Updated 10 July 2025 at 17:36 IST

Why This Hidden Metal Could Decide Future Of India’s EV Industry? CRISIL Decode

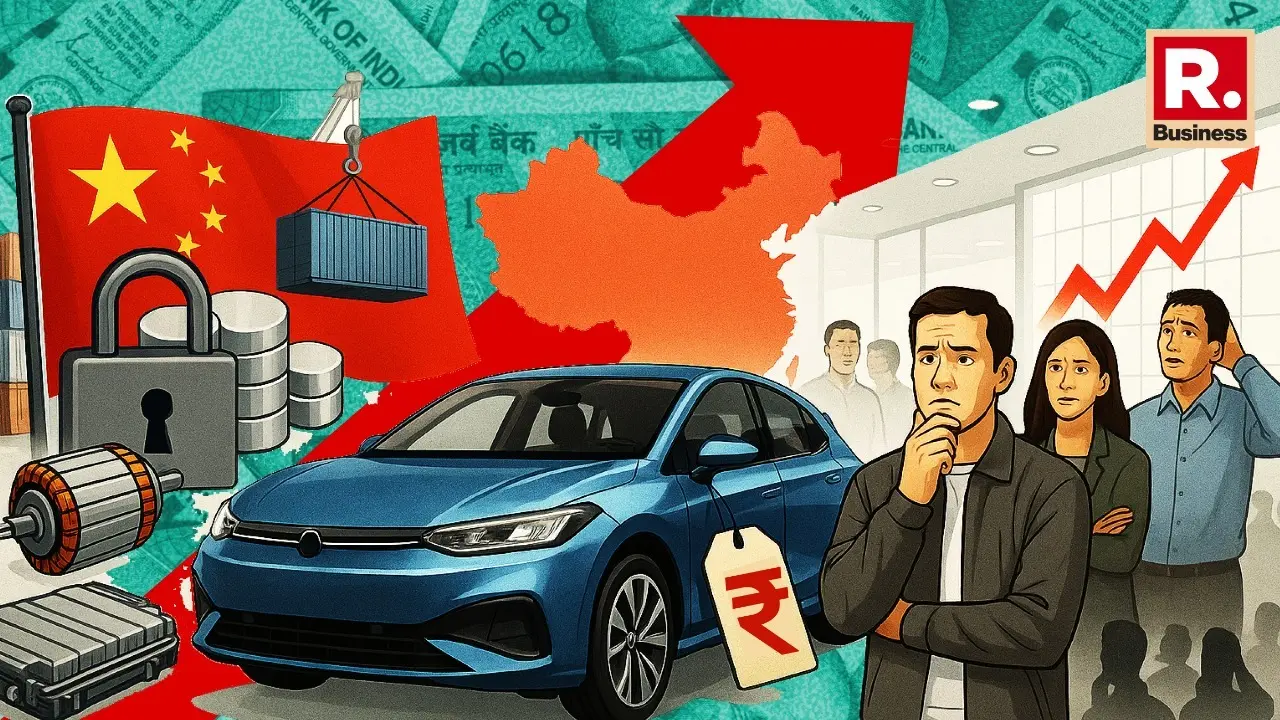

China, which dominates global supply with nearly 90% of rare earth magnet production, imposed strict export controls in April, slowing approvals and tightening global shipments. While the U.S. and Europe have seen some resumption of supply, Indian companies are still awaiting clearance from Beijing — a delay that's sounding alarm bells across the domestic auto industry.

- Republic Business

- 3 min read

As rare earth magnet exports from China face fresh curbs, Indian automakers and parts suppliers are racing to secure alternative sources, with the government stepping in to push for local production of the critical components used in electric vehicles (EVs) and electronics.

China, which dominates global supply with nearly 90% of rare earth magnet production, imposed strict export controls in April, slowing approvals and tightening global shipments.

While the U.S. and Europe have seen some resumption of supply, Indian companies are still awaiting clearance from Beijing — a delay that's sounding alarm bells across the domestic auto industry.

As reported by Reuters, government sources have indicated that Indian companies such as Mahindra & Mahindra, Uno Minda, and Sona Comstar have shown interest in manufacturing rare earth magnets domestically.

Advertisement

During a recent meeting with the Ministry of Heavy Industries, Mahindra expressed openness to collaborating with a local manufacturer or securing a long-term supply deal. Uno Minda, too, is reportedly exploring opportunities to invest in local production.

Advertisement

The pressure is mounting. Over a dozen new electric models are scheduled to hit the Indian market in the next 12–18 months, most built on Permanent Magnet Synchronous Motor (PMSM) platforms that require these magnets. Any extended disruption could force production delays as early as July 2025, according to Crisil Ratings.

“Despite contributing less than 5% to a vehicle’s cost, rare earth magnets are indispensable — especially for EVs and electric power steering systems,” said Poonam Upadhyay, Director at Crisil Ratings.

While carmakers currently have 4–6 weeks of inventory, the supply crunch is beginning to bite. India imported 540 tonnes of rare earth magnets in FY25, over 80% of which came from China. As of May-end, 30 Indian import requests had been submitted to Chinese authorities, but not a single shipment had been approved.

In response, Prime Minister Narendra Modi’s government is charting a two-pronged strategy. In the short term, efforts are focused on stockpiling, sourcing from countries like Vietnam, Japan, Indonesia, Australia, and the U.S., and incentivising local assembly via Production Linked Incentive (PLI) schemes.

Longer-term solutions include building domestic magnet manufacturing capacity and accelerating rare earth mineral exploration and mining.

It is pertinent to note that India is home to the world’s fifth-largest rare earth reserves, but production remains tightly controlled by state-run IREL, which prioritizes atomic and defence use. IREL is now reportedly planning to halt exports and scale up local supply.

Meanwhile, steel giant JSW Steel has shown interest in mining rare earths in India but awaits government clearance — a process that could take years, reported Reuters

As the magnet crunch tightens, the episode is forcing both government and industry to rethink long-term dependencies. Unlike semiconductors — which have a more diversified supply base — rare earths present a single-point failure risk, with China as the bottleneck.

Published By : Avishek Banerjee

Published On: 10 July 2025 at 17:36 IST