Updated 17 July 2020 at 22:46 IST

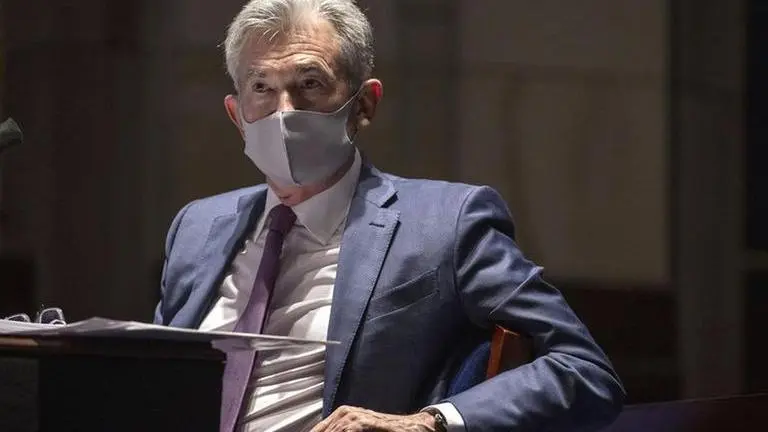

US Federal Reserve expands lending program to nonprofit groups

The Federal Reserve has opened one of its lending programs to nonprofit groups, including hospitals, educational institutions, and social service organizations.

- World News

- 2 min read

The Federal Reserve has opened one of its lending programs to nonprofit groups, including hospitals, educational institutions, and social service organizations.

The Fed said Friday that its Main Street Lending Program, which is targeted to mid-sized businesses, will now extend credit to nonprofits with at least 10 employees and endowments of less than $3 billion.

Under the program, banks make loans to borrowers that meet the Fed's criteria, and the central bank then purchases 95% of the loans to reduce the risk to the bank and enable it to engage in more lending. It's the first time since the Depression that the Fed has lent directly to companies. Main Street's goal is to lend to businesses that were successful before the pandemic struck but are now struggling.

The Fed first proposed terms and criteria for nonprofits last month and adjusted them after receiving public feedback. The required number of employees was reduced to 10, from 50, and borrowers must have 60 days cash on hand, down from 90 in its initial proposal.

Advertisement

So far, Main Street has purchased just $12 million in loans to business since it formally launched July 6. Many potential business borrowers apparently find the program too complicated and are also struggling to locate participating banks. Some economists argue the criteria are too narrow and limit the Fed to lending to relatively healthy companies that are probably still able to borrow from commercial banks on similar terms.

For nonprofits, the terms of the loans are the same as for small businesses: They can borrow for five years at an interest rate just above 3%, with no interest payments for the first year and no payments on the principal for the first two years.

Advertisement

Published By : Associated Press Television News

Published On: 17 July 2020 at 22:46 IST