Updated 4 October 2019 at 20:04 IST

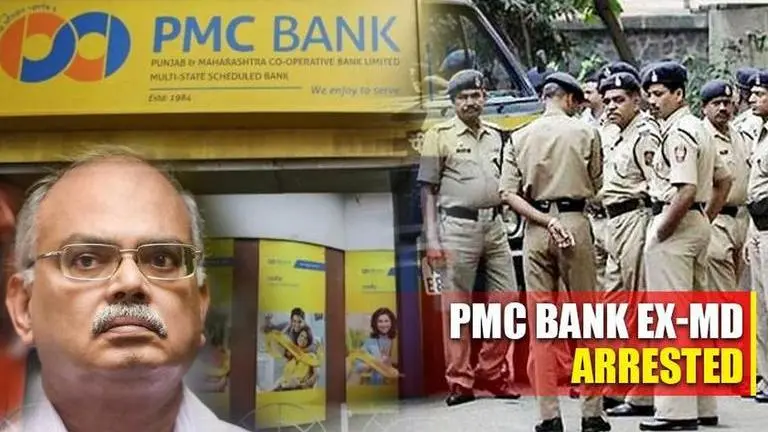

PMC Bank Crisis: Mumbai Police's EOW arrests bank's ex-MD Joy Thomas

Mumbai Police's Economic Offence Wing (EOW), on Friday, has arrested PMC bank's former Managing director Joy Thomas, a day after arresting HDIL directors

- India News

- 3 min read

Acting on the Punjab and Maharashtra Cooperative (PMC) bank fraud case, the Mumbai Police's Economic Offence Wing (EOW), on Friday, has arrested PMC bank's former Managing director Joy Thomas. Thomas was previously missing, as stated by Mumbai Police. He is being interrogated and further investigation is underway. stated the police. Earlier in the day, the Enforcement Directorate (ED) had filed an Enforcement Case Information Report (ECIR) in the bank fraud, after taking cognizance of the FIR filed by Mumbai Police's EOW. In the FIR, the ED has named the PMC board members and HDIL (Housing Development and Infrastructure Limited) promoters as accused. ED officials searched six locations in Mumbai and adjoining areas in the money-laundering case.

HDIL directors arrested

Earlier on Thursday, the EOW arrested HDIL directors Sarang Wadhawan and Rakesh Kumar Wadhawan. Sources report that property worth Rs 3500 Crores have been frozen by the police. Previously on Monday, the EOW had registered an FIR against the senior officials of PMC Bank and HDIL in connection with a fraud of over Rs 4,355 crores. Police stated that a special investigation team has been formed to probe into the issue. According to the police, PMC Bank officials gave loans to HDIL between the year 2008 and August 2019 despite not paying the previous loans. The FIR has been registered on the complaint given by Jasbir Singh Matta, who was authorized by the RBI administrator with Mumbai Police.

Advertisement

RBI extends limit

On Thursday, the Reserve Bank of India (RBI) hiked withdrawal limit to Rs 25,000 from Rs 10,000 for PMC's depositors, according to PTI. Previously on September 23, the RBI had hiked the withdrawal limit from Rs.1000 to Rs. 10,000. On September 21, the RBI took control of the bank for six-months. It had also capped withdrawals at ₹1,000 per account and the bank is not allowed to make any fresh loans for six months. This announcement by the Central bank caused chaos throughout the financial capital, with panicked account holders crowding the bank.

Advertisement

PMC admits HDIL main reason for the crisis

Earlier last week, PMC had admitted that one large account-HDIL was the sole reason for the present crisis, as per PTI. The bank's former managing director Joy Thomas had allayed fears stating all accounts were safe and fully-secured. He said the bank has cash liquidity of around Rs 4,000 crore in the form of SLR (statutory liquidity ratio) and CRR or cash reserve ratio. But, he admitted that the problem arose because of under-reporting of NPAs from the HDIL account.

Published By : Suchitra Karthikeyan

Published On: 4 October 2019 at 19:41 IST