Updated 8 January 2026 at 18:04 IST

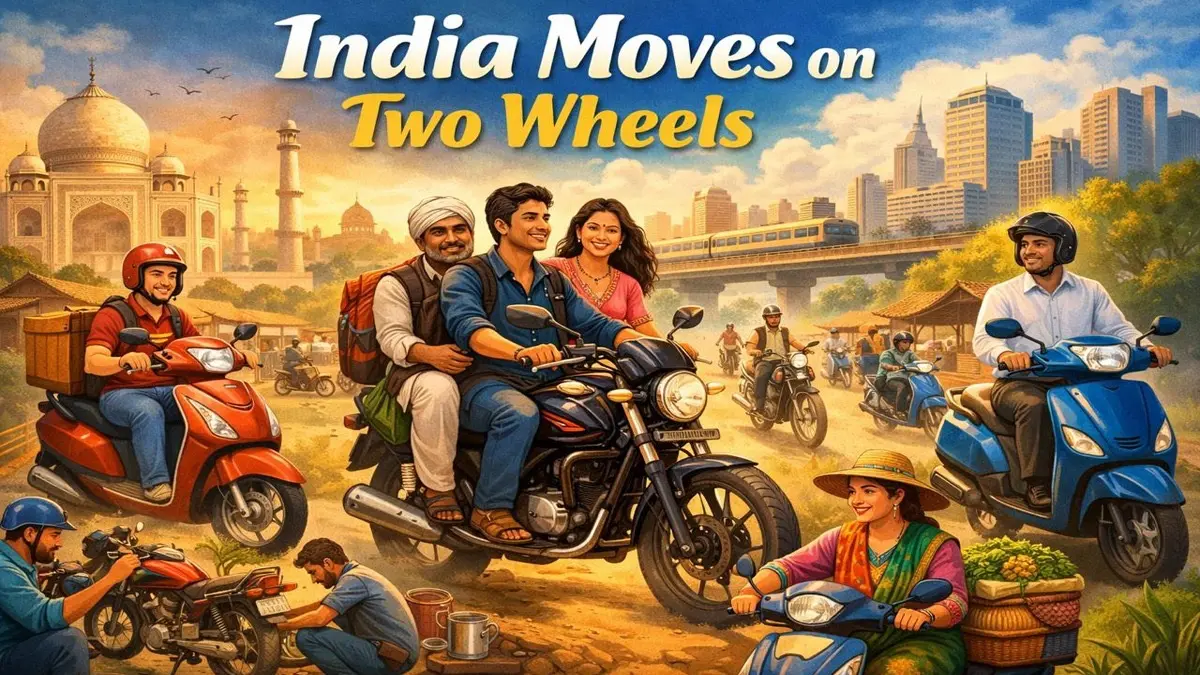

India Moves on Two Wheels

India Moves on Two Wheels explores how motorcycles and scooters power everyday life, mobility, jobs, and culture across urban and rural India.

- Opinion News

- 4 min read

New Delhi: Two wheelers occupy a peculiar and often underestimated place in India’s economy. They sit between infrastructure and improvisation. When public transport is crowded or absent, when distances are too long to walk yet need to be covered for myriad purposes, when cars are beyond affordability, two wheels quietly take over.

For decades two wheelers have carried workers to factories, students to classrooms, vendors to markets, and households through daily life. India is the world’s largest two wheeler market by volume, but the category’s deeper significance lies in what it has absorbed. It has allowed for Urbanisation without infrastructure. It has facilitated growth without mass transit. It has represented aspiration without excess.

That centrality explains why change in two wheelers has been viscous but consistent. An evolution on top of a revolution.

Scooters and motorcycles, though grouped together, evolved along distinct economic logics. Scooters settled early into urban life. Step-through frames, ease of use, and household ergonomics made them natural city vehicles. They were built around convenience and accessibility. Motorcycles followed a more utilitarian path. They prioritised fuel efficiency, endurance, and daily reliability. Over time they became instruments of work rather than lifestyle, particularly outside India’s largest cities.

Advertisement

The decisive shift came when motorcycles aligned closely with Indian economics. Hero Honda’s breakthrough was neither stylistic nor aspirational. It was arithmetic. A 100 cc engine delivering fuel efficiency close to 65 kilometres per litre changed the ownership equation at a time when fuel costs mattered deeply and income growth was cautious. The motorcycle stopped feeling like a stretch purchase and began to feel safe. Volumes followed and penetration widened across towns and villages. Motorcycles pulled decisively ahead of scooters for nearly two decades, driven by logic, affordability, and fit with everyday Indian economics.

As the market expanded, brands became more than manufacturers. They became interpreters of everyday aspiration. “Hamara Bajaj” placed the scooter within the promise of a stable middle-class life and national progress. Hero Honda spoke the language of reassurance and dependability at a moment when households measured every purchase carefully. “Chal meri Luna” captured a looser, informal mobility that felt approachable. Royal Enfield moved in the opposite direction. It resisted efficiency and standardisation, holding on to weight, sound, and character. In a market increasingly shaped by utility, it preserved individuality. Through these journeys, brands shaped how mobility was understood, valued and woven into daily life.

Advertisement

Scooters reduced in share of market but disappeared during through this period. They waited as conditions evolved. As cities became more dense and traffic patterns fractured, convenience regained importance. Automatic transmissions reduced fatigue. Lighter frames widened access. Storage space became relevant again. As urban mobility diversified and more women entered the workforce, scooters found renewed relevance. Their return was structural rather than nostalgic.

Electric mobility has followed a similar pattern. A significant fact is that electric mobility has been evolutionary and instead of a clean break, it has functioned as a reordering. Electric powertrains align naturally with scooter usage. Short distances, predictable routes, overnight charging, and lower running costs suit everyday urban movement. For many buyers, electric scooters did not feel like radical technology. They felt familiar and easier to live with.

This reordering reshaped portfolios more than demand. Legacy manufacturers were forced to reconsider line-ups built over decades. New entrants arrived without historical constraints. Early leadership was driven by speed and narrative. Over time the market returned to older disciplines. Reliability, service reach, localisation, and cost control began asserting themselves again.

In that sense, TVS’s rise to the top of the electric two wheeler market is less surprising than it appears at first glance. It reflects a company playing to long held strengths rather than chasing novelty. Manufacturing depth, calibrated expansion, and an understanding of the Indian commuter have mattered more than speed to market. The result is leadership earned quietly, through better execution rather than loud proclamation.

Sales data now reinforces this settling process. Electric two wheelers are growing quickly, yet they remain a minority of the overall market. Scooters dominate electric adoption. Motorcycles continue to anchor internal combustion volumes. The market is layering rather than flipping.

Change in this category has never been abrupt, and there is little reason to expect that to alter. The next phase will be defined by consolidation rather than disruption. Electric will grow. Scooters will lead that growth. Motorcycles will adapt more slowly. Manufacturing depth will outweigh narrative.

For India, this evolution matters beyond mobility. Two wheelers sit at the intersection of energy efficiency, domestic manufacturing, and employment, supporting large supplier ecosystems, dealer networks, and service jobs.

As always, the category will reflect everyday economics more closely than policy ambition. India will continue to move on two wheels.

Published By : Shruti Sneha

Published On: 8 January 2026 at 18:04 IST