Updated 20 February 2022 at 19:45 IST

Pakistan to borrow Gold from citizens to increase foreign exchange reserves: Report

The proposal will allow commercial banks to issue a negotiable discounted instrument to the gold owner and pay an interest rate on the precious metal.

- World News

- 2 min read

Crippled under rising debts, Pakistan is planning a proposal to borrow gold from its citizens to increase its foreign exchange reserves. According to the State Bank of Pakistan (SBP), as of February 11, the central bank's reserves which have been on a constantly declining path further slid to USD 17 billion.

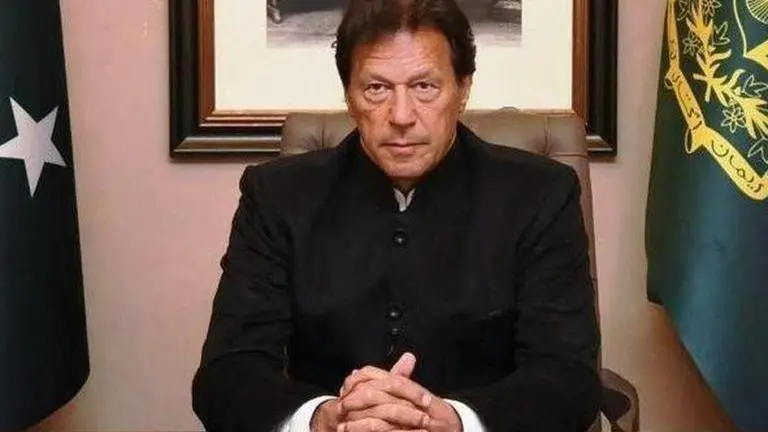

In a desperate measure to boost forex reserves, the Imran Khan-led government has discussed a proposal in the Economic Executive Council (EEC) – the body comprising all economic ministers and the State Bank of Pakistan (SBP) governor to borrow gold biscuits and bars from the citizens, The Express Tribune newspaper reported, citing sources in the Ministry of Finance.

What is the Imran Khan Govt's proposal?

The proposal to borrow gold from people against a negotiable instrument had initially been floated by an expatriate, Tahir Mehmood, to Prime Minister Khan, who then referred it to the EEC. According to media reports, the proposal will allow commercial banks to issue a negotiable discounted instrument to the gold owner and pay an interest rate on the precious metal. In return, the banks will deposit the gold with the SBP that can monetise it to increase the foreign exchange reserves.

The objective of the gold-based negotiable instruments was to "translate gold into foreign currency to enhance foreign exchange reserves," Finance Minister Shaukat Tarin had explained in the last EEC meeting.

Notably, Pakistan's foreign exchange reserves are already largely built on its expensive foreign loans. In less than three months, it has taken a USD 3 billion loan from Saudi Arabia, raised the country's most expensive debt of USD 1 billion by pledging motorway and received another USD 1 billion from the International Monetary Fund (IMF) on stringent conditions. However, Pakistan's reserves failed to get stabilised due to lower exports and higher imports along with growing foreign loans repayments.

Advertisement

(With agency inputs)

Published By : Ananya Varma

Published On: 20 February 2022 at 19:44 IST