Published 15:20 IST, April 3rd 2024

Three parties in Chancellor Olaf Scholz’s centre-left coalition had pledged to not cut benefits nor raise taxes.

Advertisement

OK boomer. Cornered by its own electoral pledge to protect the country’s pension system, the German government has found an original way to stem the unavoidable financial crisis its promises will create: a special fund, financed by public borrowing and tasked with investing in global equities. The returns will, over time, help finance the pensions of Germany’s ageing population. The fund, expected to reach 200 billion euros within a decade, is too small to be a panacea. But it could still show other European governments how to mix public and private resources to address the pension problem.

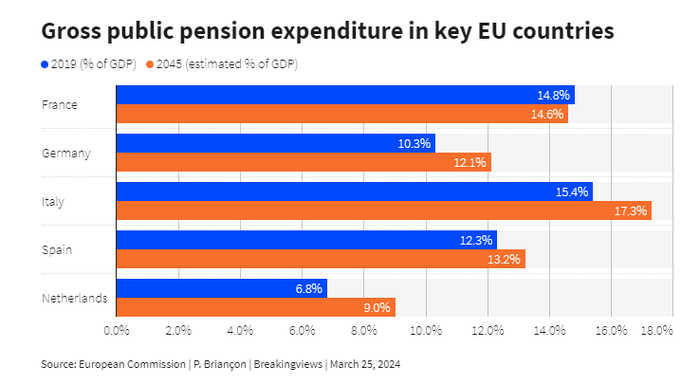

More than 22% of the German population was 65 or over in 2023 – the highest ratio among major European economies after Italy’s 24%. Like most of the rest of continental Europe, the country has a “pay-as-you-go” system where workers finance retirees’ pensions through social security contributions or taxes. Pensions financed by the public purse represent 10% to 15% of GDP in Germany, France and Italy – in contrast with the UK, where private retirement schemes dominate and state pensions only amount to 5% of GDP.

Advertisement

The three parties in Chancellor Olaf Scholz’s centre-left coalition previously pledged they would neither cut benefits nor raise taxes to finance the pension deficit. They also do not want to further raise the pension age, which is due to go from nearly 66 to 67 by 2029.

The pledges look shaky, as millions of “baby boomers” born between 1946 and 1964 retire, leaving it to younger generations to pay for their pensions. Germany had six workers for every pensioner in the early 1960s. This ratio is now two to one, and still falling. The originality of the “Generation Capital” fund is twofold. First, it will require public borrowing, despite Germany’s long-standing aversion towards debt. It won’t, however, count towards the strict “debt brake” that imposes fiscal discipline on the government. The second novelty is that the fund will invest public money in equities. Finance minister Christian Lindner said he expected returns of more than 3% or 4% – after deducting debt-servicing costs. If so, the 8 billion euros a year the fund will produce in 10 years’ time would only make a dent in the pension deficit, which the government is subsidising this year to the tune of 127 billion euros – or 27% of the federal budget.

Advertisement

Generation Capital will not spare German workers from higher contributions or lower benefits, and the government from more pension funding. But it’s a step in the right direction, not least because it will be run independently from the government and won’t be restricted to German stocks. It could serve as a model for other European countries by showing that public money invested in capital markets may be a funding source for the pensions of an ageing continent.

Advertisement

15:20 IST, April 3rd 2024