Updated January 10th, 2024 at 16:24 IST

Is India becoming a spender economy?

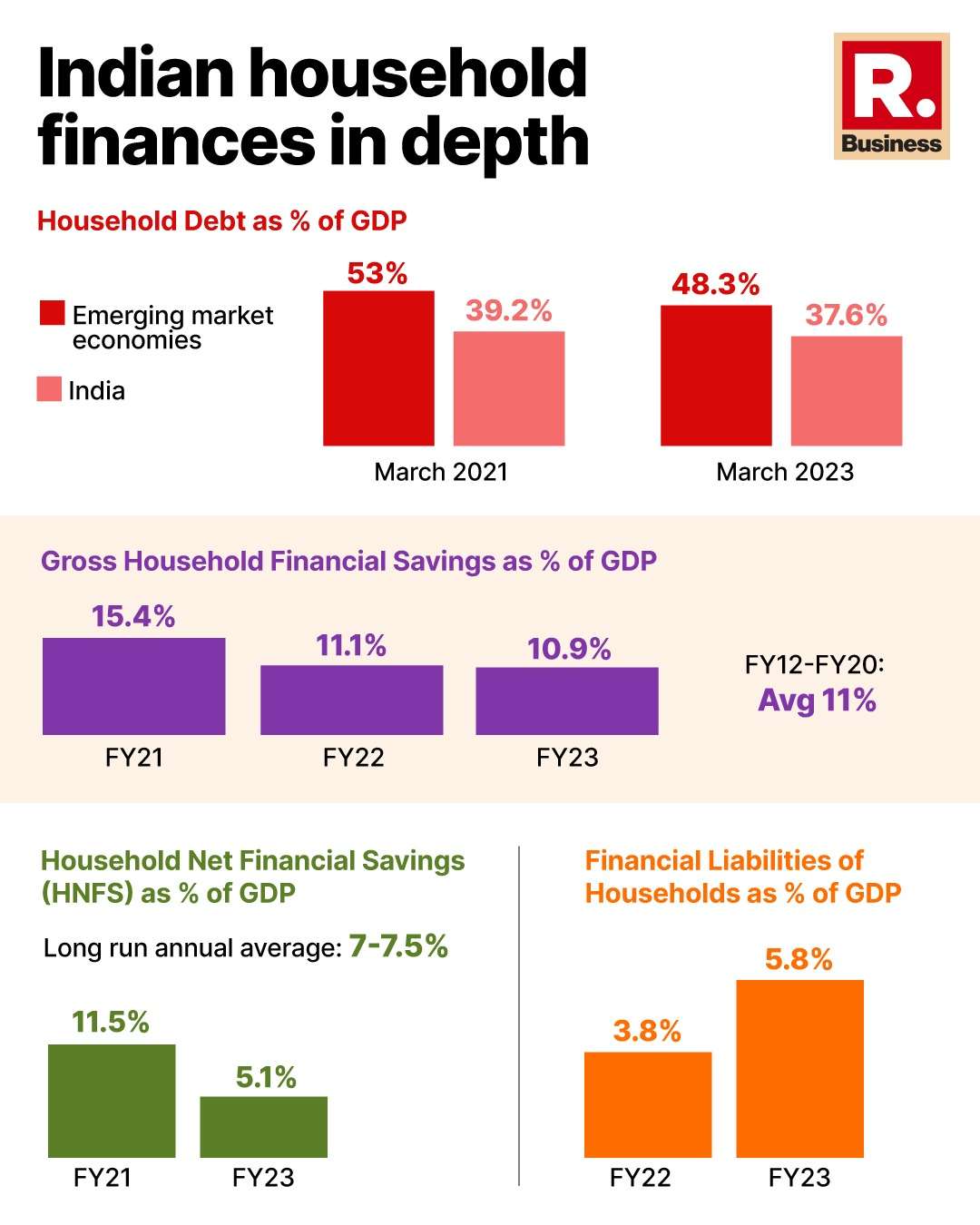

The net household financial savings in India have fallen steeply to 5.1 per cent of GDP in 2022-23 from 11.5 per cent in 2020-2021.

Advertisement

“Paradox of Thrift”- a theory by renowned economist John Maynard Keynes explains how individuals behave during an economic recession. According to the theory, individuals try to save more during an economic recession. Well, this was the case for the Indian economy but that could not be sustained in the post-pandemic era, and household savings took a hit every passing year.

