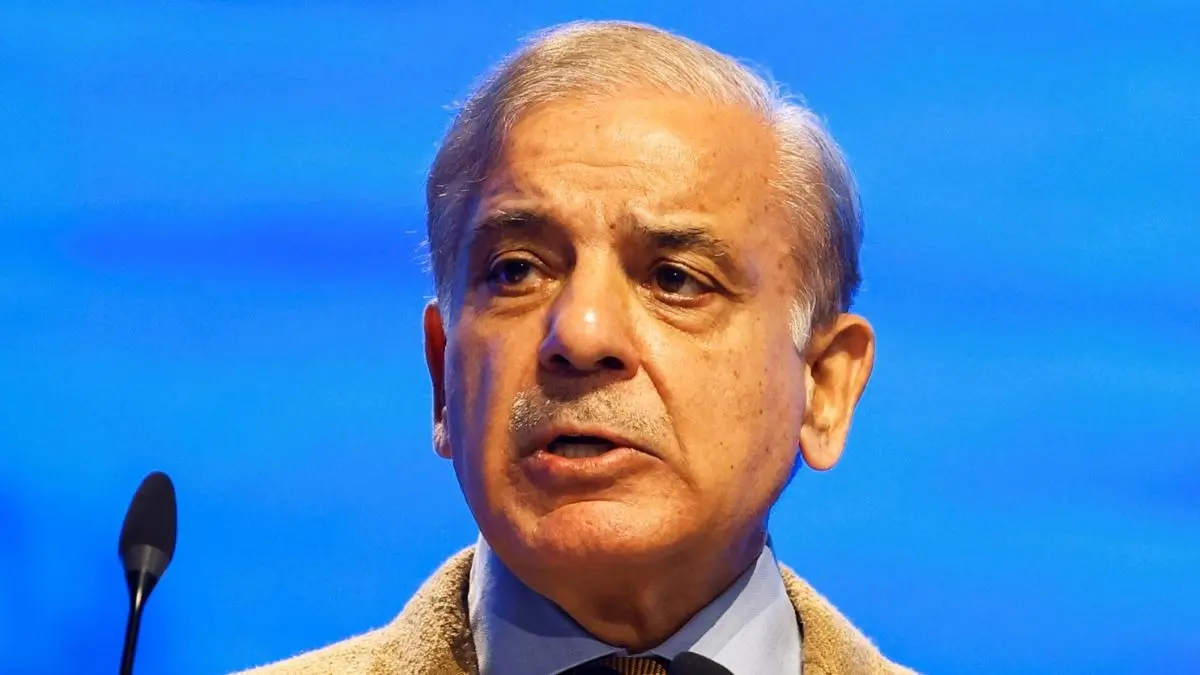

In 2023, the IMF approved yet another rescue package — this time worth $7 billion. Pakistan will receive $1 billion upfront, with the rest disbursed over three years. Prime Minister Shehbaz Sharif hailed the deal and thanked IMF chief Kristalina Georgieva, calling it a “critical moment of support.”

But the underlying conditions are strict — and familiar: hikes in gas tariffs, new taxes, tighter monetary policy, and a flexible exchange rate. In reality, it’s more of the same medicine that has yielded few long-term cures in the past.

The Cost of Borrowing: A Nation Buckling

Pakistan’s debt-to-GDP ratio has crossed 70%. More troubling is the cost of servicing this debt. According to IMF and credit rating estimates, 50–60% of the government's revenues are now spent solely on interest payments — the worst ratio among any sizable economy today.

Analyst firm Tellimer points out that most of Pakistan’s debt is domestic, accounting for 60% of the total stock and 85% of interest obligations. Meanwhile, foreign debt — largely owed to bilateral and multilateral lenders — includes around 13% owed to China. In contrast, international bondholders account for just 3.4% of Pakistan’s public debt.

Inflation Nation: Pain for the People

For ordinary Pakistanis, the burden is crushing. Gas and electricity prices have skyrocketed. The rupee has plunged — with the IMF projecting an exchange rate of 305 per U.S. dollar this fiscal year and 331 next year, both significantly weaker than current levels. Inflation has surged to nearly 30% year-on-year. While it’s expected to moderate slightly later in 2025, it will remain well above the central bank’s 5–7% target. For many households, basic food and fuel are now luxuries.

Read This Also: Poonam Gupta Takes Charge As RBI Deputy Governor, To Join MPC in June

Published By : Rajat Mishra

Published On: 2 May 2025 at 20:50 IST