Published 17:48 IST, February 28th 2024

German banks, which sit on 285 billion euros’ worth of commercial property loans, according to the European Banking Authority, look particularly vulnerable.

Advertisement

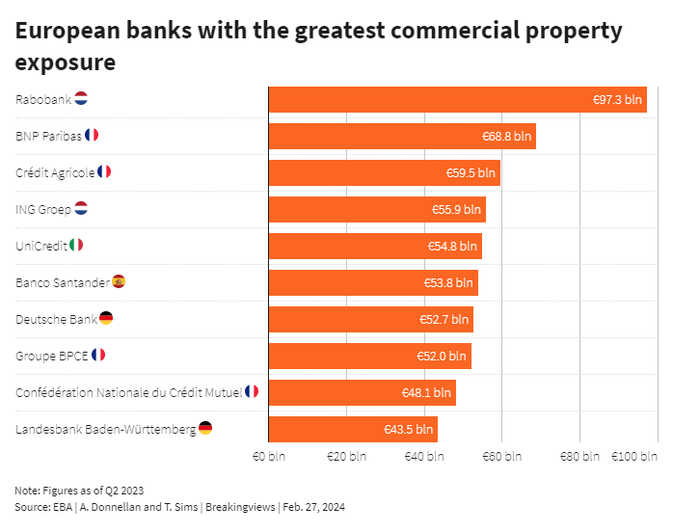

Lease of life. European banks are resting their hopes of avoiding a new crisis on two big ifs. Lenders including ING, BNP Paribas and Deutsche Bank are sitting on 1.4 trillion euros’ worth ($1.5 trillion) of loans to landlords that are looking vulnerable to higher interest rates and dwindling demand for business premises and retail space. Longer leases give EU banks more breathing space than their U.S. counterparts. But they also need rates to fall and an office revival to stay out of trouble.

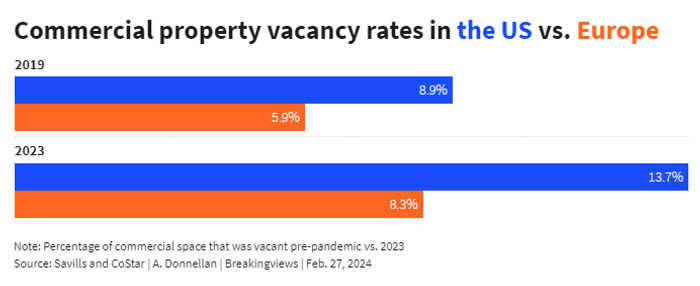

Cracks in the business property sector appeared when pandemic-related lockdowns emptied out offices and shopping malls. Unfortunately for landlords, these concerns did not dissipate when the Covid-19 emergency ended. Instead, a boom in hybrid working has driven vacancy rates in the U.S. to a record of nearly 14%, according to commercial real estate research specialist CoStar. In San Francisco 20% of offices are currently empty.

Advertisement

Europe is not immune from the property pain. Austria’s Signa, whose property empire included the Chrysler Building in New York, collapsed last year into administration. Swiss wealth manager Julius Baer ousted on Feb. 1 CEO Philipp Rickenbacher after booking large losses from its Signa exposure. In Germany, where real estate is experiencing its worst decline in decades, hedge funds are betting on the demise of specialised property lender Deutsche Pfandbriefbank. And on Monday Bank of Ireland booked a 403 million euro charge against potential risks in its commercial property portfolio.

The level of exposure should make regulators jittery. German banks, which sit on 285 billion euros’ worth of commercial property loans, according to the European Banking Authority, look particularly vulnerable. At nearly 53 billion euros, Deutsche Bank’s business property exposure is around 10% of its loan book. That’s chunky, although proportionally lower than the 44% for Deutsche Pfandbriefbank. European lenders like ING, BNP and Banco Santander have each lent between 50 billion euros and 70 billion euros to the segment, equivalent to between 7% and 10% of their loan books, according to a Breakingviews analysis of EBA data and corporate filings.

Advertisement

While most EU loans have high levels of collateral, a fifth have loan to value ratios of 80% or higher. This could become a problem for banks if office tenants downsize when their leases come due, reducing landlords’ ability to increase rents. A collapse in owners’ income would lead to a decline in valuations, forcing banks to ask them to top up their credit and eventually impair the loans if this is not possible.

Europe’s banks have some crisis buffers. To start, they have ample stores of capital with the average Common Equity Tier 1 ratio of nearly 16%, and thanks to higher interest rates they are making healthy profits. In the event of loans turning sour, these could be sacrificed to avoid any dent to their capital. Banks also have time on their side. The average European commercial property loan will mature in about four years, while most U.S. loans are due in 2024. European landlords also benefit from rent indexation, which allows them to hike rent each year in line with inflation. Meanwhile, office vacancy rates have only topped 8%, far lower than their U.S. counterparts, and European companies are pushing employees to return to the office.

Advertisement

Investors are also expecting 100 basis points’ worth of cuts in 2024, taking the European Central Bank’s deposit rate to around 3% this year. That would leave it below the Federal Reserve’s key rate, which is expected to fall to 4.5% by year-end.

There is a chance, however, that none of these scenarios pan out. Hybrid working is proving hugely popular with employees, and companies see the cost benefits of using less space: Deutsche Bank is for instance seeking to cut its office footage by 40%. Meanwhile, inflation has not yet been slain, which could hinder the ECB’s ability to cut rates.

Advertisement

Even though EU banks have time to try and help office owners navigate these challenges, avoiding a commercial property mess rests on potentially fragile pillars.

Context News

European Union banks have 1.4 trillion euros ($1.5 trillion) of outstanding loans to the commercial property sector as of the end of the first half of 2023, according to the European Banking Authority. Shares in Frankfurt-listed Deutsche Pfandbriefbank, created after the financial crisis, have fallen 60% since the start of 2024 amid concerns about the lender’s exposure to office buildings and other business premises in the United States. On Feb. 9, the German bank sought to reassure investors that it had enough funds to cope with a widening property slump.

Advertisement

17:48 IST, February 28th 2024