Take a look, India’s gross household financial savings declined from 15.4 per cent in 2020-2021 to 11.1 per cent in 2021-2022, and further to 10.9 per cent in 2022-2023 reverting to its pre-pandemic trend an average of 11.0 per cent during 2011- 12 to 2019-20. On the net household financial savings front, the net household financial savings in India have fallen steeply to 5.1 per cent of GDP in 2022-23 from 11.5 per cent in 2020-21, well below its long-run annual average of 7.0-7.5 per cent.

Advertisement

Declining savings and rising credit

The declining savings and rising credit are what exactly explain the reasons for declining household financial savings in India. But the key question to ask is- Is India becoming a spender economy?

Advertisement

“I don’t think India is a spender economy as of now, it is in transition towards a spender economy, but still we are not completely there. We still have a fair degree of divergence in income levels. K shape recovery is a testament to the divergence in our income levels,” Yuvika Singhal, Economist at QuantEco, told Republic Business.

According to the RBI, the net household financial savings declined owing to a meteoric rise in the personal and unsecured loan segment. This means more people are availing loans to buy physical assets like homes, and cars.

Advertisement

Indian household's inclination towards investing in physical assets is reflected in the latest credit growth data by the RBI. The acceleration in gross bank credit during 2022-23 was led by personal loans and credit extended to the services sector. Within personal loans, the growth in credit card receivables, which are a form of unsecured lending, rose sharply. Services sector credit was driven by lending to NBFCs.

As per the RBI trends report, the personal loan segment witnessed a growth of 21 per cent in 2022-2023. Similarly, vehicle loans witnessed a growth of 25 per cent, and credit card outstanding amount growth stood at 31 per cent in FY23.

Advertisement

“The consumption growth is not a concern as of now, the concern is that a large part of consumption is being fueled by personal loans and unsecured loans. In a nut-shell, higher consumption growth is fuelled by higher debt. This poses a systemic issue for the economy,” Suman Chowdhury, Chief Economist and Head of Research, at Acuite Ratings, told Republic Business. However, more spending and less saving by the household are also seen by economists as more of behaviour change.

“Millennials and more young people are entering the workforce, and there is a mindset of youngsters that don’t want to save money and spend more. This consumption behavior is also driving the phenomenon of declining savings,” Singhal opined. According to the Ecowrap report of the State Bank of India, financial liabilities of households jumped Rs 8.2 trillion since the pandemic, outpacing the increase in gross financial savings at Rs 6.7 trillion, thus explaining the fall in household net financial saving by Rs 1.5 trillion that is 2.5 per cent of GDP.

Advertisement

The transition towards investing more in physical assets is driven by a lower interest rate regime during the pandemic that pushed people to avail of more loans, economists opined. “It is entirely possible that a low-interest rate regime resulted in a paradigm shift of household financial savings to household physical savings in the last 2 years,” the SBI Ecowrap report explained. According to the SBI report, there is a significant long-run relationship between housing Loans and household savings in physical assets.

Even the apex bank of India believes that every Rs 1 increase in housing loans has resulted in a Rs 2.12 increase in household savings in physical assets for the 14 years that ended FY22. It is because the lower interest rate regime led to a decline in net financial savings of households and has resulted in a concomitant increase in household savings in gross physical assets.

Advertisement

The pattern of saving in physical assets by households was on the decline but as per the economists and experts, the trend is once again bouncing back. In FY12, the savings in physical assets accounted for almost 66 per cent of household savings, which gradually went down to 48 per cent in FY21 but is expected to go above the FY12 levels going forward.

“The trend is again shifting and the share of physical assets is expected to reach ~70 per cent level in FY23, due to a decline in the share of financial assets,” the SBI Ecowrap report said.

Advertisement

The same report said that the total household savings (both financial and physical) for FY23 would still surpass the FY22 levels despite the decline in financial savings as household savings in physical assets have jumped Rs 6.5 trillion in FY22 over FY21 and as per current trends it is expected to jump further by up to Rs 5 trillion in FY23 and hence will outstrip the increase in household indebtedness.

Impacting the economy

Advertisement

The decline in household savings should not be seen as a normal economic affair as it is a key function of investments and for financing the deficits. Simply put, an economy with a low saving rate is unable to fund its capital investment needs and hence runs a balance of payments deficit. To be precise, household saving is a cushion for the economy.

Simply put, the net financial savings of the household sector are the most important source of funds for the two deficit sectors, namely, the general government sector and the non-financial corporations. In the domestic market, the government and non-financial corporations are dependent on domestic savings, if they decline then they have to flock to foreign markets for funds.

Advertisement

The declining household savings means the Indian economy’s dependence on foreign funds will rise and that is not a good thing as the global environment can turn hostile at any moment and is loaded with unpredictability. “ There is no harm in depending more on foreign funds but they are hostile. We have seen in FDI inflows those which have declined by 12 per cent globally in 2022, FPI flows have also stayed fickle. As foreign flows are not consistent,” Singhal said.

