Updated January 3rd, 2024 at 13:19 IST

Indian autos in pressure after below-expectation sales in December

Listed Indian automobiles are under pressure after sales for the December 2023 period were below par, on back of the EV rush and saturation as per experts

Advertisement

Stocks plunge amid muted sales: Companies in the automobile sector in India are under pressure after sales for the December 2023 period were below par.

As per the results for Indian-listed auto companies and their sales numbers for the last month of 2023, big companies like Maruti Suzuki, Mahindra and Mahindra, as well as Ashok Leyland and Eicher Motors, registered a fall in sequential and fiscal sales.

Advertisement

Report card for Maruti Suzuki: Dip in Dec Sales

Source: Maruti Suzuki

Advertisement

On a monthly basis, Maruti Suzuki saw lower total sales at 1,37,551 units for December 2023, a 1.28 per cent dip compared to 1,39,347 units sold in the same period a year ago.

For the April-December period of 2023, the Delhi-based automobile company registered a 6.89 per cent rise in sales at 15,51,292 units compared to 14,51,237 units in the same period a year ago.

Advertisement

Passenger car sales dragged overall progress the most, with a 28 per cent dip in sales for December 2023 at 48,787 units sold versus 68,421 units sold in the same period a year ago.

Total export sales for the company were at 26,884 units, higher at 23 per cent compared to the year-ago period in December 2022.

Advertisement

Maruti Suzuki shares traded 0.85 per cent lower at Rs 10,194 on the BSE today.

Pulling auto shares down: M&M registers lower exports

Source: Mahindra & Mahindra

Advertisement

Leading the pack of trailers on the stock, Mahindra & Mahindra Ltd shares traded 2.64 per cent lower at Rs 1,658.60.

Total exports trailed 41 per cent in December at 1819 units, while the company registered a 20 per cent tumble at 19,805 units compared to 24,733 units a year ago.

Advertisement

Passenger vehicles were up 24 per cent in December at 35,174 units and 28 per cent on a yearly basis at 3,33,777 units.

The company however registered a sharp 97 per cent fall in car and van vehicle sales for FY24 in December, with 3 units sold in contrast to 112 units in FY23. On a yearly basis, the company registered a 99 per cent downfall in car and vehicle sales at 13 units sold, versus 2009 units in the year-ago period.

Advertisement

Light Commercial Vehicles (LCVs) also saw a negative growth with 6 per cent dip in units less than 2 tonnes at 2849 units, and 22 per cent downfall in LCVs between 2 tonnes and 3.5 tonnes at 12,668 units compared to 16,170 units in the same period last year.

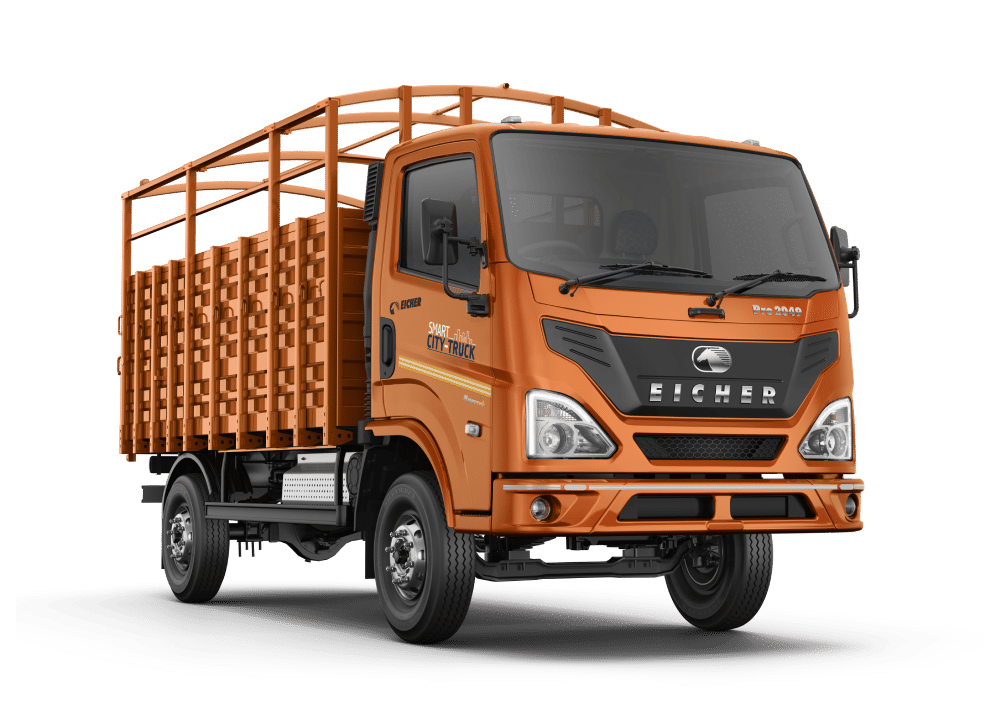

Brake on Bikes: Eicher Dec Sales Fall

Source: Eicher Motors

Advertisement

Gurugram-based Eicher Motors also saw 7 per cent sequential fall in motorcycle sales at 63,387 units in December 2023 compared to 68,400 units last year. Yearly numbers were up 11 per cent to 6,85,059 units for models with engine capacity up to 350cc, and above.

