Updated 9 May 2024 at 14:32 IST

US Expected to Lead Global Advanced Chip Production by 2032: SIA Report

The study primarily focuses on the anticipated impact of the CHIPS Act funding and China's efforts to achieve processor independence.

- Economy News

- 3 min read

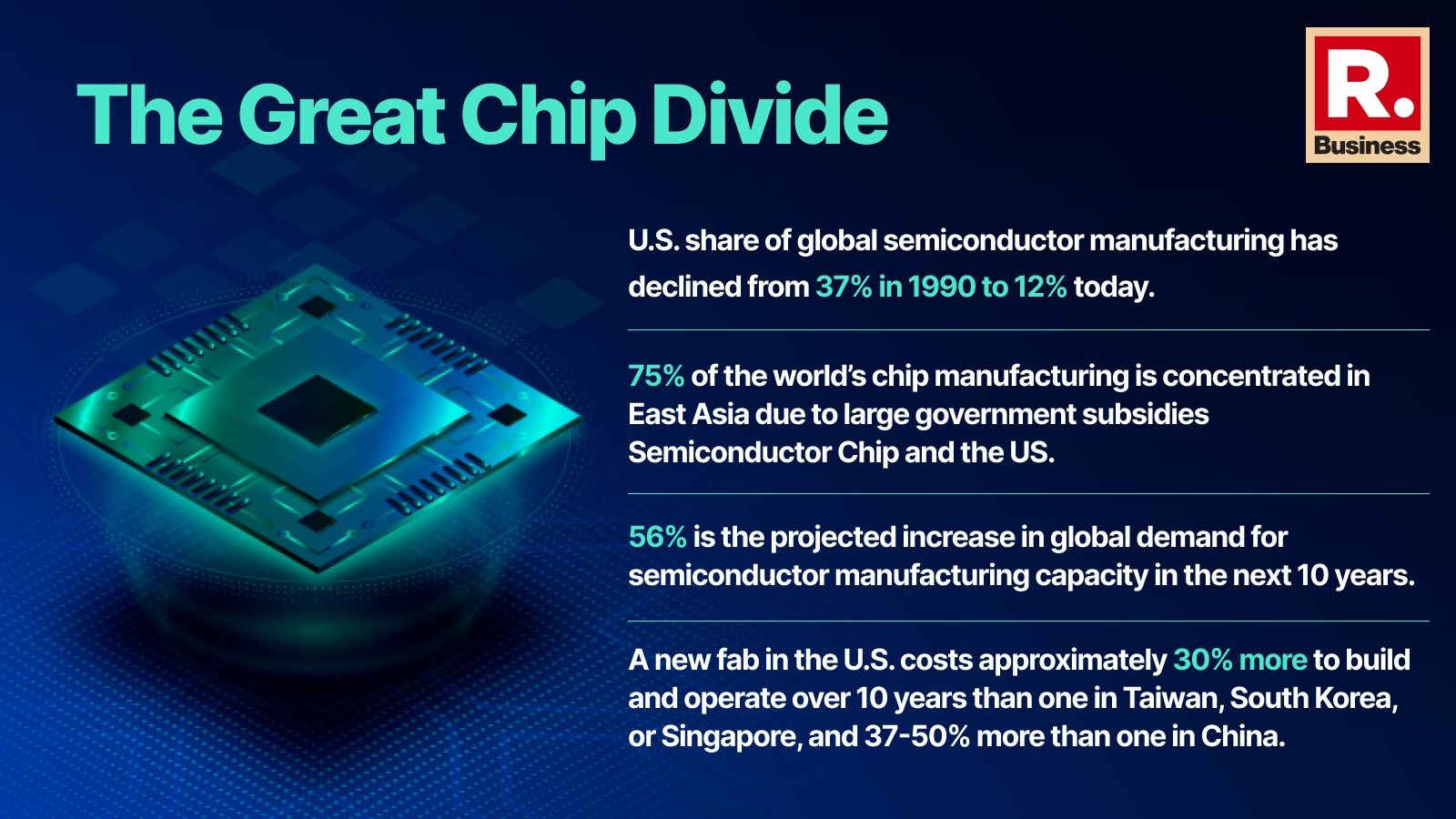

Chip war: The world is moving fast, so much so that in a short period, semiconductor chips have replaced data as the new oil. A recent study by the US Semiconductor Industry Association (SIA) has forecasted a significant shift in global advanced chip manufacturing by 2032. According to the report titled "Emerging Resilience in the Semiconductor Supply Chain," the United States is projected to produce a staggering 28 per cent of the world's most advanced processors, while China's share is expected to be a mere two per cent. The advanced chip means chips below 10 nanometers.

The study primarily focuses on the anticipated impact of the CHIPS Act funding and China's efforts to achieve processor independence. With billions in subsidies from the CHIPS Act, the US semiconductor industry is expected to experience substantial growth, reducing its reliance on foreign suppliers and bolstering domestic output.

In 2022, the majority of advanced chips were manufactured in Taiwan and South Korea, accounting for 69 per cent and 31 per cent of sub-10nm dies, respectively. However, by 2032, the SIA predicts a significant shift, with the US's share projected to rise to 28 per cent In contrast, China's share is expected to be minimal, with Europe and Japan projected to account for six and five per cent, respectively. Taiwan's share is expected to decline to 47 per cent.

While China is predicted to increase its market share for 10nm to 22nm chips, along with a slight bump in legacy silicon production, substantial decreases in DRAM and NAND fabrication will lead to an overall decline in China's semiconductor industry share. In contrast, the US is expected to rise from 10 per cent to 14 per cent of the global semiconductor industry share by 2032.

Advertisement

It's important to note that while cutting-edge chips may not be required for most applications currently, the rapid pace of technological advancement suggests that the demand for sub-10nm processors may increase significantly by 2032, driving further growth and innovation in the semiconductor industry.

Pumping in the Investments

Advertisement

In response, governments and companies worldwide are doubling down on efforts to enhance resilience. Initiatives like the US CHIPS Act, which injects $52 billion in grant incentives and offers a 25 per cent investment tax credit for semiconductor manufacturing, are gaining momentum. Similarly, the European Chips Act and initiatives in Mainland China, Taiwan, South Korea, Japan, and India highlight the global commitment to bolstering semiconductor production.

Private sector investment in wafer fabrication is also on the rise, projected to reach a staggering $2.3 trillion in 2024–2032. This significant influx of capital is expected to drive diversification in wafer fabrication capacity, with the United States emerging as a key player. By 2032, the US is poised to increase its fab capacity by a whopping 203 per cent, reversing a decades-long downward trajectory and capturing a 14 per cent share of global aggregate fab capacity.

The resilience drive extends beyond wafer fabrication to assembly, test, and packaging (ATP) activities. Initiatives aimed at expanding ATP activity in Southeast Asia, Latin America, and Eastern Europe are gaining traction, supported by government funding and foreign investments. Additionally, the development of advanced packaging technologies is driving ATP capacity expansion in the US and Europe, further bolstering resilience in the semiconductor supply chain.

Published By : Rajat Mishra

Published On: 9 May 2024 at 14:32 IST