Published 11:24 IST, March 21st 2024

Equinix, which juggles reams of information underpinning machine-learning models is a logical beneficiary.

Advertisement

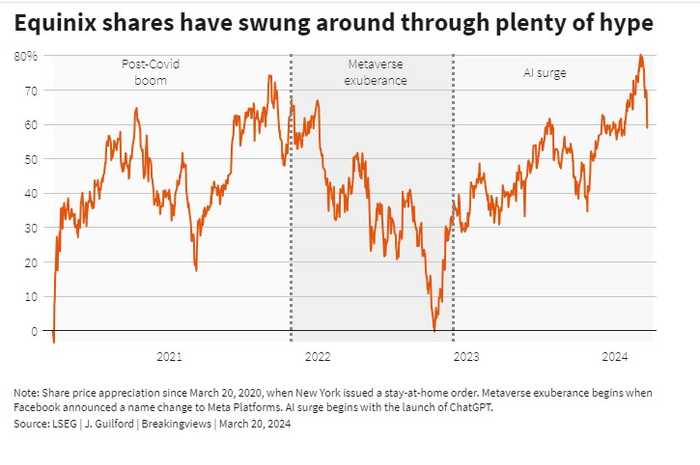

That hissing sound. Artificial intelligence is as hungry as the technology’s bullish backers. Data centers will consume some $200 billion of extra capital expenditure by 2028 to feed the boom, according to consultancy Dell’Oro. Equinix, which juggles reams of information underpinning machine-learning models, is a logical beneficiary; executives mentioned AI 33 times on their latest call with investors. Even with an influential short-seller now attacking the thesis and regulators targeting some of the broader hype, it’s a bubble that will be hard to puncture.

A report from Hindenburg Research released on Wednesday includes allegations of exaggerated profitability metrics, but the argument coalesces around one idea: Equinix is “selling an AI pipe dream.” The real estate investment trust’s market value had swelled by 30%, to $80 billion, over the past year, keeping pace with the wider exuberance. Server maker Super Micro Computer’s shares have surged nearly 800%. And AI darling Astera Labs made its market debut with a nearly 50% jump in its stock price after having priced it above the indicated range.

Advertisement

The dot-com bust might be causing some déjà vu. Torsten Slok, chief economist for investment firm Apollo Global Management, notes that companies in the S&P 500 Index trade at higher multiples of earnings than they did in March 2000. The U.S. Securities and Exchange Commission is now issuing fines for “AI washing,” or excessive claims about machine-learning nous, while the U.S. Department of Justice says it has “numerous” active investigations into the industry.

Like the web, AI really does hold out incredible promise. The problem is separating wheat from chaff. Hindenburg paints Equinix as a victim, not beneficiary, of AI. Cloud-computing giants driving the wave – Microsoft, Alphabet or Amazon.com – are building their own data centers, with such “hyper-scalers” owning a growing share of capacity, Synergy Research reckons. Meanwhile, Hindenburg and others are raising red flags about the vast watts of power required for bit-crunching. Utilities are already struggling to keep up.

Advertisement

This bad news is also sort of the good news. Buyout shops such as Blackstone have paid whopping prices to invest on the back of such shortages. It doesn’t, however, answer the question of whether Equinix and others will fatten up at the AI trough or starve at the hands of larger technology conglomerates when constraints ease. Many pretenders will unduly benefit along the way. Equinix shares dipped only 4% following Hindenburg’s allegations. It’s another sign that this particular bubble probably will deflate slowly rather than pop.

11:24 IST, March 21st 2024