Updated 16 December 2025 at 15:20 IST

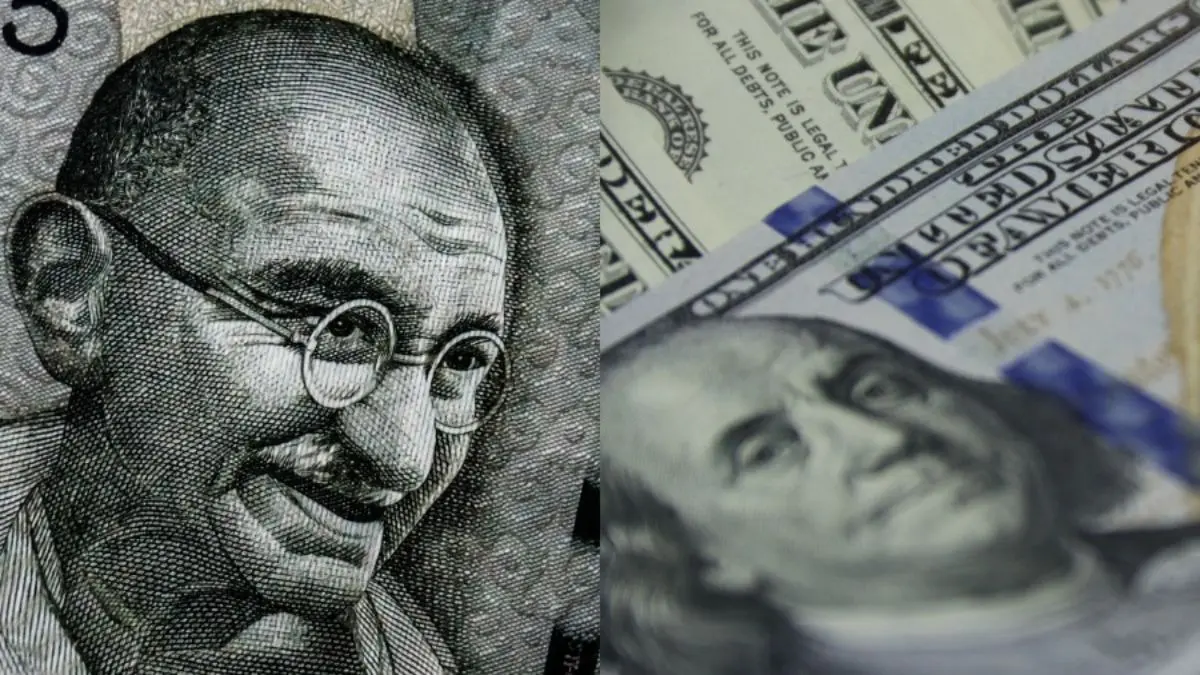

INR vs USD: The Bright Side To Rupee Depreciation

While the rupee hit an historic low, breaching 91 mark against the US dollar today, Neelkanth Mishra, Chief Economist, Axis Bank, said there is no reason to worry about rupee depreciation.

- Republic Business

- 2 min read

While the rupee hit an historic low, breaching 91 mark against the US dollar today, Neelkanth Mishra, Chief Economist, Axis Bank, said there is no reason to worry about rupee depreciation.

In the last 10 trading sessions, the currency has weakened from the 90-per-dollar level to 91, trimming almost 1% against the greenback in just the past five sessions. At 11:38 AM today, Rupee was trading at 91.075 against USD.

The only issue that needs to flagged and has been a constant remains the outflow of foreign direct investment (FDI), however, Mishra said, “Good exists bring in more money.”

He highlighted that 20025 was a period of "strategic investment in India" by global banking institutions, including Japanese banks. This most likely referred to the Sumitomo Mitsui Banking Corporation's (SMBC's)becoming the largest shareholder in Yes bank with 24.22% stake.

Advertisement

Detailing what's behind the fourth consecutive low for rupee, he said Indian firms are focusing on establishing themselves as multi-national corporations (MNC's), which has led to an increase in outflow from USD 20 billion to USD 45 billion.

Advertisement

In response to fears percolating around the fall in rupee's value, Mishra said there is "no reason to be worry about rupee, while setting expectations of mild depreciation in the near future.

On the other hand, he said the key triggers behind the loss of value in the south Asian currency is due to India being part of a poor neighbourhood, earning downgrades, and being a net AI loser.

While US witnessed AI stocks surging in value, and heavy investment in artificial intelligence, China benefited from the DeepSeek movement, algorithm, and the date centre boom. However, India was seen as a AI receiver or as Mishra termed "AI Colony".

On the other hand, cues like US tech giants investing USD 70 billion in India does signal positivity ahead of 2026.

Published By : Nitin Waghela

Published On: 16 December 2025 at 15:20 IST