Published 16:04 IST, April 12th 2024

Christine Lagarde must worry about 20 different economies and doesn’t need another one on her list, not even the world’s largest.

Advertisement

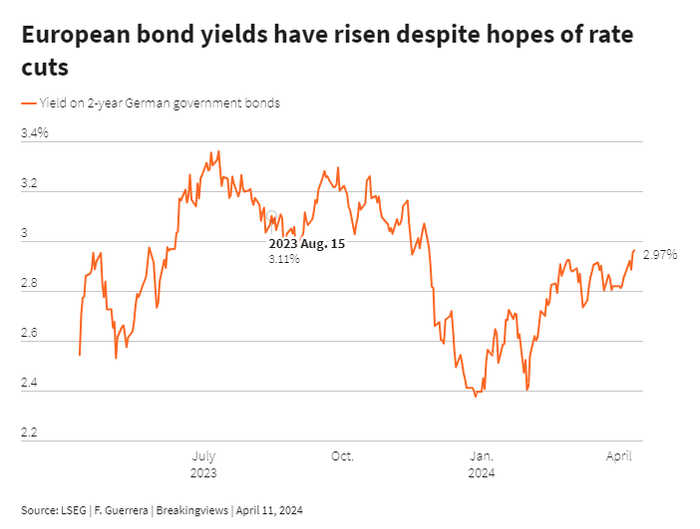

Uncool copycats. Trying to solve the interest rate riddle, euro zone bond traders are looking at the wrong clues. The European Central Bank hinted on Thursday that it may lower borrowing costs in June. That would place it ahead of the Federal Reserve. Yet fixed-income investors seem more preoccupied with strong U.S. inflation data. That will lead them to the wrong conclusion.

Christine Lagarde must worry about 20 different economies and doesn’t need another one on her list, not even the world’s largest. The ECB president clearly stated on Thursday that developments in the United States will not affect monetary policy in the euro zone. So the ECB remains ready to cut rates in June, barring any unexpected shocks, even as the Fed may delay its own easing due to a fast-growing economy and robust inflation.

Advertisement

Bond investors, however, are not listening. They keep shunning the bloc’s debt. Yields on Germany’s two-year bunds – a proxy for euro zone debt – rose from 2.96% to 2.97% on Thursday. That’s the highest level since November 2023, after a big rise from 2.89% on Wednesday. The reason for that yield jump? Strong inflation data in the United States that put paid to market hopes of a Fed rate cut in June.

Euro zone bonds have been aping U.S. ones for a while. In February, the correlation between German and U.S. two-year bond yields hit a record high, according to State Street analysts.

Advertisement

But the strategy is misguided when the two blocs’ economic realities are so different. The Atlanta Fed estimates that U.S. GDP is growing at a 2.4% annual rate. The euro zone expanded at a measly 0.1% annual pace in the fourth quarter of last year. That’s reflected in the respective inflation rates: 3.5% for the United States and 2.4% in the euro zone, getting closer to the ECB’s 2% target.

It’s true that the ECB has never initiated rate cuts before the Fed, as Deutsche Bank analysts noted last week. But Lagarde’s job is to look at economic realities, not historical records. If she follows through on her hints, euro zone yields will start falling soon, pushing prices higher. On that basis, the bloc’s bonds look a better bet than U.S. ones.

Advertisement

Foreign exchange traders get the idea. They sent the euro to a two-month low against the dollar on Thursday. Bond traders should stop obsessing about what happens in Washington if they want to avoid a painful reality check.

Context News

The European Central Bank kept interest rates at record highs on April 11 but sent a clear signal it may cut them in June as euro zone inflation continues to fall. The central bank for the 20 countries that share the euro kept its deposit rate at 4.0%. But with inflation now close to the ECB’s 2% target, bank lending at a standstill and the economy barely growing, the ECB dropped fresh hints about a possible cut at its next meeting.

Advertisement

16:04 IST, April 12th 2024