Published 15:44 IST, March 4th 2024

Deutsche Telekom, France’s Orange, Britain’s Vodafone and Spain’s Telefónica shared the stage at Mobile World Congress.

Advertisement

Singular market. European telecom operators are calling for a “new deal”. Executives gathered at their annual shindig in Barcelona this week to plead for regulators and governments to show a little understanding for an industry plagued by low growth, high costs and demands for major capital expenditures amid permanent technological change. Policymakers are unlikely to grant their wishes any time soon. In the meantime telcos will have to convince investors that the price of future growth is more investment today.

The bosses of Deutsche Telekom, France’s Orange, Britain’s Vodafone and Spain’s Telefónica, who shared the stage in a rare joint panel at the Mobile World Congress, agreed that Europe is nowhere close to becoming a single telecom market. Timotheus Höttges, the CEO of the German group, even declared that he was no longer interested in becoming a major player in a market contested by more than 40 operators, 60% of which do not make an adequate return on capital. “You cannot ride on a dead horse,” he said.

Advertisement

At least Höttges has a choice of horses. Deutsche Telekom last year earned about two-thirds of its global revenue and operating profit in the United States courtesy of its 50%-plus stake in local operator T-Mobile US. But even in Germany it demonstrated that not all telcos are equally disadvantaged. Deutsche Telekom’s revenue in the country grew by nearly 3% last year, while rival Vodafone’s local unit only managed a 1% increase.

One of the industry’s long-standing beefs is that the European Commission is overly focused on the interests of consumers. This has made competition watchdogs in Brussels reluctant to allow the number of operators in a given country to shrink from four to three. The Commission’s recent decision to approve the union of Orange’s Spanish arm with local rival MásMóvil suggests the industry’s complaints have been heard. Now operators would like more visibility on the regulator’s doctrine.

Advertisement

They are unlikely to get it. Margrethe Vestager, the Commission’s competition czar, and Thierry Breton, the former Orange CEO who now oversees the EU’s internal market, may not keep their jobs following European Parliament elections in June. And the industry’s plea to overhaul the way governments sell spectrum to the highest bidder is too nakedly self-interested to attract official support.

At least the Commission, in a white paper on the continent’s digital infrastructure needs, has suggested ways to improve regulation and harmonise the treatment of telecom spectrum. It estimates additional investment required to meet the EU’s connectivity needs at 200 billion euros – or about 1.2% of the bloc’s GDP this year.

Advertisement

But EU member states appear far from convinced by the dream of a continent-wide telecom market. If anything, governments are showing signs of designating communications as a “strategic” industry – like defence or energy – that requires closer scrutiny for national security purposes.

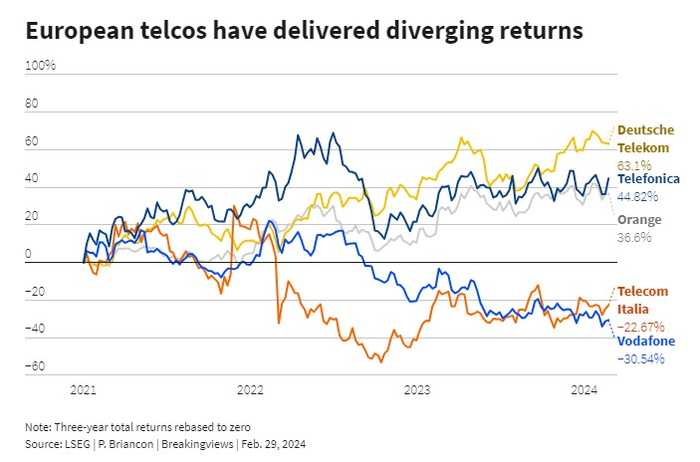

It’s therefore up to CEOs like Telefónica boss José María Álvarez-Pallete to persuade investors that only technological innovation will help the sector emerge from years of slow revenue growth. For all the gloom, many shareholders have fared reasonably well in recent years. Deutsche Telekom, Telefónica and Orange and have delivered total returns to their respective shareholders of 63%, 45%% and 37% in the past three years, according to LSEG data. By contrast, investors in Vodafone and Telecom Italia have suffered negative returns of 31% and 23%, respectively.

Advertisement

There was no shortage of new technologies to talk about in Barcelona. Deutsche Telekom’s Höttges proclaimed the near end of the mobile app within 10 years, when simple voice-activated interfaces powered by artificial intelligence will tend to consumers’ needs. Meanwhile an alliance including Japan’s SoftBank Corp, chip giant Nvidia, Britain’s Arm and equipment maker Ericsson will explore ways to use AI to optimise radio access networks, which link mobile devices to core networks. That could be a source of both savings and extra revenue.

Operators will also have to spend more to upgrade the security of their systems still vulnerable to hacking attacks or even physical damage. The Commission’s white paper underlined the need to improve the security of critical submarine cables.

Advertisement

Telecom CEOs may therefore feel they are caught in a bind. While some investors want them to cut capital spending and return cash to shareholders, the same investors may criticise them in five or 10 years’ time for not having invested enough. Some may seek to raise cash by offloading the towers that house mobile transmitters, as Vodafone and others have done. But as Orange CEO Christel Heydemann quipped, this amounts to “selling infrastructure in order to be able to invest in infrastructure.”

One potential source of financing much discussed in Barcelona a year ago appears to have been kicked into the long grass. This is the so-called “fair share” that European telcos say video streaming giants like Netflix, Google’s YouTube or Amazon.com should pay to use their networks. The idea is hotly debated in principle, hard to implement and it lacks support from policymakers.

European telcos cannot hope to match U.S. tech giants for financial clout. The combined market capitalisation of the companies managed by the four CEOs who shared a stage in Barcelona is 179 billion euros ($194 billion). That’s smaller than Netflix, and barely a tenth of Amazon and Google owner Alphabet.

15:44 IST, March 4th 2024