Updated 21 August 2023 at 14:22 IST

Why Jio Financial Services shares fell 5% on listing day?

Jio Financial Services commands market valuation of Rs 1.6 lakh crore, data from BSE showed making it the third-largest non-banking financial company.

- Republic Business

- 3 min read

Jio Financial Services shares: Shares of Jio Financial Services dropped as much as 5 per cent, its maximum daily falling limit, on its listing day to hit an intraday low of Rs 251.75 on the BSE. On the National Stock Exchange also the stock was locked in 5 per cent lower circuit at Rs 248.90.

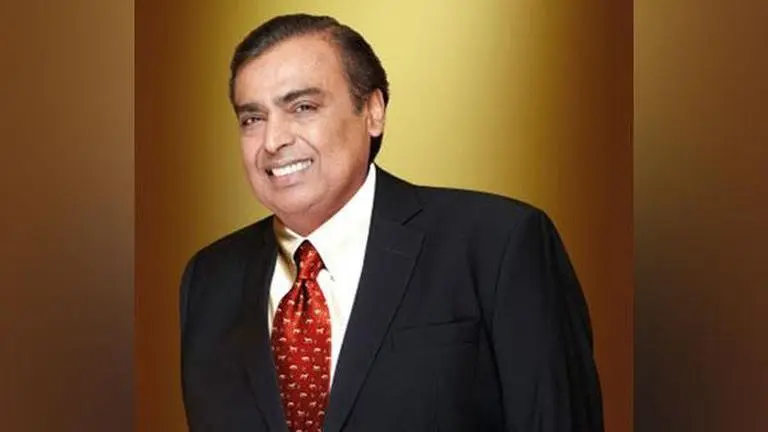

The newly listed entity backed by billionaire Mukesh Ambani was demerged from Reliance Industries last month and opened for trading at Rs 262 with almost 7 crore shares changing hands.

Expensive Valuations

Jio Financial Services commands market valuation of Rs 1.6 lakh crore, data from BSE showed making it the third-largest non-banking financial company (NBFC) in the country, behind Bajaj Finance and Bajaj Finserv, which are valued at Rs 4.15 lakh crore and Rs 2.32 lakh crore, respectively.

While Jio Financial Services is yet to build out a business in fast-growing financial services sector, analysts say its access to the vast trove of data from Reliance's telecom, digital and retail businesses will give it a leg up in lending.

Advertisement

Analysts say that the stock price dropped on the back of expensive valuations and the company is yet to start its financial services business on the ground.

Companies in financial services have grown from market valuation of Rs 1,000 crore to lakhs of crore and Jio Financial Services is entering a business which is highly competitive and regulated and it will take at least 3-5 years for Jio Financial Services, market sources told Republic.

Advertisement

In financial services sector there already lot of companies be it private sector or PSUs and it is unlike telecom business where there were limited players when Reliance Jio entered the telecom industry.

It will take time for Jio Financial Services to scale up, the source added.

Jio Financial Services has already formed a joint venture with BlackRock Inc to launch asset management services in India, with an initial investment of $150 million each.

JFS "intends to be a full service financial services player", non-executive chairman KV Kamath said during the listing ceremony.

Ambani's Reliance had last month spun off Jio Financial Services, with the stock price set at Rs 261.85 during a special discovery session. The price was higher than Rs 160-190 per share estimated by five analysts polled by Reuters.

As part of the de-merger, shareholders of Reliance Industries received one JFS share for every Reliance share.

JFS is included in major global indices such as FTSE as well as India's blue-chip Nifty 50 index after its spin off because Reliance Industries is also part of these indices.

It is scheduled to be removed from some of indices at the end of its third day of listing, as per exchange rules.

In July, the company named Hitesh Kumar Sethia as chief executive officer, and appointed Ambani's daughter Isha Ambani as a non-executive director.

(With Reuters inputs)

Published By : Abhishek Vasudev

Published On: 21 August 2023 at 14:17 IST