The exports were down 29 per cent sequentially at 6,096 units while yearly, the exports dipped 26 per cent to 54,786

Advertisement

Eicher Motors traded 3.48 per cent lower at Rs 3,895 on the BSE today.

Commercial Vehicles Suffer as Ashok Leyland registers fewer sales

Source: Ashok Leyland

Advertisement

Chennai-headquartered Hinduja Automotive subsidiary Ashok Leyland also saw fewer unit sales in December 2023 by 10 per cent at 15,323 units compared to 14,112 units sold in the same period last year in terms of domestic and exports business, even as cumulative sales saw an uptick.

The shares for Ashok Leyland plunged 3.20 per cent at Rs 180 on exchanges.

Advertisement

Domestic Distress: Tata Motors Sales Dip in India

Advertisement

Source: Tata Motors

Tata Motors saw a marginal rise of 1 per cent on-year for commercial vehicle sales domestically and globally at 96,526 units. The total domestic sales rose 4 per cent to 76,138 units, but dipped 1 per cent domestically in terms of commercial vehicle sales at 32,668 units.

Advertisement

SCV cargo and pickups were down as much as 14 per cent at 12,734 units for the December month, with a 10 per cent dip fiscally in Q3FY24.

Shares for the company traded 0.60 per cent lower at Rs 785.75 as of 11.30 am on BSE.

Advertisement

Good sales but poor shares: TVS Motors plunges on intraday

Advertisement

Source: TVS Motors

Chennai-headquartered TVS Motors saw a 25 per cent uptick in monthly sales at 3,01,898 units with two-wheelers leading sales momentum, but electric vehicles saw a marginal rise of 1.4 per cent to 11,232 units.

Advertisement

TVS Motors was trading at a 3.3 per cent intraday low on the back of muted December sales.

Foreign Bidders in red for Bajaj Auto as Exports Plunge

Source: Bajaj Auto

Advertisement

Bajaj Auto saw a 16 per cent rise with total sales at 3,26,806 units for December 2023, with commercial vehicles exports in the red at a 2 per cent dip at 11,256 even as sales rose 41 per cent domestically to 32,549 units.

Exports for both commercial and two-wheeler vehicles dipped 17 per cent in the April to December 2023 period, at 12,24,964 units compared to 14,76,535 units in the year-ago period.

Advertisement

Shares traded 1.79 per cent lower at Rs 6,580.85 for the Pune-headquartered auto arm of the Bajaj Group.

What Next?

Force Motors traded 0.20 per cent lower at Rs 3676.95 on the exchanges today, even as their results are awaited.

Experts Opine

Credit rating agency ICRA has a forecast of a CAGR of about 6 to 9 per cent across the automotive segments over the medium to long term.

“Supporting underlying factors such as rising per capita incomes, demographic profile, low vehicle penetration, favourable policy environment, including infrastructure development etc. are expected to help grow the industry demand at a steady pace,” Srikumar Krishnamurthy, Senior Vice President and Co-Group Head - Corporate Ratings, ICRA Limited said.

Aided by a preference for personal mobility and stable semiconductor supplies, the passenger vehicle industry reached all-time high volumes in FY2023, and the demand sentiments are expected to remain healthy in the segment, he added.

Advertisement

Anurag Singh, Managing Director, Primus Partners lauded the auto industry for crossing the 40-lakh mark in car sales.

“Nothing is going wrong in the sector, on a calendar year mark 4 million cars have been sold. We also have to consider the infrastructure capacity like roads. (Auto companies) are doing pretty well, as the third-largest auto industry in the world now which is a very big feat.”

Having these numbers for a long time is difficult to achieve, he added, and said the last-month slowdown “happens almost every year.”

Advertisement

According to H S Bhatia, Managing Director, Kelwon Electronic Pvt Ltd and manufacturing and marketing partner for Korean manufacturer DAEWOO India, consumers are waiting for electronic vehicles before making purchases for their petrol and fuel-based vehicles.

With newer incentive schemes like the revised PLI by the Ministry of Heavy Industries, lithium battery prices are going down from 4 per cent at present to an estimate of even 40 per cent, he added.

Advertisement

Both experts agreed that SUV makers are taking a bigger chunk of the pie in profits.

Amit Kumar, CEO And Co-Founder of RAMP Global said sales over the holiday season and seasonality may also be contributing to the decline.

“Inventory shortages, high car pricing, altering consumer tastes, and the PLI scheme's emphasis on Advanced Automotive Technologies (AAT) are all industry-specific factors. Fears of recession decrease consumer confidence, leading to postponed purchases such as automobiles,” he said.

The long-term forecast for the Indian auto industry remains good, owing to factors such as rising disposable income, more urbanisation, and push from the government through various schemes and programs including PLI, Kumar maintained.

Himanshu Arya, Co-Founder & CEO of pre-owned luxury cars platform Luxury Ride said the dip in sales during the last month can be attributed to customers delaying their purchasing plans, anticipating new offers and launches in the new year.

“Moreover, with the new budget slated to be rolled out soon, the masses generally hope to benefit from some new policy. Where the previous year surpassed the sales record of previous years, momentum will continue in 2024 as well,” he added.

Advertisement

Published January 2nd, 2024 at 19:12 IST