Updated 23 August 2019 at 20:29 IST

Nirmala Sitharaman: MSMEs to get pending GST refunds within 30 days

Finance Minister Nirmala Sitharaman on Friday announced that MSME sector that is facing liquidity shortage, will receive their GST refunds within 30 days.

- Economy News

- 3 min read

In a major relief to the MSME sector facing liquidity shortage, the government on Friday announced that all their pending GST refunds will be paid within 30 days.

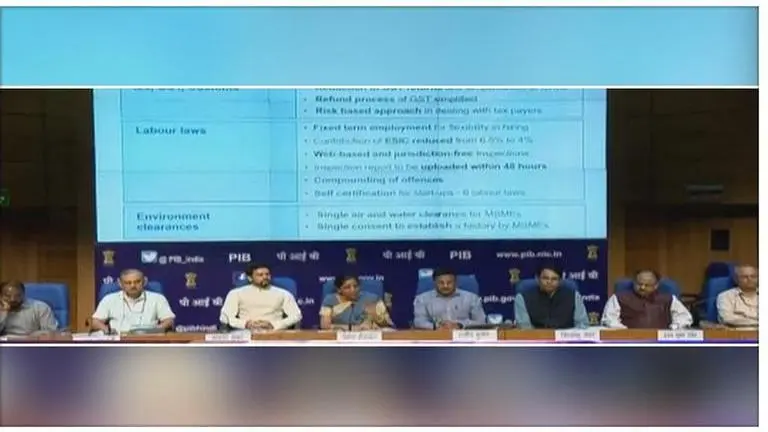

Also, in future, all GST refunds of micro, small and medium enterprises (MSMEs) will be paid within 60 days from the date of application, Finance Minister Nirmala Sitharaman said while announcing a slew of measures to boost growth. Nirmala Sitharaman also said the decision on recommendations of the U K Sinha Committee regarding ease of credit, marketing, technology and delayed payments to MSMEs will be taken within 30 days.

The government would also consider an amendment to the MSME Act to move towards a single definition. The MSMEs sector, which accounts for about 29 percent of the gross domestic product (GDP), is one of the largest job creators in the country. In addition, a major move to tackle Tax terrorism, Union Finance Minister Nirmala Sitharamanalso announced a centralized system for Income Tax issues, notices, etc, while addressing a press conference in New Delhi. She elaborated that from October 1, 2019, onwards, a centralized system would issue the notices to the tax assessees. Boosting wealth creators, she said that the system will generate unique identification numbers (DIN) to track issues and notices. Sitharaman made this statement in a climate of economic slowdown seen in the Indian economy.

Advertisement

Finance Minister Nirmala Sitharaman explains on-ground implementation

The Finance Minister explained the entire process of tax collections which will occur on the ground. She said that no notices will be issued without central approval. Assuring that anomalies in paper and practice will be eliminated, she said that these moves will favour the assessee. She also announced that the assessee will be able to track the issue and complain if he has any grievance.

Advertisement

Current Economic Slowdown

Sources have reported that India's economic slowdown led to Moody's reducing India's growth forecast by 0.4 % in GDP for the next fiscal year (FY 21). Sources have said that slow growth in the economy was allegedly triggered after some announcements in Finance Minister Nirmala Sitharaman's maiden Budget speech. The surcharge levied on foreign investors has allegedly led to an exodus of investors from Indian markets, as per sources. Recent trends have also seen a collapse in stock exchange points due to the slowing economy particularly in automobile, FMCG, construction, MSME sectors.

(With PTI Inputs)

Published By : Digital Desk

Published On: 23 August 2019 at 19:46 IST