Published 21:16 IST, March 4th 2024

Currys should soon have net cash of 23 million pounds after it sells its Greek operations.

Advertisement

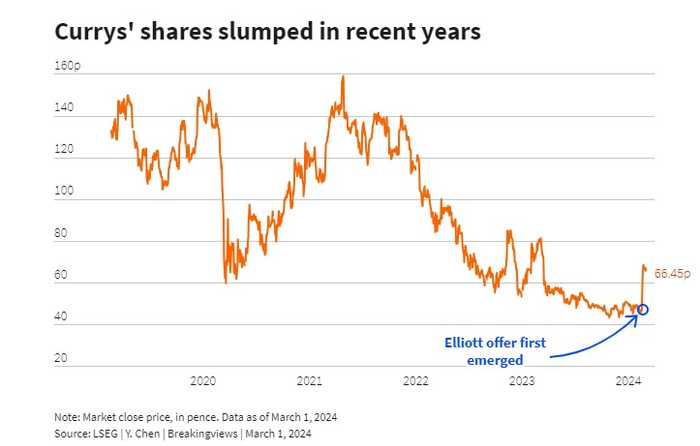

Low inventory. Why is Paul Singer so interested in Currys? It’s presumably not because Elliott Investment Management’s billionaire boss is in dire need of a decent washing machine. While a leveraged buyout of the UK electrical retailer based on Elliott’s 757 million pounds ($951 million) offer last week may have been doable, it looks dicey for the U.S. investment group to go much higher.

At affiliate Elliott Advisors’ 67 pence a share bid – 40% higher than Currys’ pre-approach trading price – there was some sort of path to private equity-style returns. Currys should soon have net cash of 23 million pounds after it sells its Greek operations and pays its planned pension contributions, giving an enterprise value of 734 million pounds. Assume the UK group grows its top line 1.5% annually in line with Investec assumptions, maintains a 6% EBITDA margin, and invests 1.5% of sales in annual capital expenditure. If Elliott borrowed 70% of the financing needed at a cost of 8% and sold the retailer on after five years at the 1.6 multiple of EBITDA at which Currys has traded in the past, Singer’s internal rate of return would be around 20%, Breakingviews calculations suggest.

Advertisement

Unfortunately for Singer, all that is beside the point: Currys’ board last week rejected his 67 pence offer. Given that the retailer’s shares hit 150 pence less than three years ago, one can see why. Meanwhile, one of Currys’ top shareholders claims the group should only entertain offers at 75 pence a share.

Elliott’s scope to get to that sort of level looks constrained. Ever since central banks hiked rates, banks have been wary of signing off too much leverage. That’s likely to be a particular factor with Currys, which rents its shops rather than owning them and which has to manage a pension deficit. In addition Britain’s economy is set to grow at under 1% in 2024, and last week bike and car parts retailer Halfords plunged nearly 30% in a day on a surprise profit warning.

Advertisement

Imagine Elliott bid 75 pence a share for Currys, but was only able to borrow 60% of the deal outlay at a cost of 14%. Assume also that competitive pressures meant Currys’ EBITDA margin fell to 5.8%, and its top line only grew at 0.5% a year on average. With lesser and pricier leverage, the annualised rate of return would fall to 1%.

That’s not worth doing. It would also be unwise to get into a bidding war with $37 billion Chinese retailer JD.com, which is also interested and which sits on $11 billion of net cash. Unless rival suitors keep their powder dry, Singer may need to get his white goods elsewhere.

Advertisement

21:16 IST, March 4th 2024