Published 20:51 IST, February 13th 2024

Since listing in New York at $52 billion in September, Arm CEO Rene Haas has had quite the ride.

Advertisement

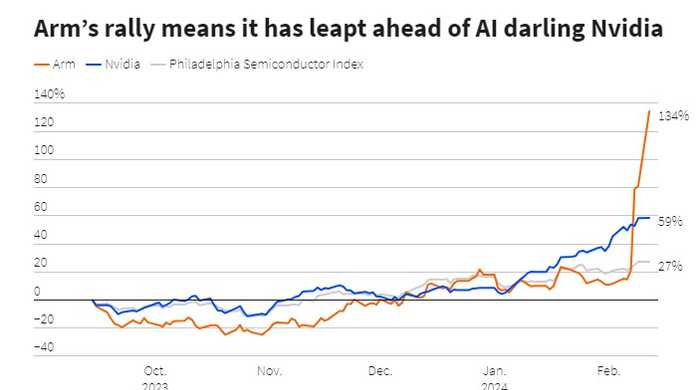

Artificial inflation. Arm seems to have morphed into the artificial intelligence equivalent of a meme stock. Shares of the SoftBank Group-backed chip designer have doubled since the UK-headquartered, U.S.-listed group announced strong earnings last Wednesday, valuing the company at $153 billion. That level is both hyper-inflated and arguably durable.

Since listing in New York at $52 billion in September, Arm CEO Rene Haas has had quite the ride. Following a first-day pop way above his $51 a share listing price, the group’s shares then bumped along at or below that level for over a month. Investors didn’t quite seem to believe Haas’ projections that he could grow revenue by 11% in the 12 months to March 2024 and then at 25% the year after, or that he could return the group’s operating margin to over 40%.

Advertisement

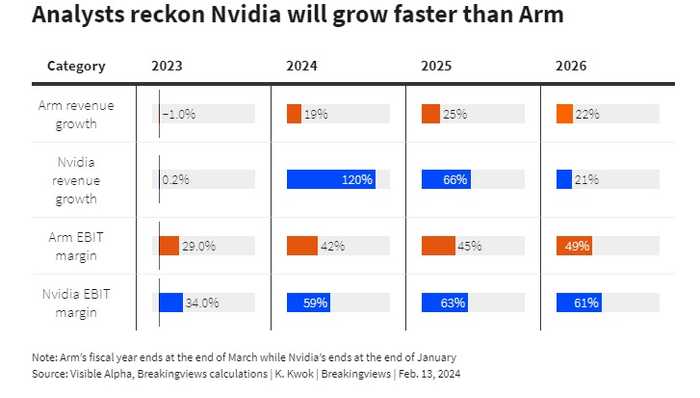

Last week’s earnings gave them reason to shed these doubts. In 2023, Arm’s revenue fell by 1%, with a 25% margin. But in the three months to the end of December, Haas managed a 14% year-on-year increase in revenue. Arm now predicts top-line growth of as much as 20% in the 12 months to March 2024, while analysts expect its margin to hit over 40%, per Visible Alpha data.

A key driver of the revenue strength is because Arm managed to persuade five more unidentified customers to sign up for full access to its chip designs, enabling Haas to book a chunk of this so-called licensing revenue upfront. The margin bounce, meanwhile, is partly because Arm managed to double the royalties it charges per chip by selling a more advanced version of its product – making the core smartphone business in which it has a dominant market share more profitable. Finally, more customers are looking to use Arm’s energy-efficient intellectual property to design both AI applications and data centres, both areas in which Haas wants to grow.

Advertisement

Even so, following investors’ ecstatic reaction Arm now trades at 84 times the operating profit analysts expect it to generate in 2025, using Visible Alpha data. That’s way more expensive than stock market AI darling Nvidia, which on average is expected to double its revenue in the coming two years with an EBIT margin of 60%. Nvidia trades at only 29 times its expected operating profit in 2025, despite its expertise in graphics processing unit chips making it a more obvious winner from the AI revolution.

Advertisement

For Arm’s latest valuation to stack up on analysts’ assumed 45% operating profit margin, Haas would have to double its revenue in the year to March 2025, on Breakingviews calculations. That seems questionable. While more customers are signing up for access to Arm’s designs, revenues from licenses are lumpy and unpredictable, partly because most big chip groups have already signed up for one. In the year or more it might take to turn Arm designs into customers’ own products, Haas won’t be able to charge royalties – these only kick in when the chips are shipped. Separately, growth in the smartphone market that is Arm’s bread and butter could decelerate, while the outlook for electric vehicles and data centres where it wants to grow is also uncertain.

Given all that, you’d expect Arm’s stock to be heading for an equally sharp fall. That’s not certain, though. With SoftBank still holding a 90% stake, very little of Arm’s stock freely trades. That magnifies any movement up or down, and makes shorting risky. Were the Japanese group’s boss Masayoshi Son likely to crystallise some of his post-IPO gains when lock-up restrictions for early shareholders cease on March 12, Arm shares might take a dive. But judging by its own comments SoftBank seems keen to exploit its enhanced ability to borrow against its much more valuable shares.

Advertisement

That leaves Arm investors in an odd position. Their company is doing better than they might have feared. But that may only be a minor driver of where it currently trades.

20:51 IST, February 13th 2024