Concurring with Singhal, Chowdhury said, “Depending on foreign capital is not a good thing, and inflows from abroad are influenced by many factors and are not consistent.”

Advertisement

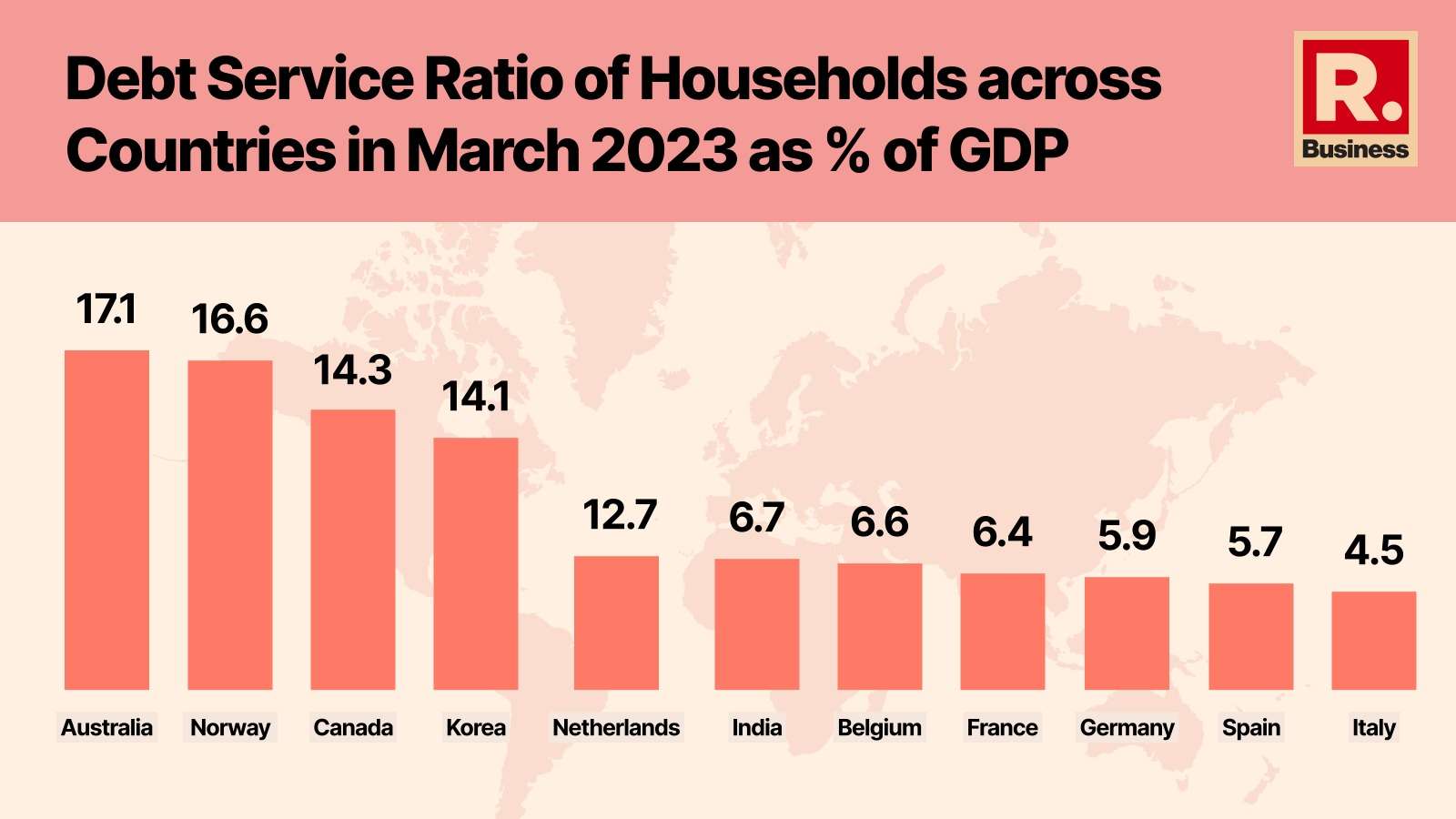

As far as the household saving rate, and net financial saving rate of India are concerned, India is much better compared to its peers- thanks to India’s huge domestic consumption.

“Indonesia and the Philippines are also doing good as far as household saving is concerned. India's economy stands out amongst its peers because of its huge domestic consumption. India is not dependent on the global health of the economy for its fortune. We are not that intertwined as others are,” Singhal told Republic Business.

Advertisement

Published January 2nd, 2024 at 18:09 IST