Updated 31 October 2023 at 18:26 IST

Disney walks open-eyed towards Reliance mousetrap

Disney selling a controlling stake in its India business to Reliance is its best option now.

- Opinion News

- 3 min read

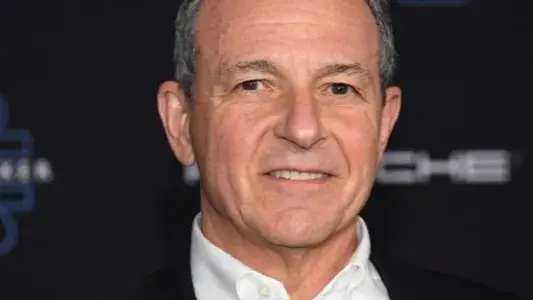

Position of weakness. Selling a controlling stake in its India business to Reliance would be Walt Disney’s least-worst option. The $147 billion U.S. media giant run by Bob Iger is closing in on a deal with Mukesh Ambani’s conglomerate after considering hawking the business off in chunks, Bloomberg reported last week. Disney Star is losing money and subscribers; reversing that would require both investment and cost-cutting, with no guarantee of success. Offloading it to Reliance now, at half the roughly $16 billion enterprise value analysts at Elara Capital ascribed to it when Disney took over the assets in 2019, would be a victory.

Its television outfit reaches more than 790 million people through over 60 channels across sports and entertainment. It loses money, but valuing it generously on the 3.4 times average multiple of trailing revenue at peers like Zee Entertainment Enterprises and Sun TV Network means it’s worth about $3 billion, annualising its $637 million top line in the nine months to the start of July.

The Disney+ Hotstar streaming business has hit a rough patch. Average monthly revenue per paid subscriber halved to $0.59 over the 12 months to the start of July as some 18 million of them, or 31%, quit the platform after it lost lucrative digital streaming rights for Indian Premier League cricket to Reliance’s JioCinema last year.

Analysts at Wells Fargo reckon Hotstar’s enterprise is worth $4 billion, while Elara pegs it at $5 billion. That values it at 10-13 times its $400 million of revenue in the 12 months to the end of September, per MoffettNathanson estimates, a steep premium to the 5.5 times multiple that slower-growing global rival Netflix trades at. A less frothy 3.8 times would fetch $1.5 billion.

Advertisement

That would value Disney Star at $4.5 billion, way below both Disney’s internal valuation of $10 billion and Reliance’s working estimate of $7 billion to $8 billion, per Bloomberg. But it gels with the $4 billion the potential buyer has ascribed to the business, India’s Economic Times reported on Oct. 24, without naming sources.

Ambani, Asia’s richest person, is known for not overpaying. He’d benefit from having Disney Star on the same stage as his streaming and TV businesses, though. Combined, the two could more easily cut costs and command higher advertising rates, assuming regulators approve any tie-up. That should help Disney reject too low-ball an offer. And by keeping a minority stake, it would benefit from any upside. The longer Iger waits to hop onto Reliance’s mousetrap, though, the less he might get.

Advertisement

(Source: Reuters Breakingviews)

Published By : Leechhvee Roy

Published On: 31 October 2023 at 18:26 IST