Updated 9 July 2025 at 11:52 IST

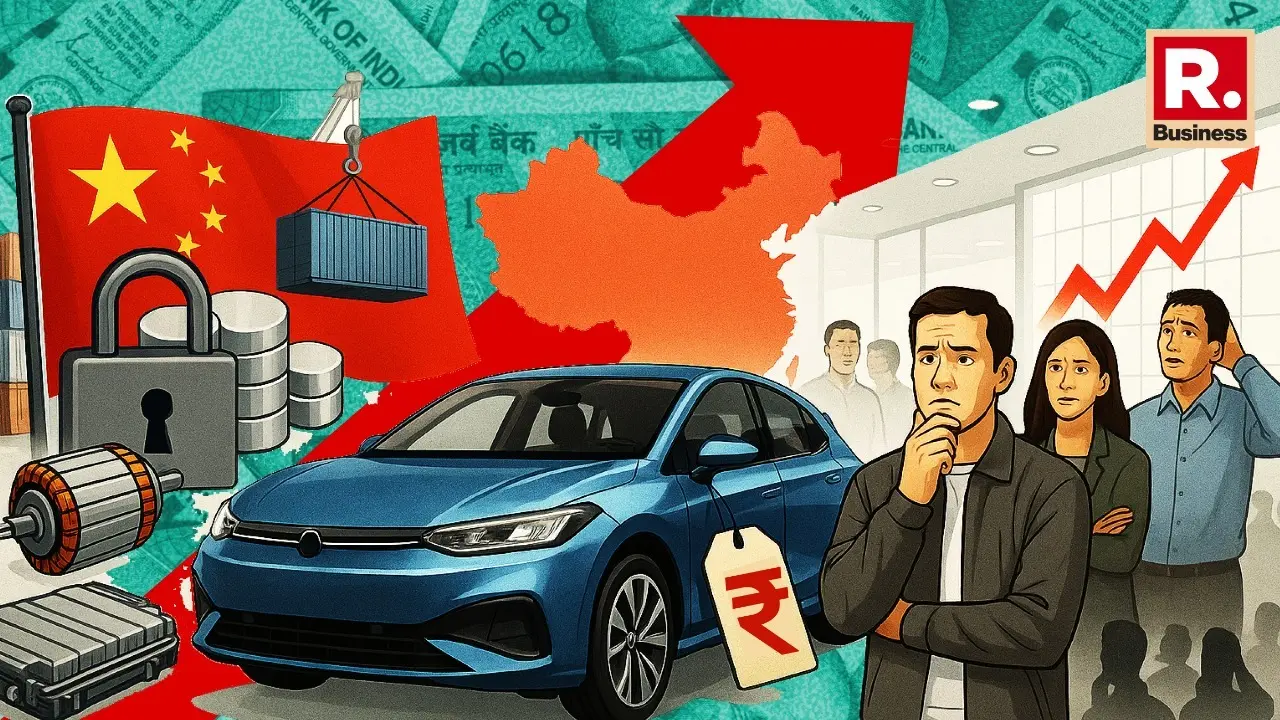

Will Your Next Car Get Costlier? Auto Component Industry Urges India to Act Fast as China Curbs Rare Earth Exports

China, which accounts for 61% of mined rare earths but controls 92% of global output, has tightened export controls since June last year amid escalating trade tensions, especially following steep US tariffs imposed by former President Donald Trump.

- Republic Business

- 3 min read

India’s auto component industry raised red flags over emerging geopolitical headwinds — most notably, the halted imports of rare earth magnets from China, which are critical for Eectric Vehicle (EV) manufacturing.

At a press conference on Tuesday, the Automotive Component Manufacturers Association of India (ACMA) revealed that the sector — which has grown by nearly 10% during FY25 — is now facing serious uncertainty on the import front, particularly when it comes to rare earth supplies used in EV traction motors.

China, which accounts for 61% of mined rare earths but controls 92% of global output, has tightened export controls since June last year amid escalating trade tensions, especially following steep US tariffs imposed by former President Donald Trump.

Advertisement

“Since April, we have had no visibility on when rare earth magnet imports from China will resume,” said Vinnie Mehta, Director General of ACMA, He went on too add, “No one has formally reported a shortage, but the reality is: no imports have come in since April. Inventories are limited, and once they’re exhausted, production may be impacted.”

China’s decision to block the export of rare earth magnets — key components in motors used across EV platforms — has rattled global supply chains. For India’s fast-growing EV ecosystem, which heavily relies on these imports, the move could derail production timelines unless alternative sourcing is found.

Advertisement

Industry calls for national strategy on critical materials

ACMA President and Subros CMD Shradha Suri Marwah said the issue requires urgent government-to-government intervention, especially in the short term.

“India has the raw materials for these magnets — what we lack is the processing technology. We’ve begun work on alternative solutions, but we also need a long-term national strategy to secure critical materials essential for future mobility,” she said.

Calling the situation “a serious concern,” Marwah emphasised that the current shortage highlights the need for India to build self-reliance in key areas tied to clean and future-ready mobility.

“The limited availability of rare earth magnets underscores the importance of securing India’s EV manufacturing ambitions through a cohesive national framework,” she added.

Strong Growth Amid Global Volatility

Despite the challenges, the auto component sector continued its upward march in FY25, buoyed by strong domestic vehicle production and steady export demand. The industry has nearly doubled in size over the last five years, reflecting both India’s growing internal demand and its expanding role in the global automotive supply chain.

“FY25 was another milestone year,” said Marwah. “Our growth was supported by domestic resilience, expanding exports, and higher levels of localisation. As India transitions toward new-age mobility, the industry is actively investing in innovation, technology, and capacity to serve both domestic and international markets.”

Meanwhile, media reports suggest that India is exploring rare earth and copper sourcing opportunities in Australia as it seeks to mitigate the impact of Chinese export restrictions that have disrupted global supply chains, particularly affecting the domestic auto and white goods sectors.

According to Malini Dutt, Trade and Investment Commissioner for New South Wales, discussions are underway for India to acquire early-stage rare earth blocks and partner with Australian firms. Indian public and private players have also shown strong interest in securing copper assets, spurred by growing domestic smelting capacity and investments from companies like Adani.

Published By : Avishek Banerjee

Published On: 8 July 2025 at 18:05 IST