Published 12:57 IST, March 26th 2024

If Boeing does take a leaf from GE, it should avoid some of its peer’s mistakes.

Advertisement

Golden wings. What could be a tougher challenge than fixing up Boeing? The flailing aircraft manufacturer’s CEO Dave Calhoun is to leave at the end of this year, having failed to resolve a thicket of safety issues, regulatory probes and customer grievances. Whoever Boeing appoints to clean up this mess will need financial incentives equal to its enormity.

Boeing could crib ideas on that front from General Electric, Calhoun’s onetime employer. The jet-engine maker was once in similarly dire straits, buckling under the weight of overpriced acquisitions, poor financial decisions and a culture of deep denial. Its share price had halved in under two years. After ousting CEO John Flannery, it brought on turnaround specialist Larry Culp.

Advertisement

To motivate Culp, GE did something unusual, awarding him an extravagant sign-on bonus linked to the company’s stock. The higher the average 30-day share price, the more shares he would get, with a maximum payout of $232 million. Some shareholders were wary: Roughly a quarter rejected the plan at GE’s 2019 annual meeting. Fundamentally, though, this was the high cost of hiring for a high-risk job.

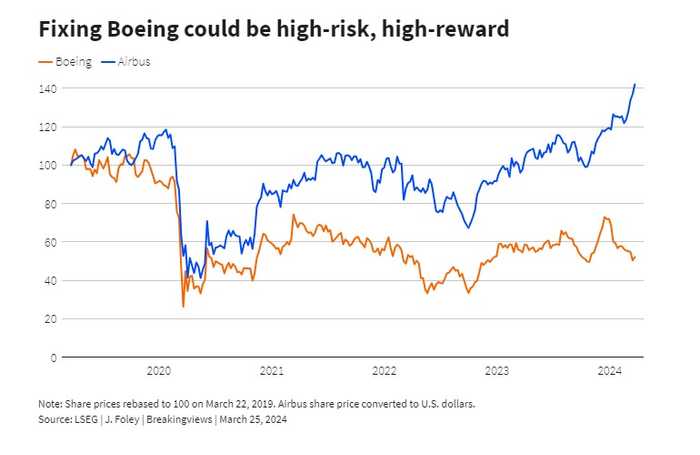

Running Boeing will be a similarly big ask. Shares have slumped as the blowout of a 737 MAX body panel mid-flight compounded manifold existing troubles, prompting regulators to limit production. Like GE, the underlying problems are grave and cultural as well as operational. Boeing must placate watchdogs, win back customers and fix – or replace – the 737 MAX. There’s every chance the new boss will fail as Calhoun did.

Advertisement

If Boeing does take a leaf from GE, it should avoid some of its peer’s mistakes. Culp’s welcome bonus was linked only to GE’s share price, without adjusting for the company’s peers or major indices, meaning he could benefit from a general market upturn. The biggest misstep came amid Covid-19, when the board reset Culp’s targets to make his bonus easier to attain. Still, it worked. GE’s shares have doubled since Culp took charge; he had secured the maximum payout by last July.

There’s a risk that any CEO motivated with share-price targets pursues those at the expense of other factors, like safety. But for Boeing, the two issues are now tied: The most likely way for shares to recover is to fix engineering issues and assure customers the company’s planes are safe. The GE model – with some tweaks – would give a new CEO a strong incentive to get that done.

Advertisement

12:57 IST, March 26th 2024