Published 22:29 IST, February 29th 2024

Revenue in London Stock Exchange Group main data and analytics unit has grown by about 4% YoY.

Advertisement

Data dependent. London Stock Exchange Group is waiting for its data dividend. It’s three years since the operator of the city’s bourse transformed itself by absorbing information purveyor Refinitiv. Chief Executive David Schwimmer has hit his targets for growth and increased margins. Yet investors continue to value the 47 billion pound ($60 billion) company at a discount to rivals.

Most large acquisitions fail to live up to early hopes. But LSEG’s results for 2023, released on Thursday, show Schwimmer has delivered on the commitments he made at the time of the deal. Total income before fees on third-party data reached 8 billion pounds, representing a compound growth rate of around 6% over three years – in the middle of the targeted range. And though the company’s EBITDA margin of 47% was below the promised 50%, this is due to recent acquisitions and investments related to LSEG’s partnership with Microsoft.

Advertisement

Even so, Schwimmer has work to do. Revenue in LSEG’s main data and analytics unit has grown by about 4% a year since 2020. That’s an improvement on Refinitiv’s sluggish pre-acquisition performance, and the company’s improved Workspace terminal has recently helped lift subscriptions. Nevertheless, LSEG’s traditional capital markets and clearing businesses have expanded at a faster rate.

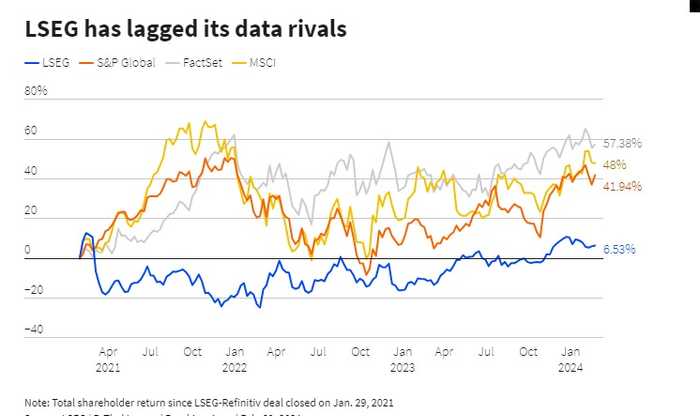

Investors are taking a wait-and-see approach. Before Thursday’s announcement, LSEG shares had recorded a total return of just over 6% since the Refinitiv deal closed in January 2021, lagging data providers such as MSCI, S&P Global and FactSet Research Systems. Including net debt of 6.1 billion pounds, the company is valued at less than 14 times last year’s EBITDA. That’s closer to other bourse operators like Nasdaq than rival data groups, which trade at multiples of between 20 and 30 times.

Advertisement

Narrowing this gap will depend in part on persuading Microsoft users to pay for LSEG data. Schwimmer will soon start rolling out services which integrate the company’s offerings with the tech giant’s products. This opens up a vast new potential customer base. LSEG’s data unit currently has several hundred thousand users; Microsoft’s Teams messaging service has more than 300 million.

LSEG’s board is consulting shareholders about boosting Schwimmer’s compensation, Sky News reported earlier this month. Investors will want to make sure any pay rise is tied to LSEG delivering its data dividend.

Advertisement

22:28 IST, February 29th 2024