Updated April 17th, 2024 at 18:10 IST

Luxury’s great divide will get more striking

After two post-Covid boom years, the French behemoth and its bling peers are facing a phase of revenue stagnation.

- Business

- 3 min read

Advertisement

Growing apart. The world of luxury is increasingly a tale of the haves and the have-nots. Bernard Arnault’s $420 billion Tiffany-to-Dior conglomerate LVMH sent a sobering message on Tuesday as it unveiled a 3% year-on-year rise in first-quarter sales ignoring currency moves – well below the 13% expansion for 2023 as a whole. After two post-Covid boom years, the French behemoth and its bling peers are facing a phase of revenue stagnation. As growth flattens, a pre-existing gap between winners and losers may widen.

Investing in European luxury used to be a one-way bet. Considered defensive due to their supposedly more resilient customer base, these stocks tended to attract investors even in times of crisis. Shares in LVMH, for instance, rose 50% between 2007 and 2012 even as the aftermath of the global financial crisis prompted a 35% fall in the STOXX Europe 600 Index, LSEG data show. In the following decade, LVMH rose 450% compared to a rise in the European stock market benchmark of only 80%.

Advertisement

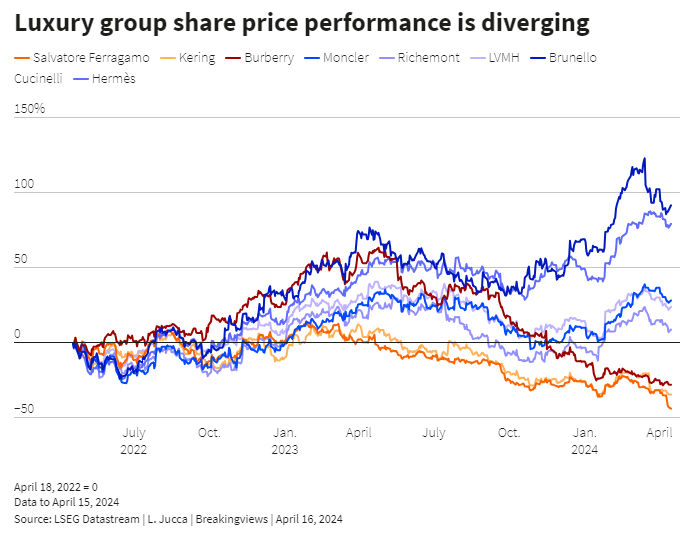

The past few months show a different trend. Rising inflation and a slowdown in China, which together with other Asia-Pacific markets represents around 40% of global luxury sales, have eaten into shoppers’ purchasing power. But the impact has been uneven. While ultra-luxury brands like $255 billion Birkin bag purveyor Hermès International and $7 billion “king of cashmere” Brunello Cucinelli continued to attract buyers, more challenged brands like Kering’s Gucci, Burberry and Salvatore Ferragamo – which rely on less affluent shoppers and are trying to reinvent themselves with new designers – have struggled to woo shoppers.

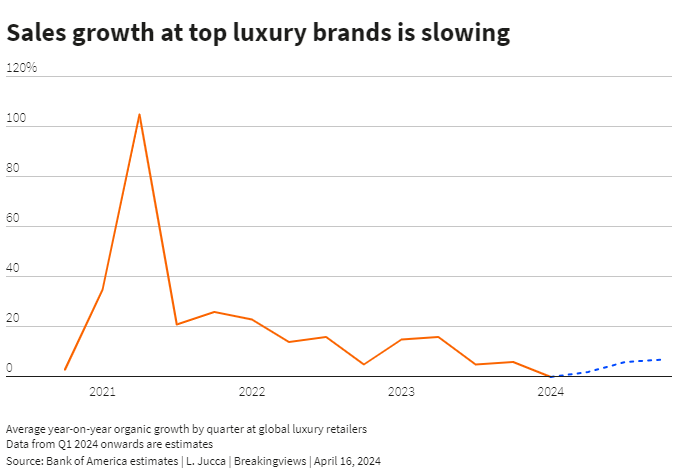

LVMH, which also sells jewellery and wine and whose top brand Louis Vuitton shares exclusivity traits with Hermès, should continue to be classed as a winner despite its pedestrian first quarter. But for the luxury sector as a whole, like-for-like revenue is on average expected to stay flat in the first quarter, the worst quarterly performance since the end of 2020, and rise just 2% in the next, Bank of America estimates show. That suggests the sector’s sales growth could be half the 9% or so recorded last year and way off the double-digit expansion seen in 2022. With less growth to go round, the overall numbers may hide some markedly different trajectories. While Cucinelli sales are forecast to jump 13% this quarter, Burberry’s are seen slumping 12%, according to Visible Alpha estimates.

Advertisement

Some of these considerations have started to feed into luxury stock prices: Burberry and Ferragamo shares are down around 20% since the start of the year, Hermès is up 20%, while LVMH lies in between, up 8%. The polarisation is unlikely to disappear: Gucci’s struggles suggest brand name alone is no guarantee of eternal success. The risk is that some famous designers end up in the bargain bin.

Advertisement

Published April 17th, 2024 at 18:10 IST