Published 16:41 IST, February 28th 2024

The rally can be attributed to the heightened trading activity, totalling $3 bn, in Bitcoin spot ETFs, showing increasing demand in the market, experts suggest.

Advertisement

Bitcoin nears $60k: With more than a 4.4 per cent rise in prices, Bitcoin has recorded its biggest monthly rally since 2021, breaking past the $59,467 mark. Bitcoin is currently trading at $59,306 with a market capitalisation of over $1.16 trillion. The rally is being driven by the constantly increasing volume in spot Bitcoin ETFs bringing in institutional capital into the asset class.

Bitcoin price chart | Image credit: Coinmarketcap

Advertisement

Talking about the strong rally of Bitcoin rally, Siddhartha Gupta, SVP, Business and Strategic Alliances, CoinDCX said "In the midst of a remarkable surge in the broader crypto market, Bitcoin has soared past the $59,000 mark, inching tantalisingly close to its all-time high of $68,789 set in November 2021. This rally is fueled by a convergence of factors, including the growing attraction of spot Bitcoin ETFs among institutional investors.”

“The impending halving event, coupled with expectations of interest rate cuts, further add to the bullish sentiment surrounding Bitcoin. With historical precedents indicating significant price spikes following halving events, and institutional demand reaching euphoric levels, Bitcoin is poised to potentially surpass its previous highs as we move into March,” added Gupta.

Advertisement

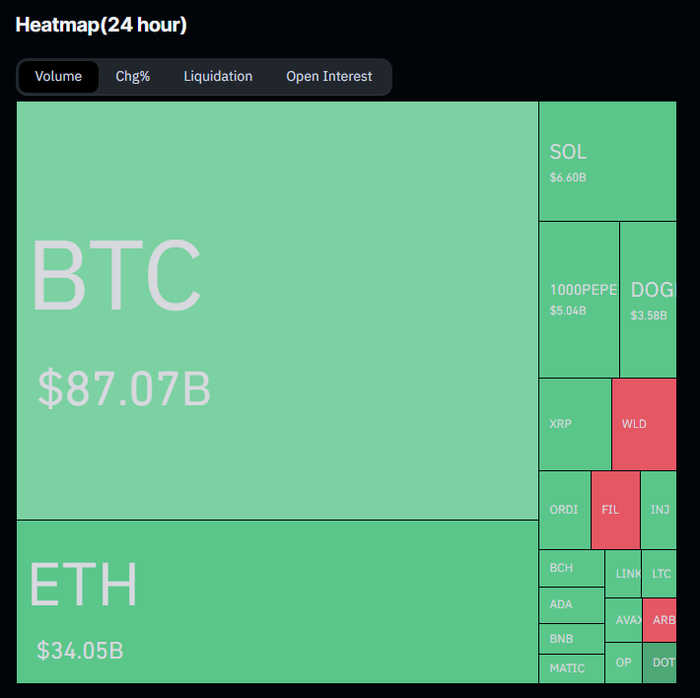

Bitcoin trade volume | Image credit: Coinglass

Labelling the surge in Bitcoin price as the arrival of crypto spring, Parth Chaturvedi, Investments Lead, CoinSwitch Ventures said, “After 2 long years of price correction, Crypto Spring has arrived early in 2024, as the spot BTC ETFs continue to gain investor interest and are the primary reason for the current surge in BTC prices.”

Advertisement

“Blackrock's IBIT did over $1 billion in trading volume for the last two days, putting it in the top 10 most traded ETFs in the US. This is unique for a newly launched asset's ETF that has only been trading for 2 months. Blackrock now has around $7 billion in BTC holding and Fidelity has around $5 billion, which are phenomenal numbers for a newly launched ETF. This is being coupled with this demand surge, we are now less than 50 days away from the upcoming supply shock, in terms of the BTC halving which is scheduled to happen in April 2024,” Chaturvedi added.

Growing investor confidence

Comparing the price action of Bitcoin in this month with 2021 when Bitcoin hit its all-time high, Vikram Subburaj, CEO of Giottus said, “It is thrilling to witness Bitcoin’s remarkable surge, adding 5 per cent in value over the past 24 hours and breaching $59,000 along the way. This recent price spike is a testament to the growing investor confidence in crypto and its market maturity, significantly influenced by the record trading volumes exceeding $3 billion for Bitcoin spot exchange-traded funds (ETFs) yesterday.”

Advertisement

Underlining the strong possibility of Bitcoin breaching its all-time high shortly, Edul Patel, C0-founder of Mudrex, said, “This surge can be attributed to the substantial trading activity, totalling $3 billion, in Bitcoin spot ETFs, showing increasing demand in the market. Currently, BlackRock’s fund has even made it in the top five of all (including non-crypto) ETFs based on 2024 inflows. Moreover, the approaching Bitcoin halving event, a historical catalyst for price surges, adds to the positive outlook.

Talking about the steep surge in the Bitcoin charts, Ryan Lee, Chief Analyst at Bitget, Research said, “BTC initiated a new round of upward movement on February 28th, breaking through the previous high to $57,000. The total market capitalisation of BTC is $24.75 billion, with a 24-hour trading volume of $80.9 billion. The trading volume of nine Bitcoin ETFs in the United States also reached a new high at $3.2 billion.”

Advertisement

Resistance beyond $60,000

“Institutional bullish sentiment is strong, and with 54 days remaining until the Bitcoin halving, coupled with expectations of a mid-year Fed rate cut, Bitcoin is expected to find support at $50,000, potentially experiencing volatility in March to challenge historical highs. Resistance above is seen at $60,000 and $69,000, while support below is in the range of $48,000 to $52,000,” added Lee.

Kumar Gaurav, Founder and CEO of Cashaa said, “Anticipation of a sustained rally post the Bitcoin halving event in April has also meant a lot of new and existing investors taking new long positions in the Bitcoin market. Liquidation of a lot of short positions in Bitcoin futures due to this rally also has meant that these short sellers have had to go into the market and buy Bitcoin to cover their positions, adding to the upward pressure on Bitcoin prices.”

16:39 IST, February 28th 2024