Updated 23 September 2019 at 18:05 IST

Sensex, Nifty rally for 2nd day on tax booster; close at 2-month high

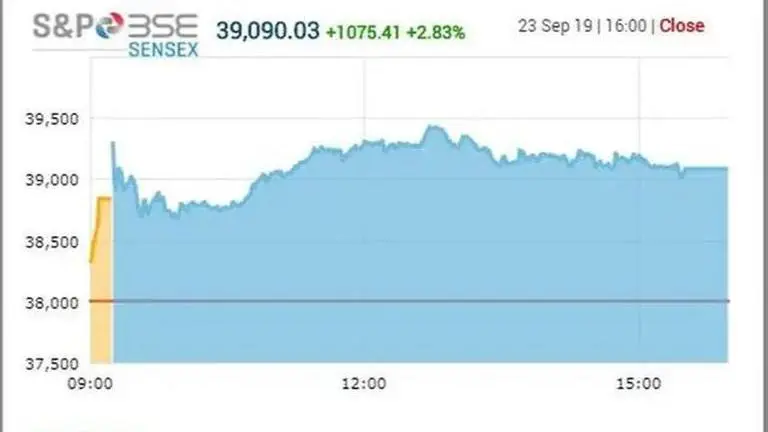

At the closing bell, the Bombay Stock Exchange S&P Sensex was up by 1,075 points or 2.8% at 39,090 while the Nifty 50 was 329 points higher at 11,603

- India News

- 4 min read

Market benchmark BSE Sensex skyrocketed by 1,075 points to close at more than two-month high on Monday, extending its bull run for a second straight day on the back of gains in financial, banking and FMCG stocks after the tax booster by the government. The broader NSE Nifty zoomed by 326 points or 2.89% to end at a two-month of 11,600.20 with 32 of its constituents closing with gains. Brokers said that the trading at the National Stock Exchange was marred by some glitch mainly in the closing session for 10 minutes. Brokers suffered disruption from 1515hrs to 1529 hrs.

Sensex posted its biggest two-day gains

The 30-share Sensex soared over 1,426 points in day trade before closing higher by 1,075.41 points or 2.8% at 39,090.03, a level not seen since July 17. In the two-day rally, Sensex posted its biggest two-day gains of 2,996.56 points or 8.30%, while the 50-share Nifty soared 895.40 points or 8.36%.

Bulls took over Dalal Street on Friday after Finance Minister Nirmala Sitharaman delivered a surprise cut in corporate tax rates. Sensex logged its biggest single-day jump in over a decade by surging 1,921.15 points or 5.32% while Nifty zoomed 569.40 points or 5.32% on that day.

Advertisement

'Markets witnessed a stellar rally'

"Markets for the second day in a row, after the historic decision to cut corporate tax, witnessed a stellar rally. A lot of buoyancy has come from the fact that these measures will boost the profitability of a number of companies, which will either be used to stimulate demand by lowering prices, payouts to shareholders in the form of dividends or using it for capital expenditure," Devang Mehta, Head - Equity Advisory, Centrum Wealth Management said.

Advertisement

Top gainers in the Sensex pack included Bajaj Finance, L&T, Asian Paints, ITC, Axis Bank, Kotak Bank, ICICI Bank, HDFC twins, Maruti and SBI, rallying up to 8.70%. On the other hand, Infosys, RIL, Tata Motors, PowerGrid, NTPC, Bharti Airtel, Tech Mahindra, TCS and HCL Tech tanked up to 4.97 per cent. Broader BSE Midcap and Smallcap indices rallied 3.08% and 2.73% respectively.

'Rally continued as the positive sentiment for revival in earnings growth'

Sectorally, BSE capital goods index, bankex, industrials, finance, FMCG, oil and gas, consumer durables and realty indices surged up to 6.55%. While BSE IT, tech, telecom, utilities, and power indices closed down by up to 3.29%. Vinod Nair, Head Of Research at Geojit Financial Services commented: "Rally continued as the positive sentiment for revival in earnings growth attracted investors to the market. Banks outperformed while mid & small cap witnessed strong bargain buying in expectation of turnaround in consumption story and improvement in the balance sheet."

Announcing a Rs. 1.45 lakh crore fiscal stimulus to jump-start flagging growth, the finance minister on Friday slashed the base corporate tax for existing companies to 22% from 30%; and for new manufacturing firms, incorporated after October 1, 2019, to 15% from 25%. Further, the GST Council slashed the same on hotel tariffs and some goods with a view to addressing sectoral concerns in a slowing economy.

'The 10% tax reset has witnessed frantic buying across high tax-paying entities'

"The 10% tax reset has witnessed frantic buying across high tax-paying entities in the last two trading sessions. The rebalancing act has led to selling in IT & pharmaceuticals with a shift towards manufacturing & private banks & select FMCG stocks," S Ranganathan, Head of Research at LKP Securities said.

Tracking gains in Axis Bank (7.3%), and Kotak Bank (7.22%), Nifty Banking index zoomed 5.51%. Meanwhile, the rupee was trading flat at 70.92 against US dollar. Brent crude futures fell 0.79% to $63.77 per barrel (intra-day). Market breadth was positive as 1,638 scrips advanced at BSE while 972 stocks declined. As many as 103 stocks soared to the 52-week high while 216 scrips hit the upper limit on Monday.

Elsewhere in Asia

Elsewhere in Asia, Hang Seng and Shanghai Composite Index ended significantly higher, while Nikkei and Kospi settled in the red. Stock exchanges in Europe were trading on a negative note in their respective early sessions due to geopolitical tensions in West Asia.

Published By : Press Trust Of India

Published On: 23 September 2019 at 16:51 IST