Published 20:07 IST, April 19th 2024

The conference’s opening day coincided with luxury titan LVMH’s meagre 3% year-on-year rise in first-quarter revenues.

Advertisement

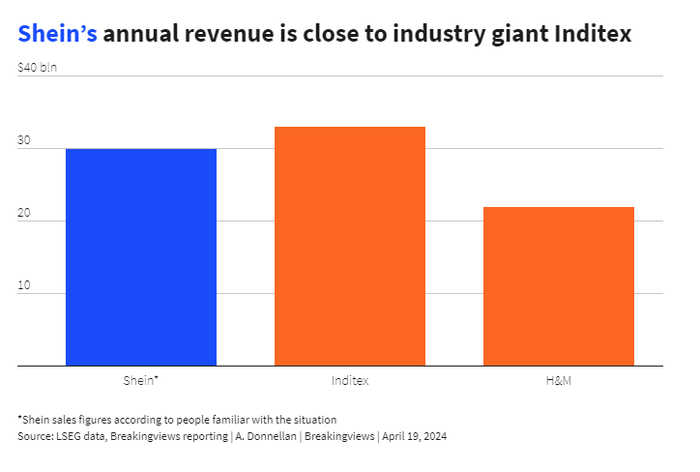

Haunted house. Retailers are in a tight spot. Consumers in key markets like China, Europe and the United States are spending less on clothes, and a sector that boasts $30 trillion in global revenue is pinning its hopes on low-cost items as exemplified by fast fashion giant Shein, and the cash-rich Middle East. Behind the scenes, delegates gathering at the 2024 World Retail Congress in Paris were worried about the increasing disconnect between those two growth areas and their previous focus on environmental, social and governance concerns.

The conference’s opening day coincided with luxury titan LVMH’s meagre 3% year-on-year rise in first-quarter revenues, and a brutal restructuring at troubled UK fashion brand Superdry. The conference organisers seemed to have decided to ignore rather than confront these bad vibes. In contrast to robust questioning on previous years’ panels, there were endless glitzy video advertisements. An underwhelming exchange between Shein’s head of strategy for the U.S. and UK, Peter Pernot-Day, and Fabletics Brand President Ashley Kechter – which largely consisted of the two executives congratulating each other – was sadly typical.

Advertisement

Off the record, conference-goers were more open about their concerns. One is that Shein’s model seems to run counter to growing government reservations about ultra-consumption for ultra-consumption’s sake. Its ethos was summed up by Christina Fontana, the company’s senior director in charge of brand operations, who was chiefly focused on how her company’s app became the most downloaded in the U.S. She explained how Shein is most popular with Gen Z women who often visit the site multiple times a day with no idea what they want to purchase. They simply scroll through the selections of $5 shirts and bags as a form of “play” before buying.

That’s fine, except politicians increasingly fret about the climate-worsening waste this is exacerbating. In France itself, lawmakers have already voted on measures to curtail fast fashion brands. That includes a ban on advertising the cheapest textiles and a charge imposed on low-cost garments. Meanwhile, the European Union has announced a similar crackdown on fashion waste.

Advertisement

The looming regulatory risk may explain why many delegates were lured to Saudi Arabia’s Diriyah stand. A vast scale model of the kingdom’s new project dominated the airy lounge of the conference. The sandy toned multi-level development represented only part of the kingdom’s $62 billion plan for an expansion of a town near Riyadh that was the birthplace of the Saudi state.

The developers boasted that the Public Investment Fund project will have a thoroughfare as impressive as the Champs-Élysées in Paris and feature a new stadium, museums and mosque. Crucially, it will also entail vast quantities of retail space for the world’s biggest brands to showcase their wares.

Advertisement

For brands like LVMH, Mulberry, Carrefour and Mattel bigger sales opportunities in Middle Eastern hubs like Dubai and the UAE are important given the trickier situation at home. Last year, the Dubai Mall lured a record 105 million shoppers, making it the most visited place on earth in 2023, figures released by the mall suggest. According to Fahed Ghanim, CEO of Majid Al Futtaim Lifestyle – a retail partner for international brands in the Middle East and part of Majid Al Futtaim Group which runs 29 shopping malls in the region – Dubai stores are among the top-three revenue generating outlets globally.

Even so, for now the Gulf still carries a downside. While Saudi Arabia has taken some steps to equalize its society, plenty of female delegates at the sidelines of the conference told Breakingviews that they still struggled to see the kingdom as an enticing tourist destination. In other words, both Shein’s fast fashion and Saudi’s

Advertisement

retail bonanza offer obvious ways to ease their growth concerns. The problem for retailers is they also come with increasingly obvious strings attached.

Context News

The annual World Retail Congress took place in Paris between April 16 and April 18.

Advertisement

20:07 IST, April 19th 2024