Published 18:33 IST, March 5th 2024

Bayer’s CEO Bill Anderson does not want to to break up the business, denying shareholders a speedy fix for debt pile.

Advertisement

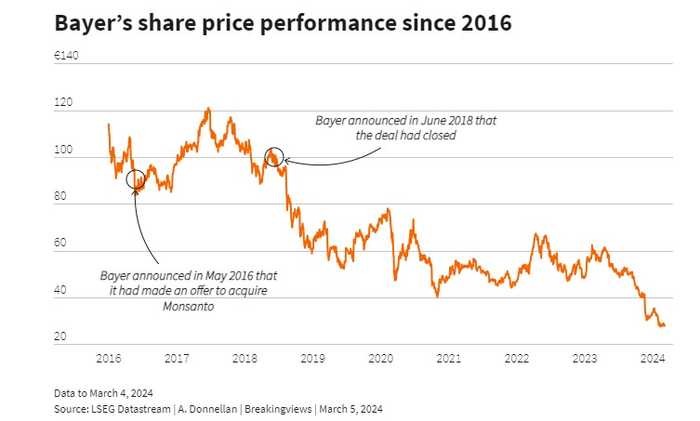

Bay-ing time. Is Bill Anderson displaying appropriate caution, or mindless inertia? Bayer’s CEO on Tuesday backed away from a plan to break up the business, denying shareholders a speedy fix for the 27 billion euro ($30 billion) group’s debt pile and its spiralling U.S. litigation costs. On balance, he’s taking the riskier option.

One can see why Anderson might favour the status quo. Although investors like activist Jeff Ubben have been pushing to break up Bayer via a sale of the consumer unit which makes Claritin hay fever medicine, that might also crystalise a capital gains charge. JPMorgan analysts reckon the net present value of the unit’s cashflows is 21 billion euros, but also think the same unit might only fetch 12 billion euros if valued in line with the multiples of peers like Reckitt Benckiser, plus a discount to reflect lower margins.

Advertisement

Anderson may also be comfortable with the company’s elevated debt levels. The company’s 35 billion euros of net debt is nearly 3 times the 11.7 billion euros of EBITDA before special items it delivered in 2023. But that’s only marginally above the leverage on which rival drugmaker GSK operated before it spun off its consumer health division Haleon. Slashing Bayer’s dividend by 95% should save around 2 billion euros annually, while retaining the consumer unit’s healthy cash flows may also help maintain the company’s BBB credit rating.

Advertisement

Still, that level is just one notch above junk. And Bayer is not exactly giving shareholders a clear picture. Far from ruling out a future sale, Anderson is instead saying “not now”. Meanwhile, Bayer recently lost a number of Roundup-related U.S. court cases. If that persists it may have to sacrifice more cash to pay claimants rather than cut debt, potentially imperiling the investment grade rating.

This risk is hiding in plain sight in Bayer’s valuation. Its crop science could be worth 40 billion euros, based on a 2024 EBITDA multiple of 7 times, a slight discount to rival Corteva. Its pharma group may be worth 32 billion euros, assuming 6 times the same year’s EBITDA – a slight discount to GSK and Sanofi. Add the consumer health arm, knock off net debt, 5 billion euros of pension liabilities and around 6 billion euros for Roundup payouts, and Bayer’s equity should be worth over 40 billion euros. That arguably implies more than 10 billion euros of further Roundup pain.

Advertisement

A sale of the consumer arm could have meant a much quicker deleveraging. Assigning 10 billion euros of the proceeds would have seen net debt drop to 2 times EBITDA. The rest could have been used to invest in Bayer’s pharma drug pipeline, which has endured a number of failures.

Ultimately, Anderson needs to come up with a better plan for fighting court cases in the U.S. One plan would involve striking larger deals with claimants to avoid regular dents to its cash flow. But in the meantime, shareholders could have expected more than just wait and see.

Advertisement

18:33 IST, March 5th 2024