Updated 10 April 2025 at 12:17 IST

Why Did Trump Pause Tariffs for 90 Days—And What Comes Next?

The 90-day tariff hiatus presents an opportunity for the U.S. to engage in negotiated trade agreements with other countries.

- Republic Business

- 3 min read

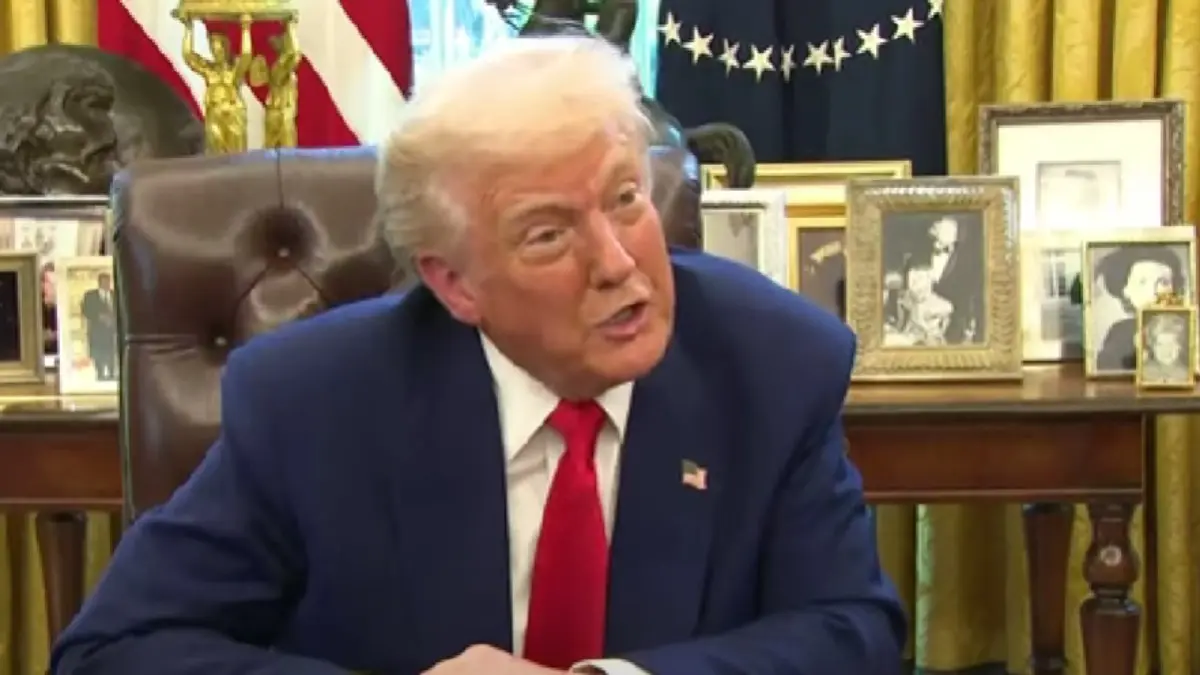

On April 9, 2025, President Donald Trump issued a 90-day pause on most new tariffs under his "reciprocal" trade policy, after more than 75 nations made appeals. But he sharply raised tariffs on Chinese imports to 125%, accusing Beijing of not having respect and retaliating at similar rates.

The short-term suspension keeps a broad 10% tariff on imports, with some exceptions such as vehicles being subject to a 25% rate, and does not include Mexican and Canadian goods covered by the USMCA. Market Reactions and Economic Implications.

The news triggered a record-breaking increase in U.S. stock markets. The Nasdaq saw a 12% increase—its best performance in 24 years—while the S&P 500 rose by 9.5%, its biggest gain since 2008. The Dow Jones Industrial Average also increased by 7.9%, by 2,963 points, its largest point gain in history.

In spite of this optimistic market reaction, there are still concerns about the continued trade tensions with China and their possible consequences for the world economy.

Advertisement

Strategic Reasons for the Tariff Halt

President Trump referred to widespread alarm and criticism as grounds for suspending the tariffs, explaining that individuals were getting "yippy"—anxious or apprehensive. He asserted that no other president would have taken such aggressive trade measures.

The move is apparently driven by investor warnings of impending economic crises and seeks to calm markets while giving time for negotiating good trade agreements.

Advertisement

Global Trade Dynamics

While the tariff halt covers most countries, the United Kingdom has been left out, with a 10% baseline import duty on almost all imports into the U.S., alongside continuing 25% tariffs on aluminium, steel, and autos.

This has taken a major toll on the UK economy, with the FTSE 100 dropping by 2.92% to a 13-month low and heightened fears of an impending recession. The European Union has retaliated with a 25% tariff on some U.S. products, calling for negotiation rather than escalation.

Future Prospects

Economic analysts caution about growing prospects of a global recession, characterized by declining share prices and lower investments. The 90-day tariff hiatus presents an opportunity for the U.S. to engage in negotiated trade agreements with other countries.

Treasury Secretary Scott Bessent verified that negotiated trade agreements could start taking shape by June. But the increase of tariffs on Chinese imports to 125% reveals that there are still major problems in U.S.-China trade relations.

Published By : Musharrat Shahin

Published On: 10 April 2025 at 12:17 IST