Updated 28 January 2026 at 14:23 IST

Why More Traders Are Looking Globaland The Platform Powering The Shift

The South Africa–regulated brokerage is positioning itself as a bridge between local traders and global financial markets, offering access to forex, international equities, indices, commodities, and precious metals through a single digital platform.

- Initiatives News

- 2 min read

From currency swings to tech-stock rallies, global markets are moving faster than ever. For a growing number of South African retail investors, the answer isn’t trading more often — it’s trading smarter, with better tools, broader access, and stronger local oversight.

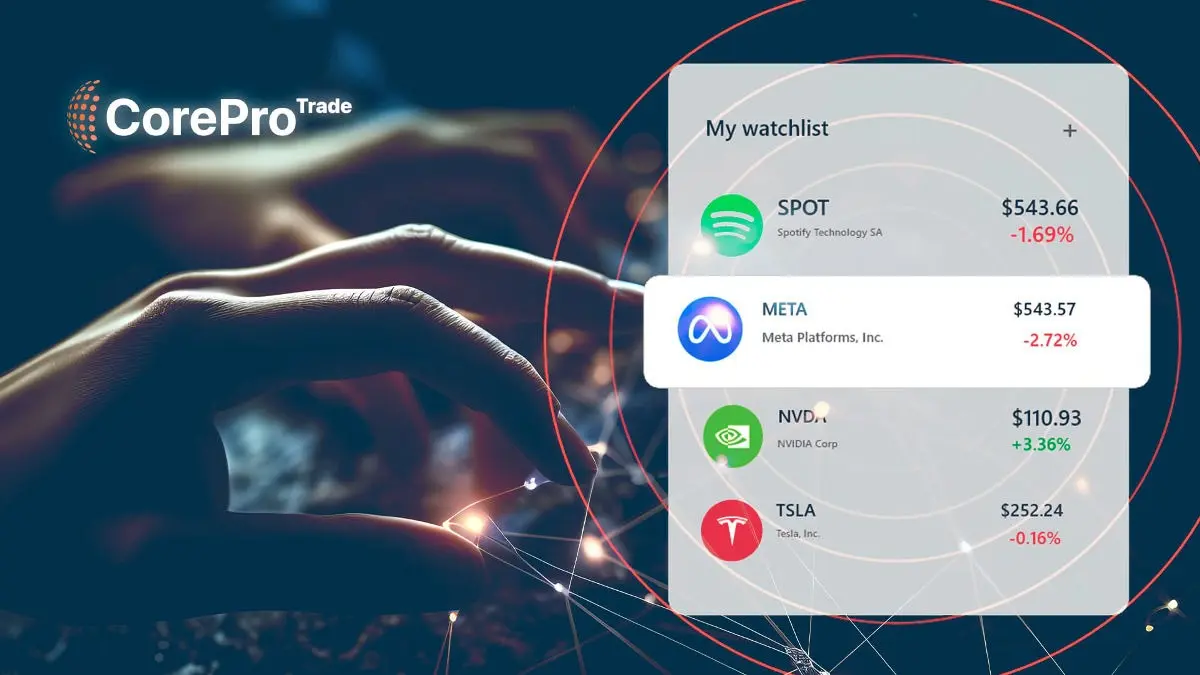

That shift is helping platforms like CoreProTrade also known as Core Pro Trade gain traction. The South Africa–regulated brokerage is positioning itself as a bridge between local traders and global financial markets, offering access to forex, international equities, indices, commodities, and precious metals through a single digital platform.

As retail trading evolves beyond speculation and social-media-driven hype, CoreProTrade is betting on a more disciplined, education-led approach.

Global Markets, Local Control

Advertisement

For years, South African traders seeking international exposure often turned to offshore brokers, accepting regulatory distance as a trade-off for global access. Today, that trade-off is becoming less attractive.

CoreProTrade operates under the oversight of the Financial Sector Conduct Authority (FSCA), allowing traders to participate in global markets while remaining within South Africa’s regulatory framework. The platform emphasizes verified onboarding, data encryption, and compliance-focused operations — areas that have become increasingly important as scrutiny of online trading platforms intensifies.

Advertisement

“Traders want global opportunity, but they also want accountability,” said a person familiar with the platform’s strategy. “Local regulation has become a competitive advantage, not a limitation.”

Built for the Modern Retail Trader

At its core, CoreProTrade is designed to reduce friction. The platform offers commission-free CFD trading on key instruments, with pricing built into spreads rather than per-trade fees. Traders can access leverage of up to 1:200, supported by standard risk management tools such as stop-loss, take-profit, and pending orders.

The company’s proprietary platform, CoreProTrade X, runs entirely in the browser and on mobile devices, eliminating the need for downloads or complex installations. Positions, balances, and data sync seamlessly across desktop and mobile, reflecting how modern traders move between devices throughout the day.

For many users, the appeal lies in simplicity. “Everything is in one place — markets, charts, education, and account management,” said one active trader using the platform. “It removes a lot of the friction that slows decision-making.”

Education Over Hype

One of CoreProTrade’s defining features is its emphasis on education. Through CoreProTrade Academy, users gain access to structured courses, webinars, and demo trading accounts that simulate live market conditions.

The demo environment allows traders to test strategies without financial risk, using the same charts, tools, and pricing available on live accounts. This approach ref

Published By : Namya Kapur

Published On: 28 January 2026 at 14:23 IST