Updated 16 July 2025 at 14:24 IST

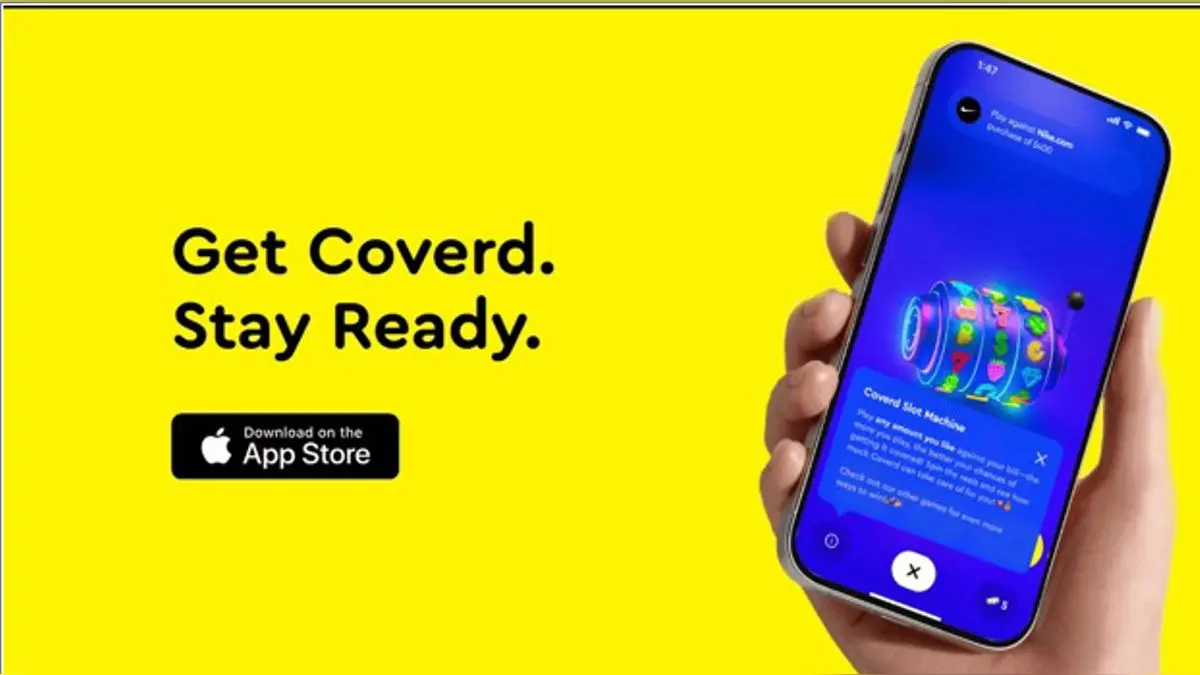

Coverd Transforms the Way Young People Tackle Financial Goals

“We wanted to make paying off credit cards feel less like a punishment and more like a reward,” says co-founder Eric Xu.

- Initiatives News

- 3 min read

In a financial world full of dry budgeting tools and grim credit counseling services, one startup is flipping the script—literally—by turning credit card debt repayment into a mobile game.

Coverd, a newly launched fintech app, poses a radical question: What if paying off your credit card debt felt more like playing Candy Crush than checking your bank balance? The app, created by former engineers from Morgan Stanley, Google, and Hudson River Trading, gamifies the process of repaying debt through legally structured sweepstakes games.

The idea is deceptively simple. Users purchase low-cost “practice coins” in the app. With each purchase, they’re granted “Coverd Cash”—free sweepstakes entries they can use to play games like slots, plinko, blackjack, and roulette. Winnings can be applied toward paying down linked credit card balances or saved for future expenses.

It’s not gambling—at least not in the legal sense. Coverd operates under U.S. sweepstakes law, meaning users can also enter games for free (without making a purchase), and no real-money wagering takes place. The structure is similar to popular sweepstakes models used by brands like McDonald’s or Publishers Clearing House, but with one key difference: the prizes reduce your debt.

Advertisement

“We wanted to make paying off credit cards feel less like a punishment and more like a reward,” says co-founder Eric Xu. “The question we asked ourselves was, why can’t financial progress feel exciting?”

The timing couldn’t be more relevant. U.S. credit card debt hit a staggering $1.1 trillion this year, driven by rising interest rates and inflation. Many Americans—especially younger adults—feel like they’re drowning in balances they can’t escape. Coverd’s pitch is designed to appeal to that demographic: give them an experience that’s mobile-first, emotionally rewarding, and actually fun.

Advertisement

And it seems to be working. Early users are reporting that Coverd taps into the same psychology as daily mobile games, but with tangible financial results. One user compared it to “Duolingo for your wallet”—a quick, habitual experience that chips away at a bigger goal over time.

Beyond the novelty of gamification, Coverd is betting on a behavioral shift. In a world where people are bombarded with financial advice—cut your lattes, stick to spreadsheets—this startup offers a softer, dopamine-driven alternative. It’s less about deprivation and more about motivation.

That said, not everyone is convinced. Some critics have raised concerns about whether encouraging game-like behavior in a financial context could blur ethical lines. But Xu and his team are clear: the games are strictly optional, the platform is regulated, and users are never encouraged to spend recklessly.

With plans to roll out a “Coverd Card” later this year (offering up to 100% cash back and additional sweepstakes entries per transaction), the company is doubling down on its mission to reward users for managing their money better.

In a saturated market of fintech tools and debt apps, Coverd is carving out a unique space—one where fun, legality, and financial freedom meet.

Published By : Moumita Mukherjee

Published On: 16 July 2025 at 14:24 IST