Updated 26 March 2025 at 13:36 IST

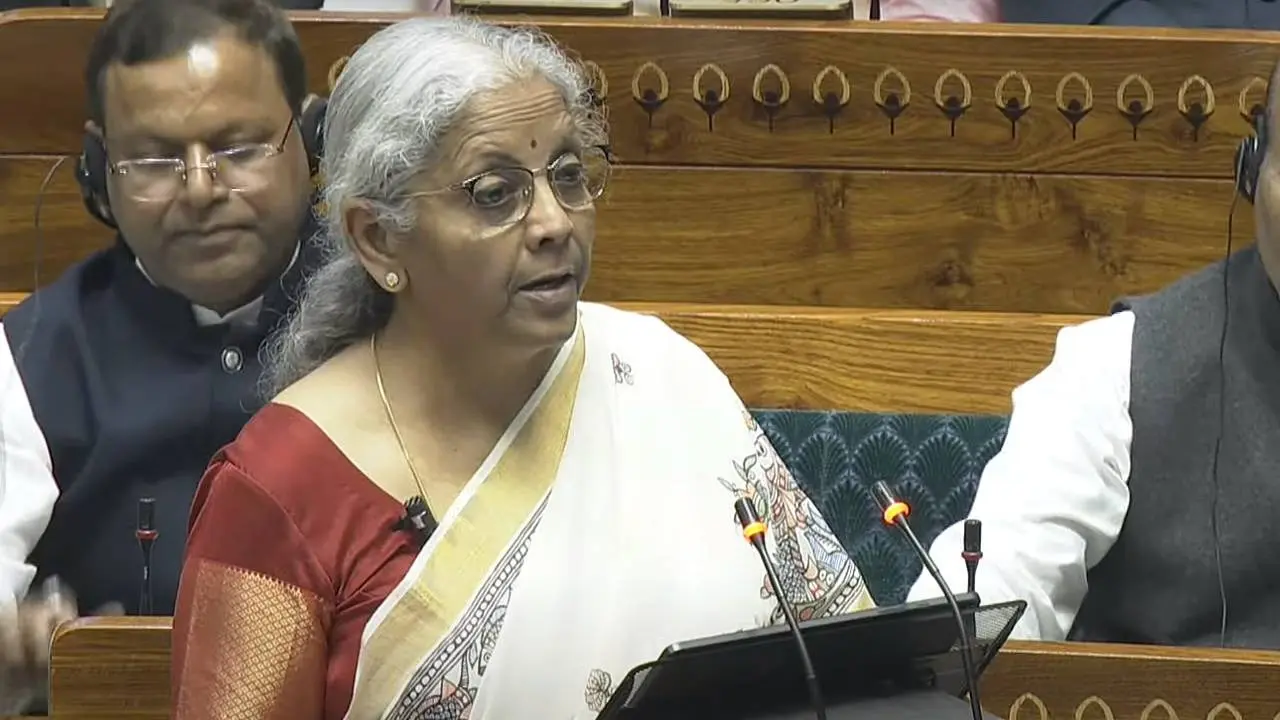

WhatsApp Chats Reveal Rs 200 Cr Unaccounted Money: FM Sitharaman

According to Sitharaman, encrypted messages on mobile phones led to unearthing Rs 250 crore unaccounted money.

- Republic Business

- 2 min read

The Union Minister of Finance, Nirmala Sitharaman , while defending the new Income Tax Bill in the Lok Sabha said that WhatsApp messages helped reveal Rs 200 crore in unaccounted money which was linked to crypto assets.

How Was The Unaccounted Money Found?

The Finance Minister while addressing the Lok Sabha said that granting tax authorities access to digital record is crucial for addressing tax evasion and financial fraud.

According to Sitharaman, encrypted messages on mobile phones led to unearthing Rs 250 crore unaccounted money.

Evidence from WhatsApp communication helped unearth Rs 200 crore unaccounted money, she added.

Advertisement

Sitharaman also pointed out that Google Maps history was used to identify the locations that were visited frequently to hide cash.

Further, Instagram accounts were analysed to determine 'benami' property ownership.

Advertisement

FM's Defence Of The New Income Tax Bill

According to Sitharaman, the move helps keep tax enforcement up to date with new technology, simultaneously ensuring that virtual assets like cryptocurrencies do not go unnoticed.

The new Income Tax Bill also empowers officers with the right to access communication platforms like emails, WhatsApp, and Telegram, and the business software and servers used to hide financial transactions, the minister explained.

According to the FM, collecting evidence from digital accounts is imperative to prove tax evasion in court and to calculate the exact amount of tax evaded.

More About Income Tax Bill, 2025

The Income Tax Bill, 2025 was introduced in the Lok Sabha on February 13 and it seeks to replace the Income Tax Act of 1961.

While the new Bill seeks to retain most of the provisions from the original Act, its primary focus is to simplify the language as well as removing redundant sections.

A notable revision or update in the Bill is the inclusion of virtual digital assets within the definition of undisclosed income, including digital tokens, cryptocurrency, and other representations of value, according to PRS India.

Additionally, the Bill also authorizes tax officers to access virtual digital spaces during search and seizure operations, including email servers, social media accounts, online investment and trading platforms, and websites that store asset ownership details.

As part of the new Bill, authorities can override codes to investigate tax evasion on these digital spaces.

Published By : Sagarika Chakraborty

Published On: 26 March 2025 at 13:36 IST