Updated 4 April 2025 at 18:10 IST

JP Morgan Warns of US Recession as Trade War Sparks Massive Selloff

Economists warn that higher tariffs could fuel inflation, disrupt global supply chains, and weaken consumer spending.

- World News

- 2 min read

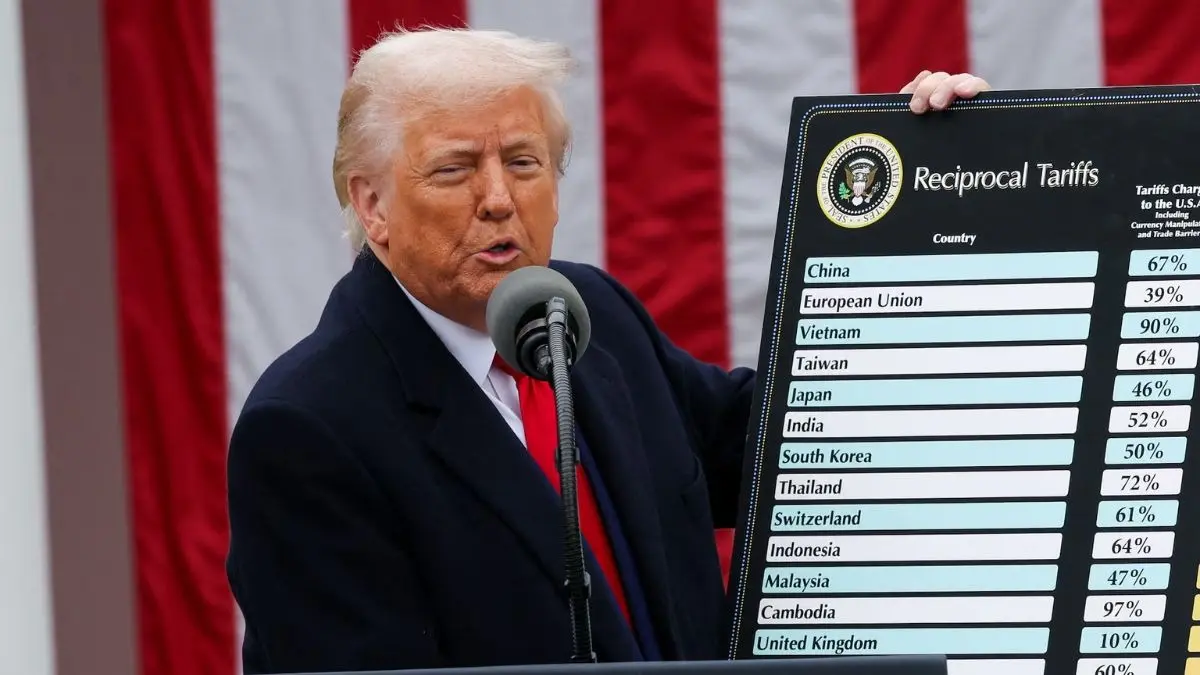

Fears of a global recession have surged after China hit back at US President Donald Trump’s sweeping tariff policies, triggering a massive market selloff. J.P. Morgan now puts the risk of a U.S. recession at 60%, as investors brace for further economic fallout.

Financial markets reacted sharply to the growing trade war, with major indices suffering steep declines.

A Quick Look at the Numbers

S&P 500 futures dropped 2.7%

Nasdaq lost 2.8%

Advertisement

Europe’s STOXX 600 plunged 4.4%, its worst day since the COVID crash

Japan’s Nikkei 225 fell 2.8% for a second straight session

Advertisement

Oil and Banking Stocks Take a Hit

Energy and banking sectors also felt the heat, with oil prices plunging 6% as investors worried about slowing global demand. Bank stocks collapsed, reflecting concerns that rising tariffs could choke economic growth.

Recession Warnings Grow Louder

Traders are now betting on over 100 basis points in Federal Reserve rate cuts, signaling expectations that policymakers will be forced to intervene. Economists warn that higher tariffs could fuel inflation, disrupt global supply chains, and weaken consumer spending, all of which could push the U.S. and global economies into a downturn.

With no signs of de-escalation between Washington and Beijing, analysts caution that the situation could worsen, putting further pressure on financial markets and economic stability worldwide.

Published By : Sagar Kar

Published On: 4 April 2025 at 18:10 IST