Updated 14 April 2024 at 16:54 IST

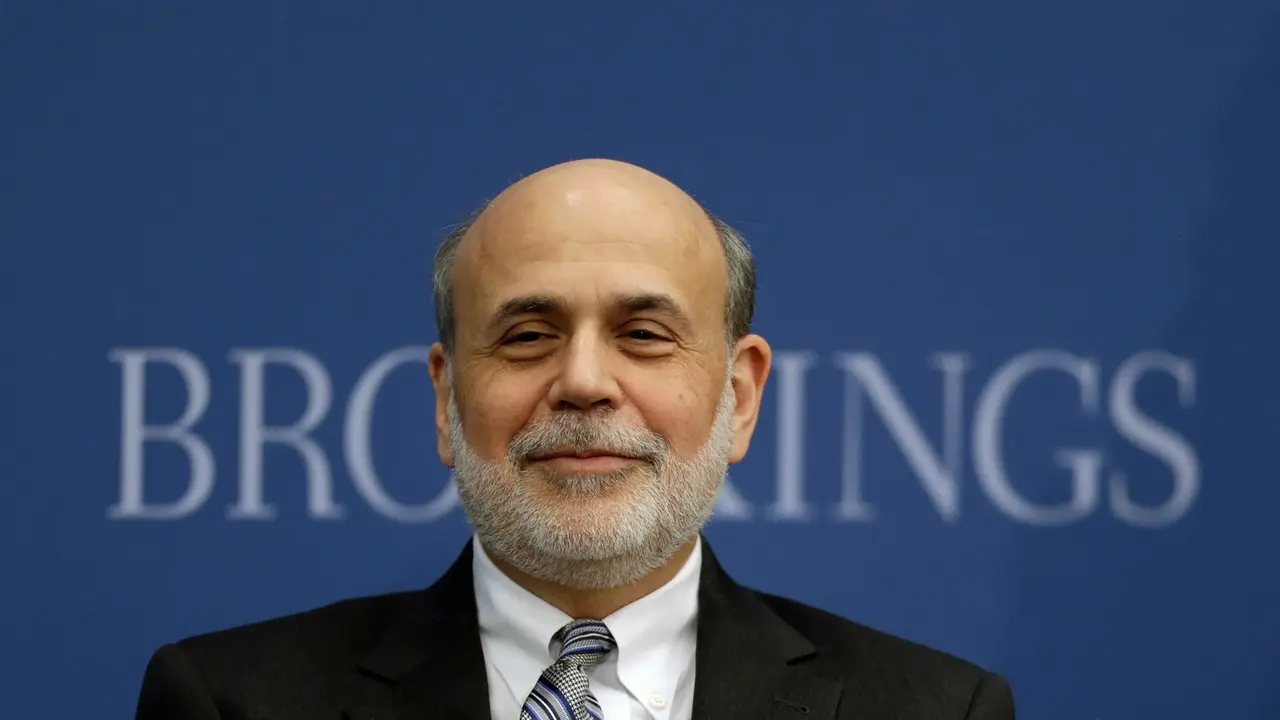

Bernanke partly mends cracks in BoE’s crystal ball

Former Fed Chair Ben Bernanke on April 12 urged the Bank of England to overhaul the way it makes economic forecasts and communicates them to the public.

- Republic Business

- 3 min read

Big Ben strikes 12. Ben Bernanke wants the Bank of England to say what it really thinks. The former Federal Reserve chair on Friday published the results of his review of the UK central bank’s forecasting and communications processes. He’s right to urge the BoE to stop hiding behind market predictions of future interest rates, and to be less verbose. But his 12 recommendations for greater transparency are not daring enough.

Everyone makes mistakes. But when a central bank errs in forecasting inflation or unemployment people suffer, markets gyrate, and politicians squeal. The BoE is one of the culprits: its inflation forecasting errors quadrupled as prices began rising in 2021. The only consolation for Governor Andrew Bailey is that others, notably Sweden’s Riksbank and the European Central Bank, made even bigger mistakes.

The BoE deserves some credit for last year asking Bernanke to review the way it predicts the future. The Nobel prize-winning economist did not pull his punches, calling some of the practices and systems “out of date", “uncomfortably ad hoc” and giving rise to “potentially perverse effects”.

Bernanke takes aim at the BoE’s reliance on market prices about the future direction of interest rates in its predictions and communications. He’s right. Relying on traders’ bets to forecast inflation and other economic variables is inaccurate and misleading. It does not reflect what members of the BoE’s rate-setting Monetary Policy Committee think. And it’s self-fulfilling, because markets take their cue from what policymakers say. The former Fed chief is also not keen on the BoE’s “fan charts”, which attempt to convey the likelihood of different economic scenarios. In his view, they are rooted in outdated methods and confusing.

Advertisement

When it comes to recommending a better system, though, Bernanke ignores his own advice to be bolder. He simply urges the BoE to “de-emphasise” market forecasts and to publicise alternative scenarios.

He could have gone further. One option would be to require the BoE staff, or the entire MPC, to come up with a forecast of where interest rates will go – like Norway’s Norges Bank or the Reserve Bank of New Zealand. A more radical innovation would be to ask each MPC member to make their own predictions and publish those. This is how the Fed’s Open Market Committee produces its famous “dot plot”.

Advertisement

None of these innovations would eliminate forecasting or policy errors. But they would provide investors, politicians and the public with a much-needed glimpse into the black box of monetary policy. Bernanke’s recommendations only partly mend the cracks in the BoE’s crystal ball.

Context News

Former Federal Reserve Chair Ben Bernanke on April 12 urged the Bank of England to overhaul the way it makes economic forecasts and communicates them to the public. The BoE asked the Nobel prize-winning economist to review its forecasting practices in July 2023 following widespread criticism of its failure to predict rampant inflation in previous years. Bernanke’s 12 recommendations include: urging the BoE to drop its reliance on market views of the future path of interest rates, be open to alternative scenarios of economic activity, and make its monetary reports shorter.

Published By : Anirudh Trivedi

Published On: 14 April 2024 at 16:54 IST