Published 11:25 IST, March 20th 2024

Grayscale Bitcoin Trust has been around since 2013, crown jewel of cryptocurrency billionaire Barry Silbert’s Digital Currency Group.

Advertisement

Ahead of the curve. Bitcoin’s latest celebration is being ruined by party poopers. Even as the cryptocurrency surged to an all-time high of almost $74,000, the amount of assets in the oldest and largest related U.S. fund keeps tumbling. It’s an understandable flight to new lower-fee options, but there’s good reason for some investors to stick with a premium product.

The Grayscale Bitcoin Trust has been around since 2013, the crown jewel of cryptocurrency billionaire Barry Silbert’s Digital Currency Group. Grayscale spearheaded the crusade to win approval from U.S. regulators to open exchange-traded funds tracking digital assets. It won permission to convert the trust to an ETF in January, while other money managers, such as BlackRock, have started rivals.

Advertisement

Grayscale slashed GBTC’s 2% fee by a quarter, but its 10 competitors all charge less than 1%, according to their websites. The discounts have helped deplete Grayscale’s coffers by $10 billion. Boss Michael Sonnenshein on Tuesday pledged to eventually cut fees further. In just two months, the trust has now lost more than $3 billion that it took a decade to accumulate, a figure that would have been far worse had Bitcoin’s value not soared.

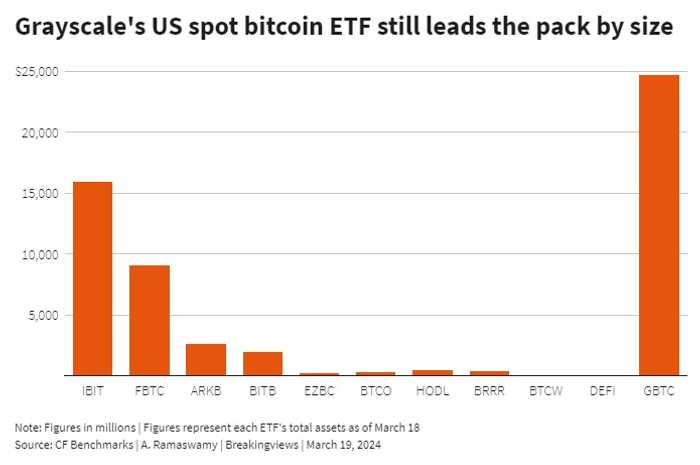

Grayscale has benefitted from being early, however. Its nearly $25 billion in assets makes it the largest U.S. spot bitcoin ETF by a wide margin, and for now at least, tallies almost as much as the $31 billion in the other 10 funds combined, according to Monday’s data from cryptocurrency index provider CF Benchmarks.

Advertisement

The plan unveiled last week to spin out some Grayscale shares into an almost-identical ETF will allow holders to shift some of their investment without paying any capital gains tax. This should help slow or stop the rapid outflows.

Bigger investors might yet stick with Grayscale, too. Its size advantage, in theory, makes it easier for fast-paced traders such as Jane Street and Virtu Financial to find counterparties willing to buy or sell at a given price. As with other investment choices that regularly introduce lowest-cost services, they aren’t always right for everyone. State Street’s flagship ETF tracking gold, for example, is eight times larger than its cheaper substitute, according to ETF.com.

Advertisement

Much will depend on bitcoin’s price. A sharp tumble probably would accelerate the Grayscale exodus. And yet the trust first grew beyond $1 billion in October 2017, when each bitcoin was worth around 10% of where it trades now. Even in the wild world of crypto, there’s a room for VIPs.

11:24 IST, March 20th 2024