Published 21:21 IST, February 23rd 2024

Delay in real-time transactions to hit high-volume Paytm transactions, says CAIT Secy General Khandelwal.

Advertisement

Banks as Paytm PSPs: Amid the current Paytm fiasco, the Confederation of All India Traders (CAIT) has expressed concern that banks as payments service providers (PSPs) stepping in as Payment Service Providers, will cause a delay in high-volume Paytm transactions, which may in turn adversely impact trade and commerce.

In an exclusive interview with Republic Business, CAIT Secretary General Praveen Khandelwal said with other banks as PSPs, Unified Payments Interface (UPI) is likely to lose its edge in ensuring a real-time transaction. “Small traders, vendors, and other businesses will definitely be impacted by the routing of payment through other private banks as PSPs will be time-consuming,” said Khandelwal.

Advertisement

Khandelwal asserted that such an unprecedented event in the fintech ecosystem of the country will not shatter the confidence of traders and other stakeholders in the digital payment system built over the years. Allaying apprehensions in various quarters about reverting to a cash system, CAIT Secretary General Praveen Khandelwal said that the government has paved the path for the adoption and acceptance of digital payments in India, and it has now become routine.

Trouble mounts for Paytm

The CAIT President said that there are several options available in the market, and users can freely migrate to any other option of their choice. Khandelwal added that there will be no disruption in the digital payment ecosystem of the country.

Advertisement

“Rather, it will become stronger, as several other digital payment players have taken aggressive steps by deploying their sales teams on the ground which will create greater awareness,” said Khandelwal. “Since the past many years, the CAIT has been deeply engaged in promoting traders to adopt and accept digital payments,” added Khandelwal.

CAIT National President B C Bhartia and Secretary General Praveen Khandelwal said that with the action taken on Paytm, the RBI has reiterated its commitment not to allow any wrongdoing in the payment sector that violates the law. The CAIT office bearers emphasised that the RBI's strong message indicates that building businesses without established regulatory frameworks are impractical.

Advertisement

“They stressed that it must be understood by companies in every sector of the Indian economy that regardless of their size, the law will take its own course if anyone dares to flout it, and certainly, India is not a banana republic,” said Khandelwal.

CAIT has expressed concern regarding the Paytm issue as millions of its users, prominently including a sizable number of small businesses, artisans, and women entrepreneurs, besides the general public, are customers of shopkeepers.

Advertisement

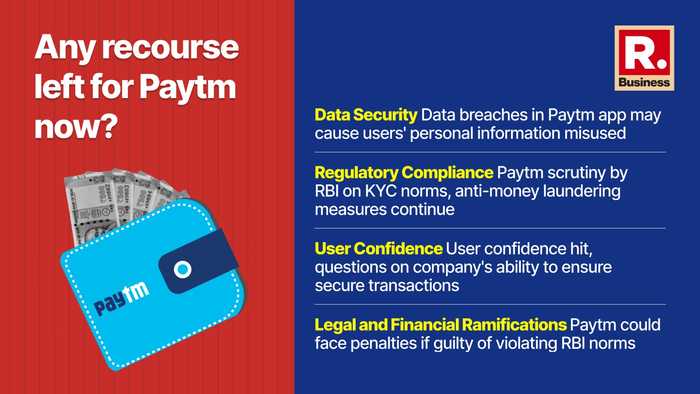

“Due to the mass confusion among the trading community regarding the security of their money in various instruments of Paytm and the potential future actions by the RBI or any other government entities, CAIT has conducted an in-depth study of the issue and has identified various crucial but pertinent questions arising from the current situation,” Khandelwal added.

Advertisement

21:13 IST, February 23rd 2024